How to Deposit and Trade Crypto at MEXC

How to Deposit on MEXC

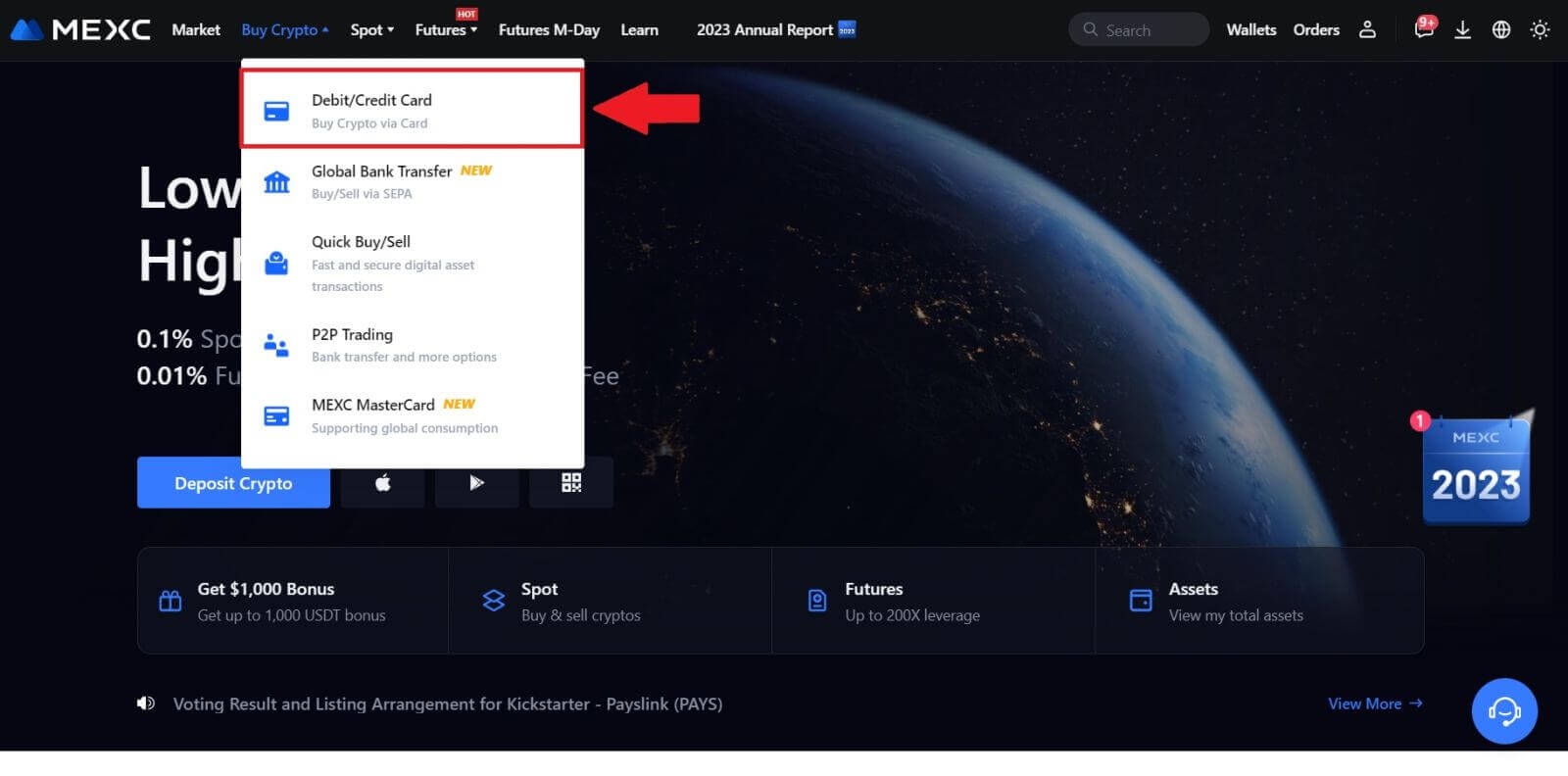

How to Buy Crypto with Credit/Debit Card on MEXC

Buy Crypto with Credit/Debit card on MEXC (Website)

1. Log in to your MEXC account, click on [Buy Crypto] and select [Debit/Credit Card].

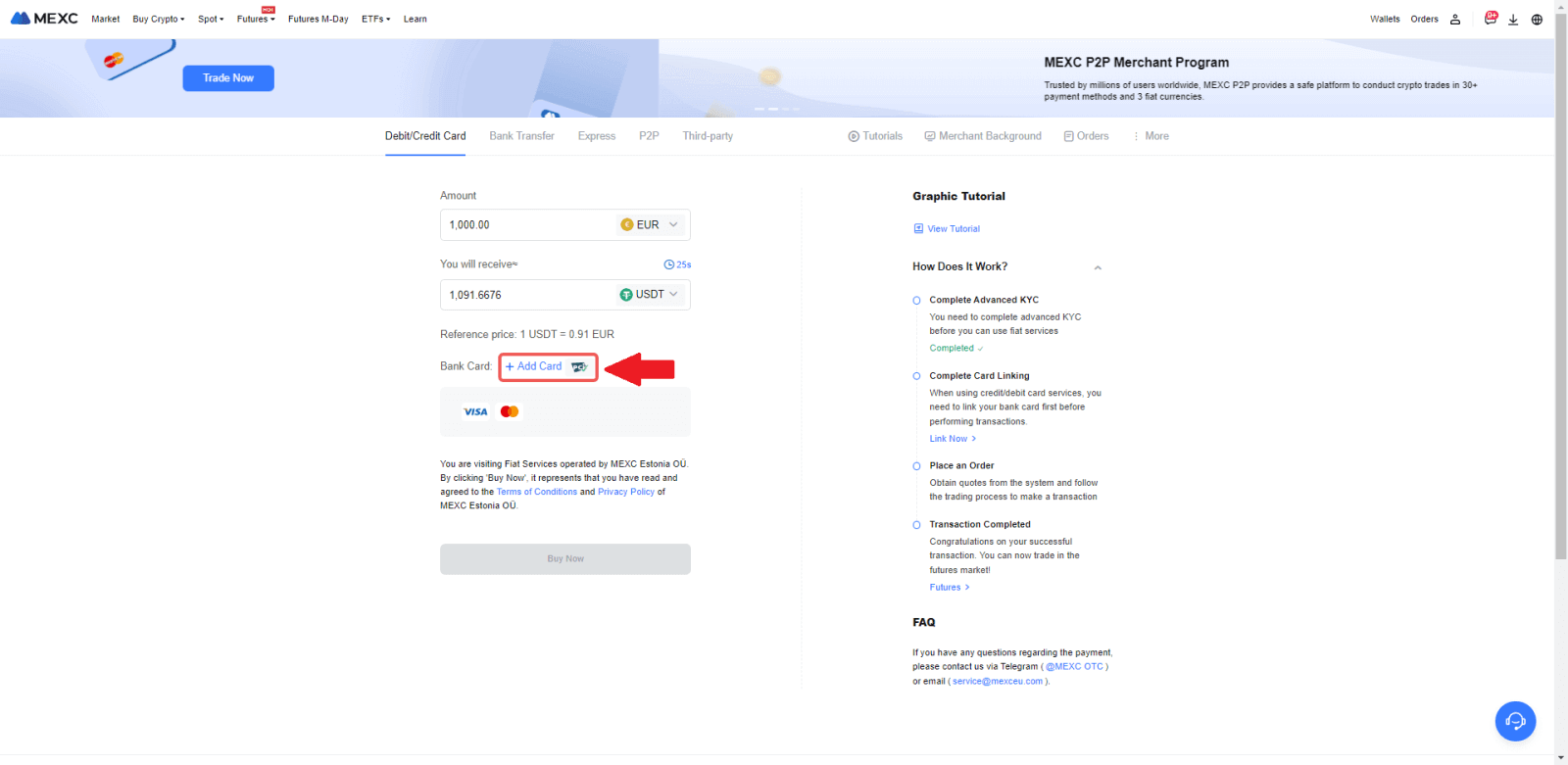

2. Click on [Add Card].

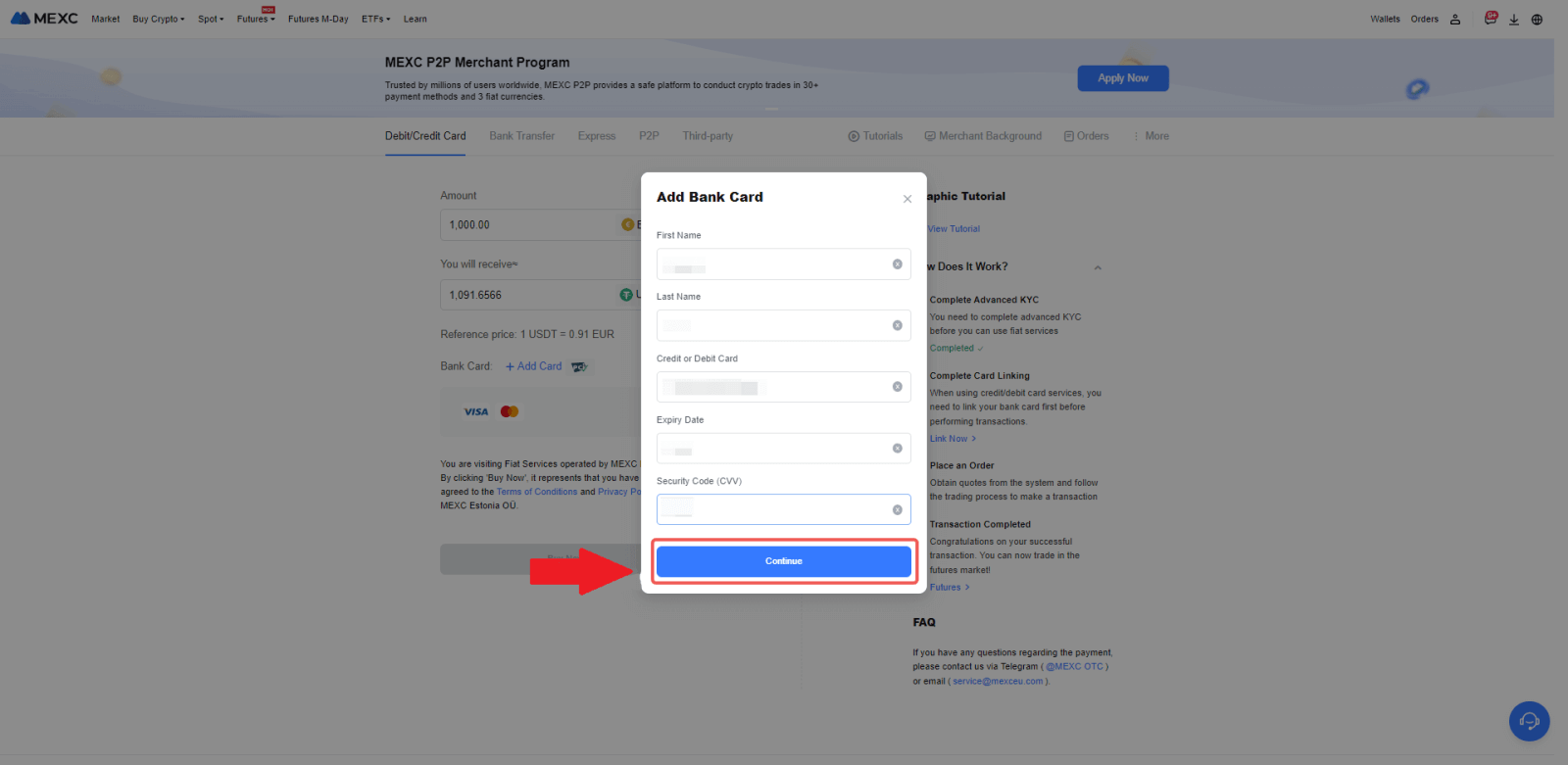

3. Enter your bank card details and click [Continue].

4.Initiate your cryptocurrency purchase using a Debit/Credit Card by first completing the card linking process.

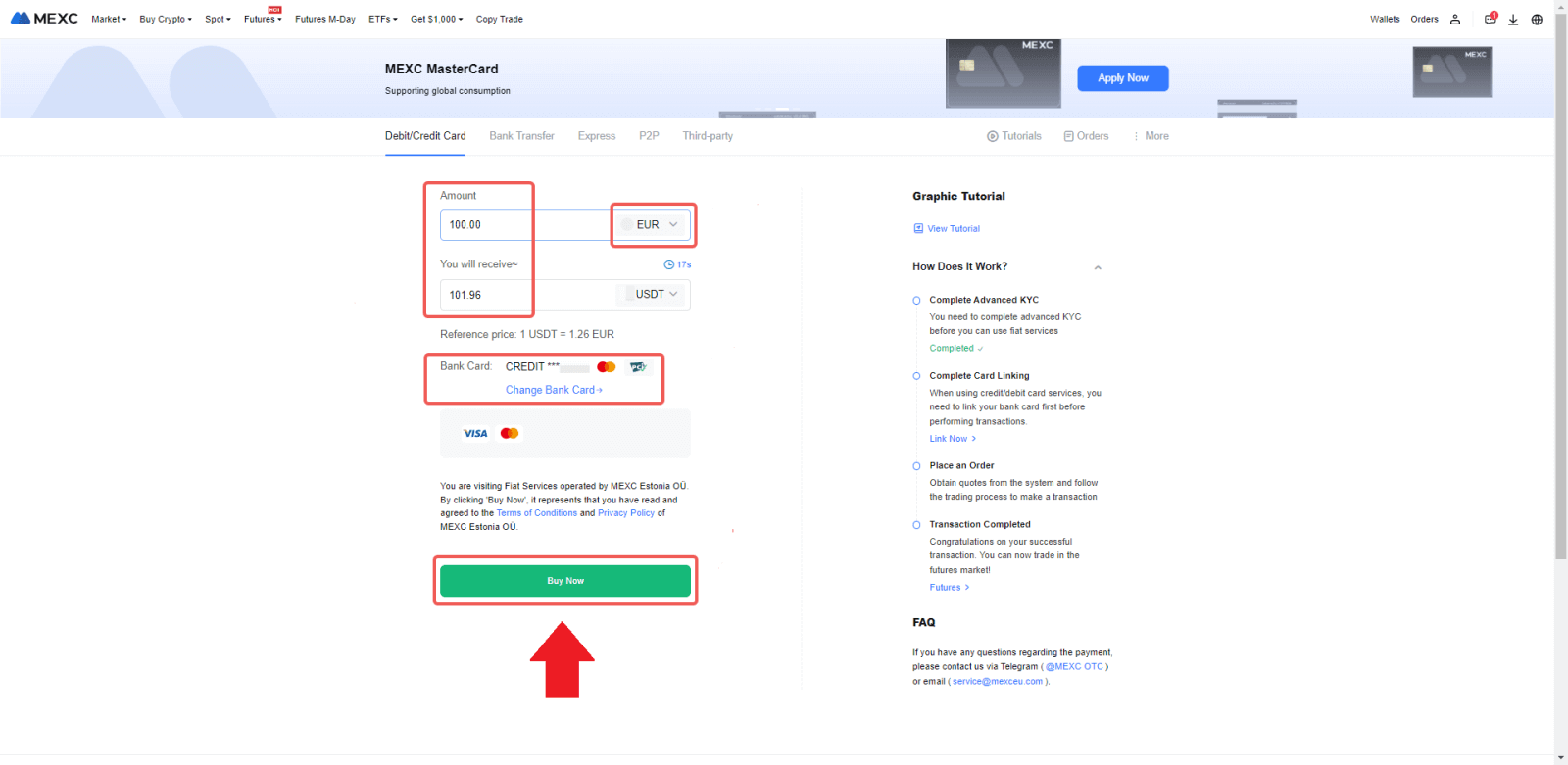

Choose your preferred Fiat Currency for the payment, enter the amount for your purchase. The system will instantly show you the corresponding amount of cryptocurrency based on the current real-time quote.

Choose the Debit/Credit Card you plan to use, and click on [Buy Now] to proceed with the cryptocurrency purchase.

Buy Crypto with Credit/Debit card on MEXC (App)

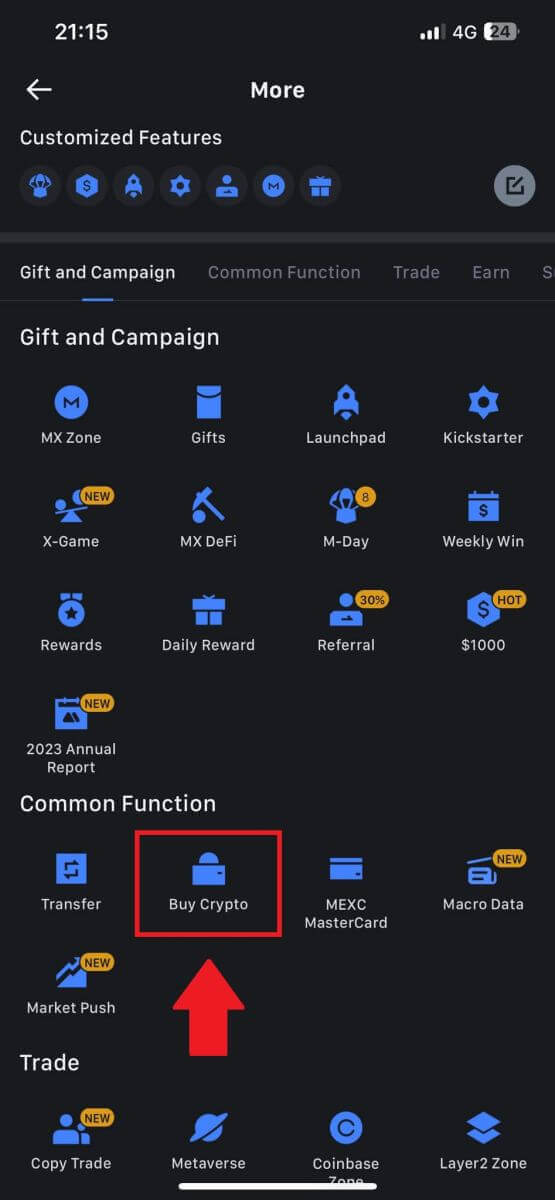

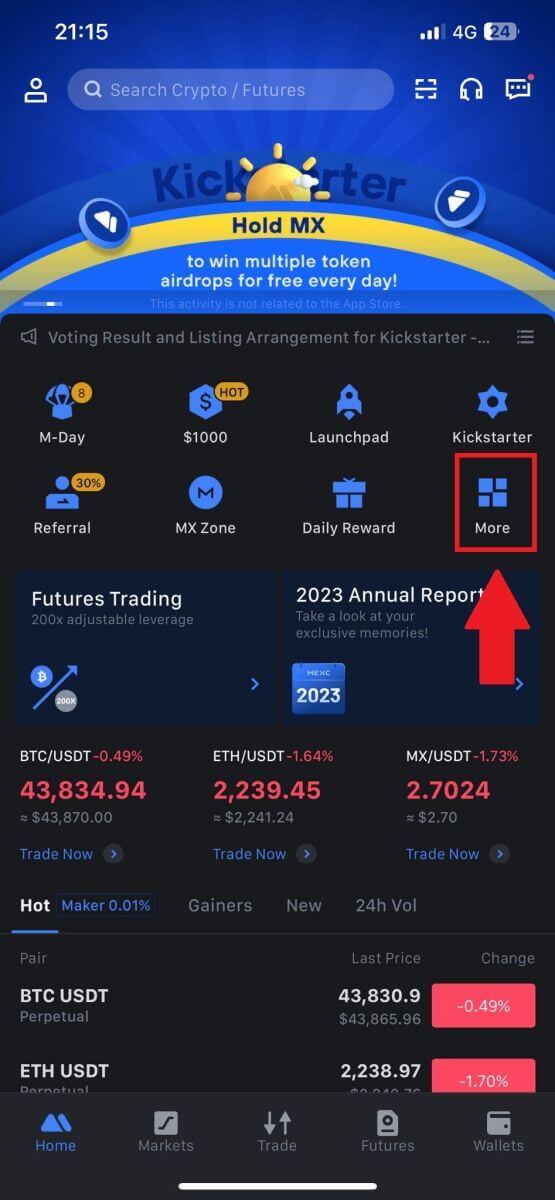

1. Open your MEXC app, on the first page, tap [More].

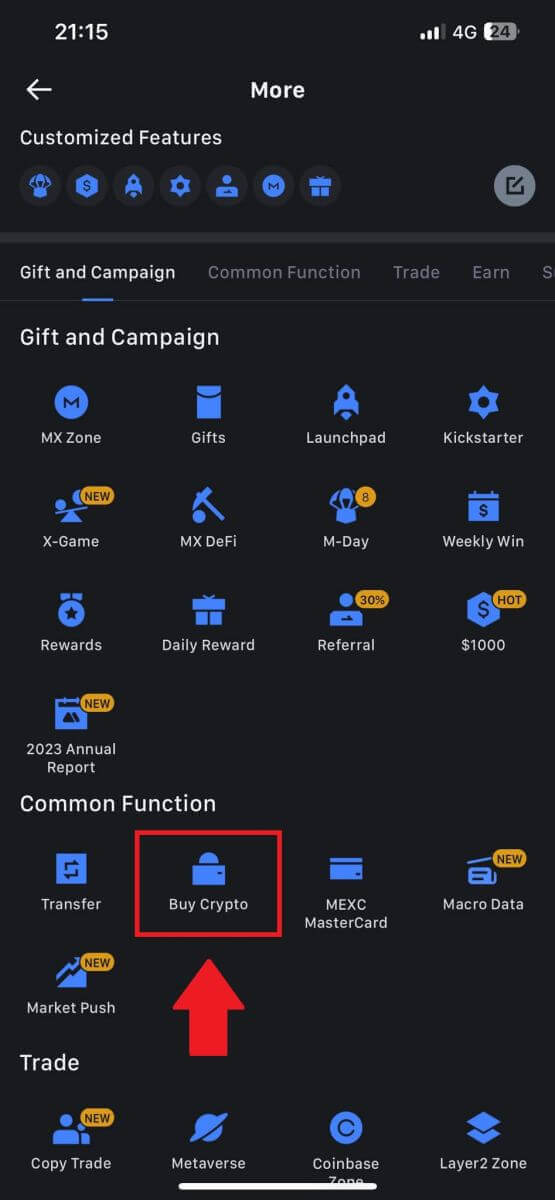

2. Tap on [Buy Crypto] to continue.

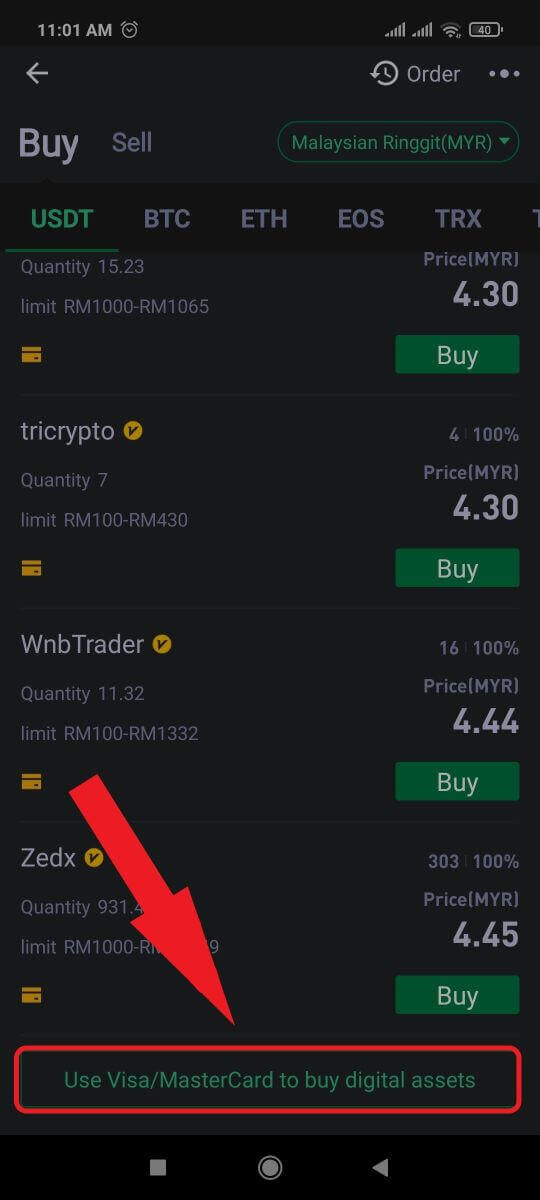

3. Scroll down to locate the [Use Visa/MasterCard].

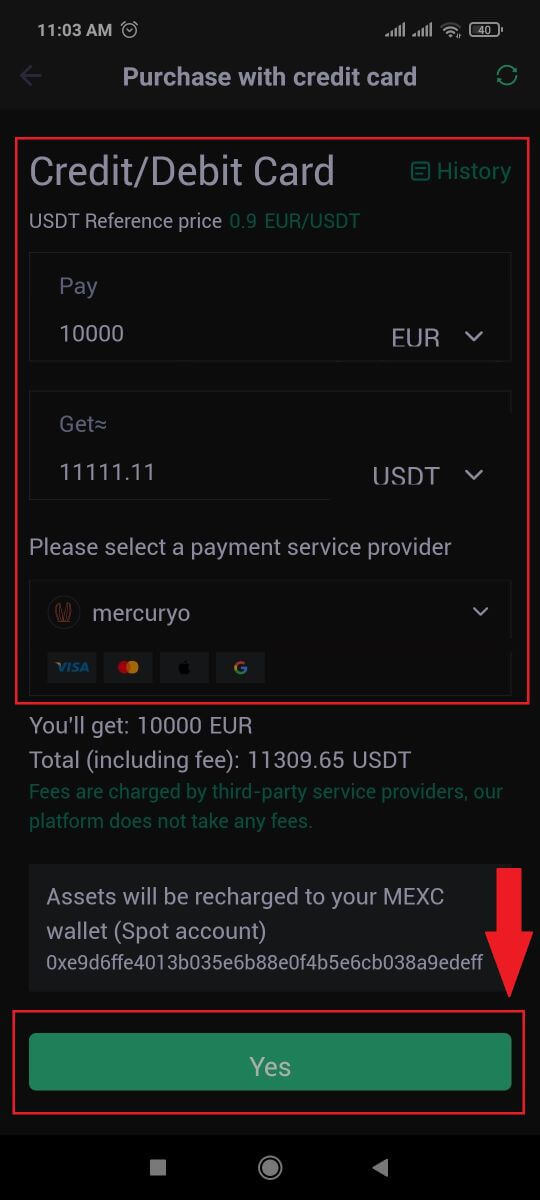

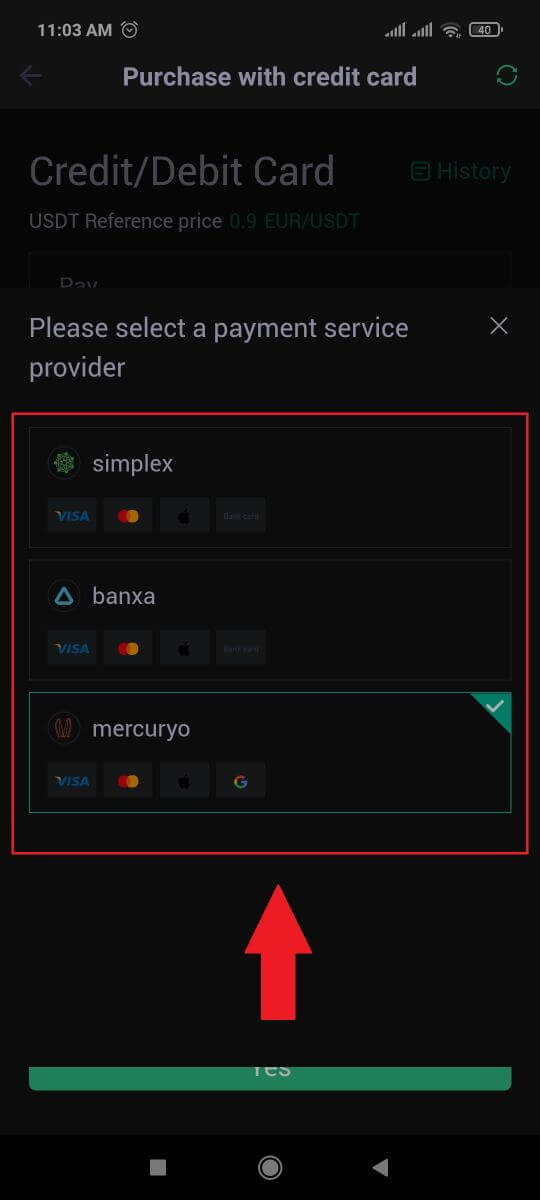

4. Select your Fiat currency, choose the crypto asset you want to purchase, and then pick your payment service provider. Then tap on [Yes].

5. Keep in mind that various service providers support different payment methods and may have varying fees and exchange rates.

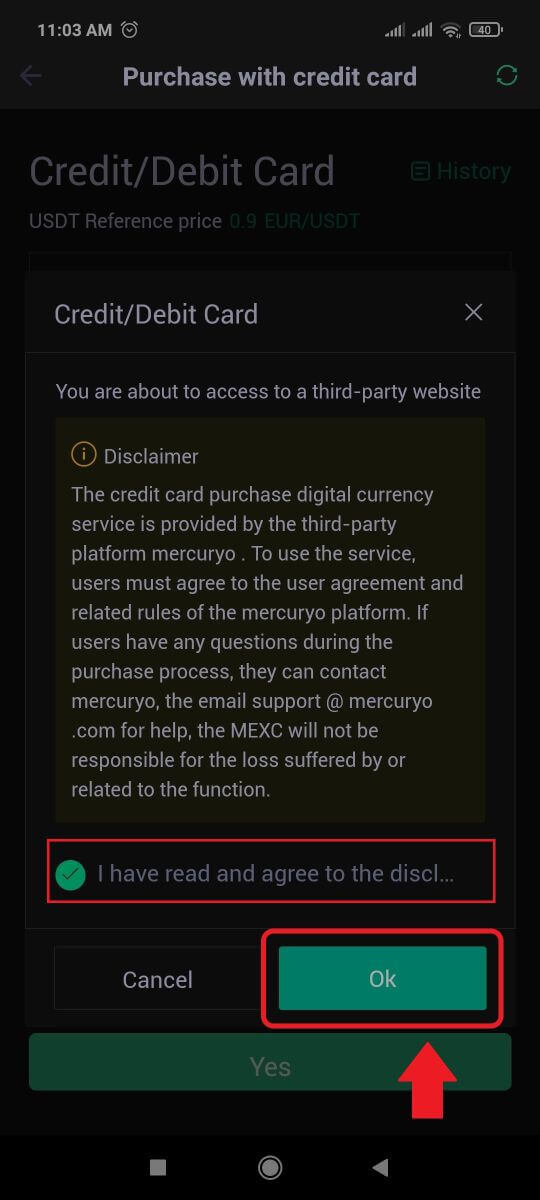

6. Tick on the box and tap [Ok]. You will be redirected to a third-party site. Please follow the provided instructions on that site to complete your transaction.

How to Buy Crypto via Bank Transfer - SEPA on MEXC

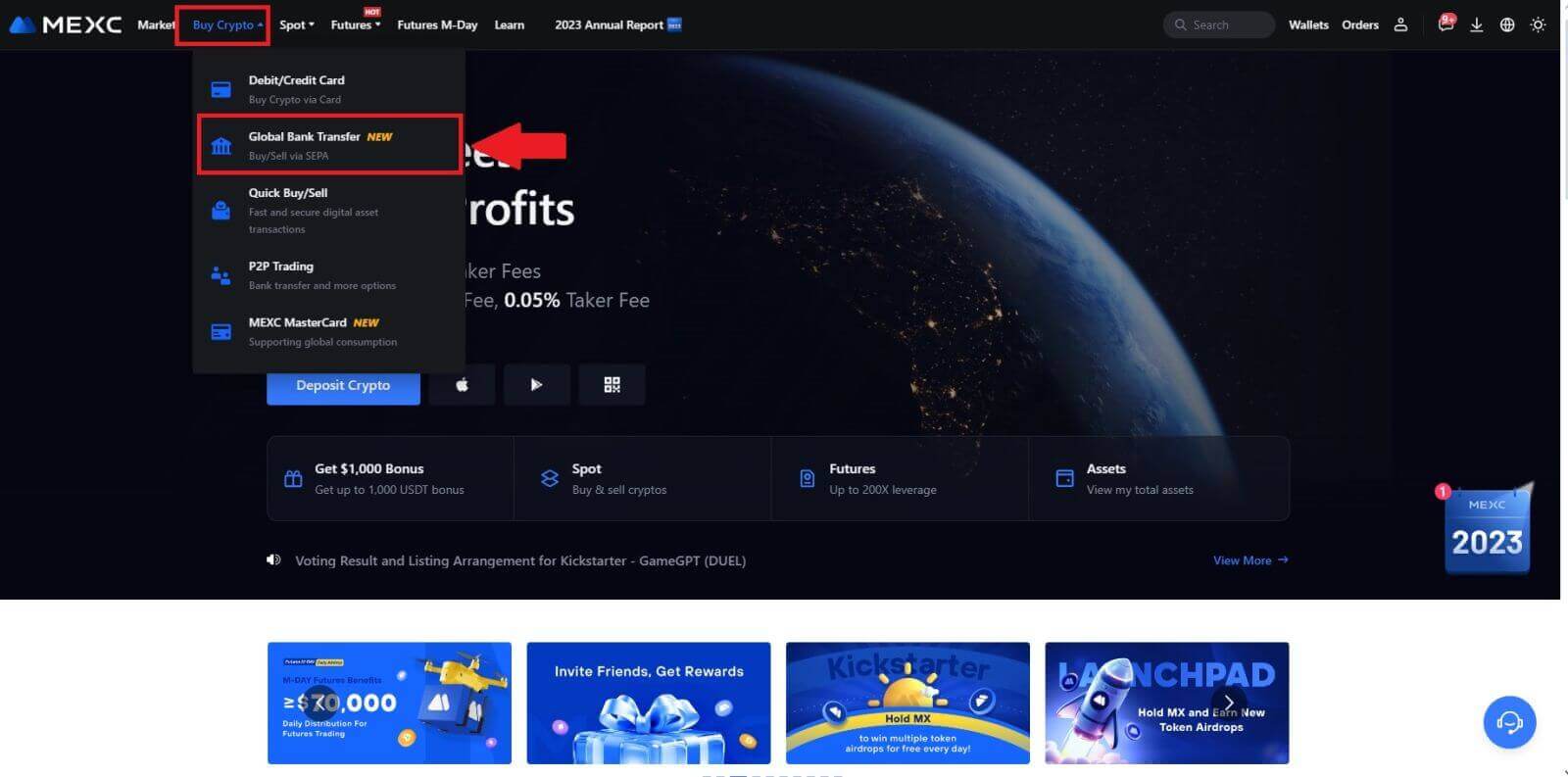

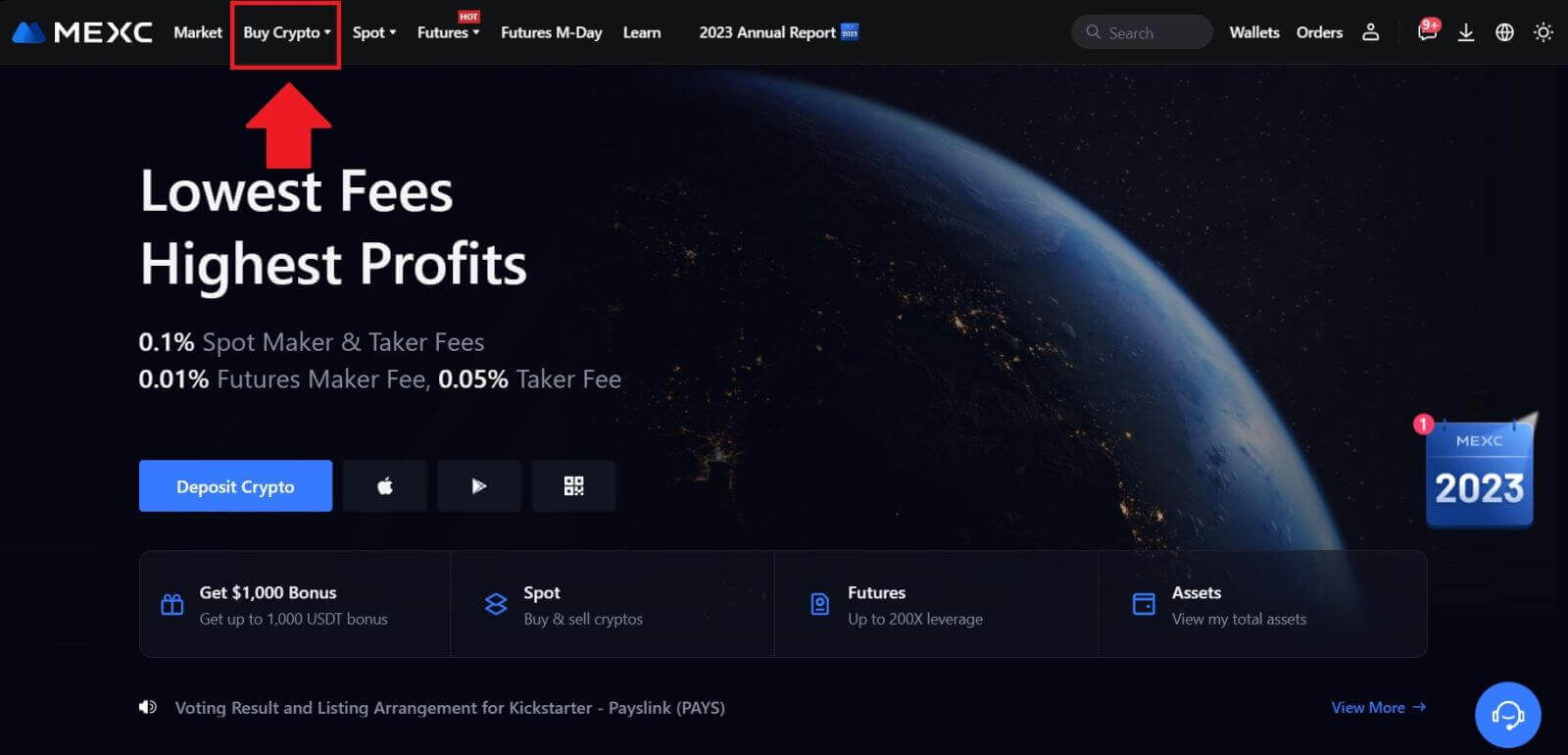

1. Log in to your MEXC website, click on [Buy Crypto] and select [Global Bank Transfer].

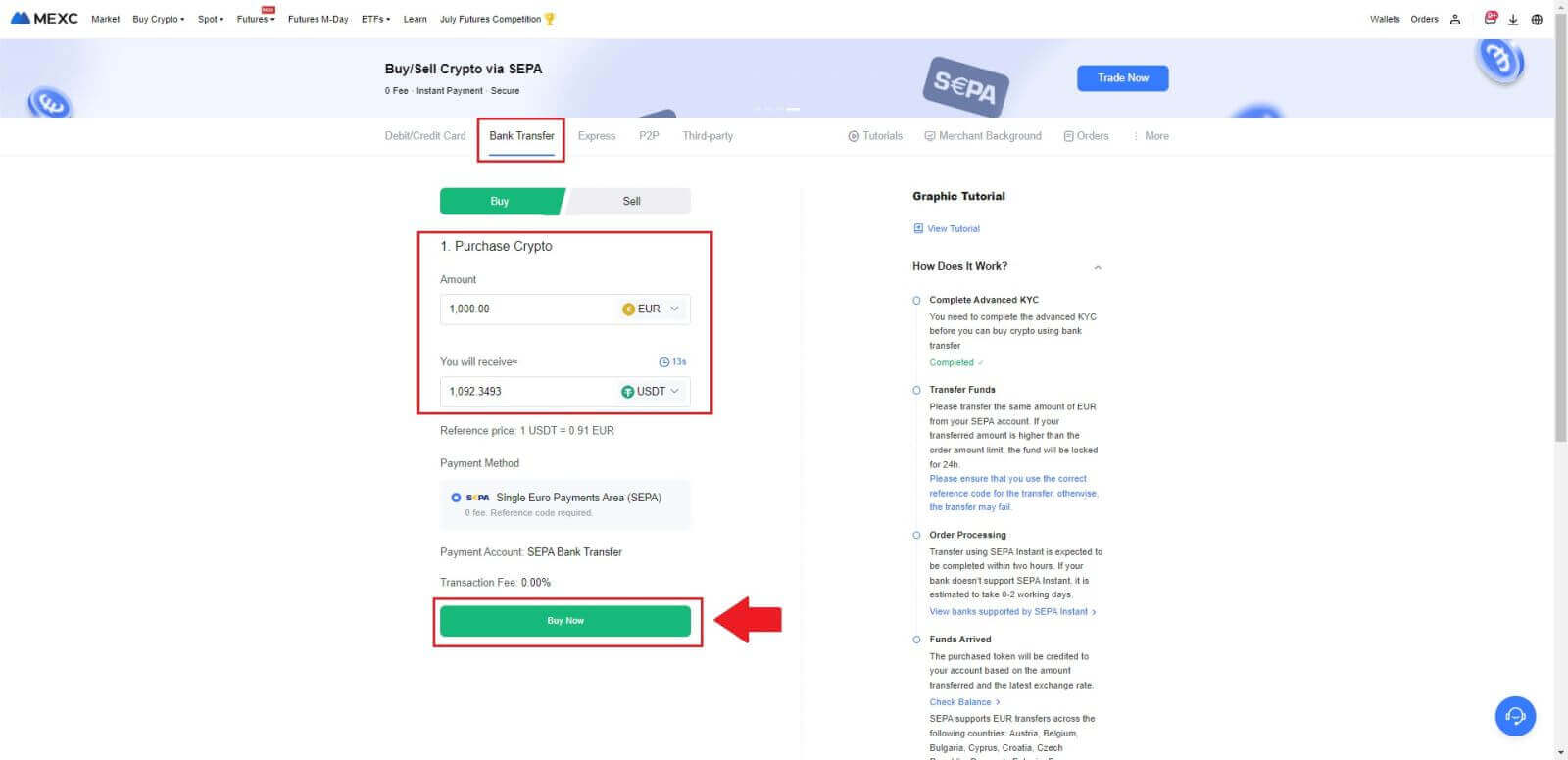

2. Select [Bank Transfer], fill out the amount of crypto that you want to purchase and click [Buy Now]

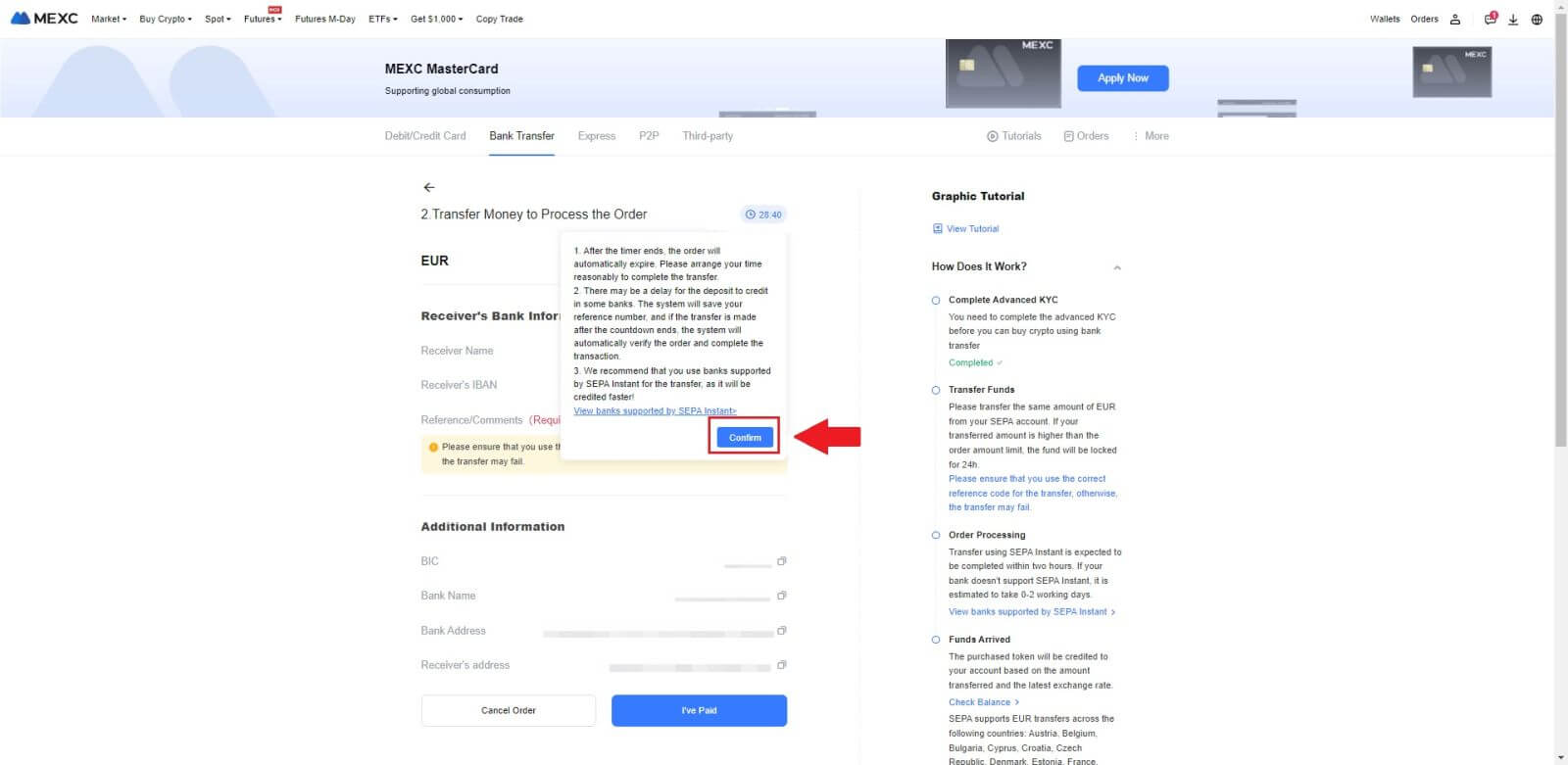

3. After placing a Fiat order, you have 30 minutes to pay. Click [Confirm] to continue.

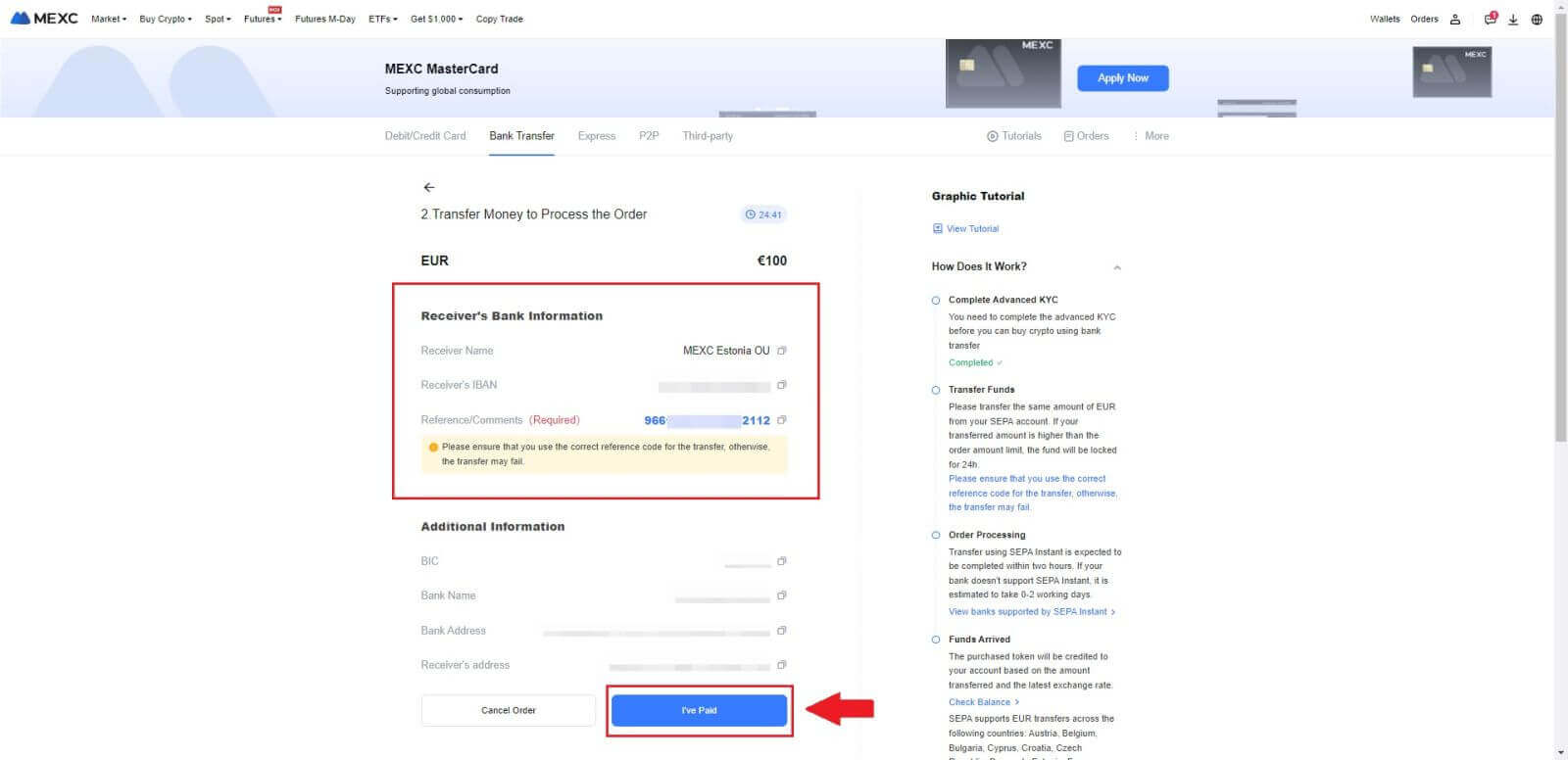

Check the Order page for [Receiver’s Bank Information] and [Additional Information]. Once paid, click [I’ve paid] to confirm.

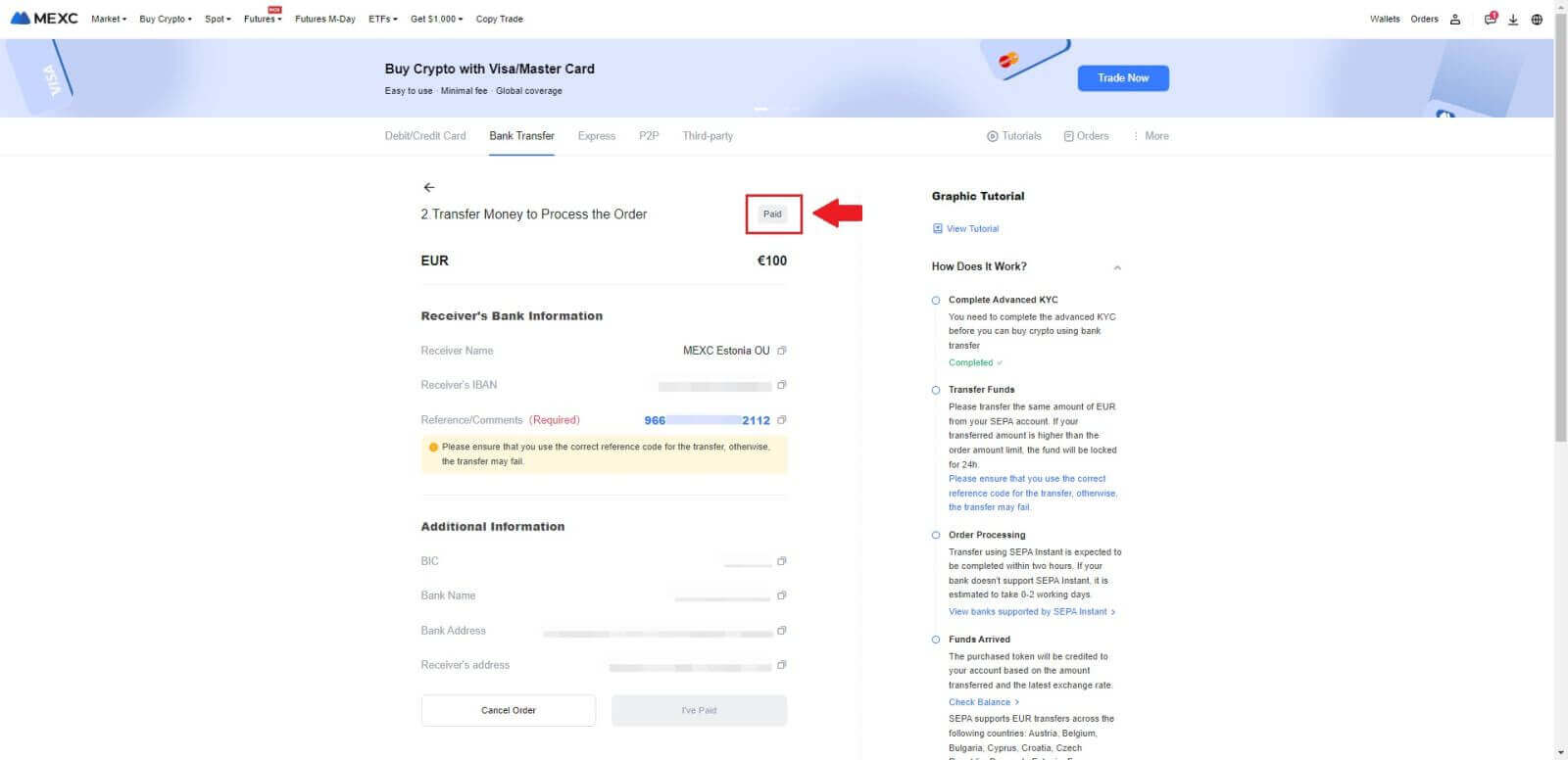

4. Once you mark the order as [Paid], the payment will be processed automatically.

If it’s a SEPA instant payment, the Fiat order is usually completed within two hours. For other payment methods, it may take 0-2 business days for the order to be finalized.

How to Buy Crypto via Third Party Channel on MEXC

Buy Crypto via Third Party on MEXC (Website)

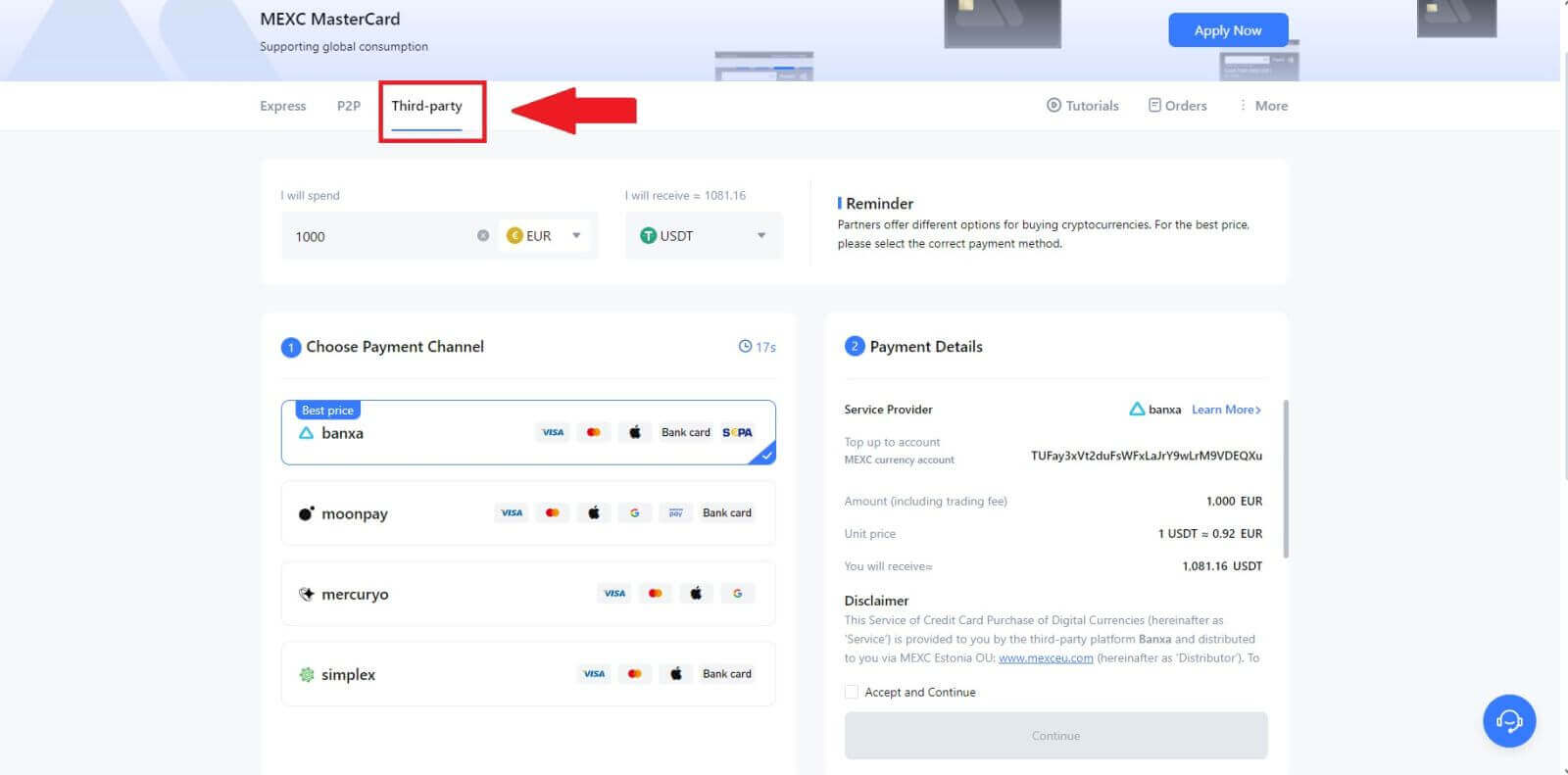

1. Log in to your MEXC website, click on [Buy Crypto]. 2. Choose [Third-party].

2. Choose [Third-party].

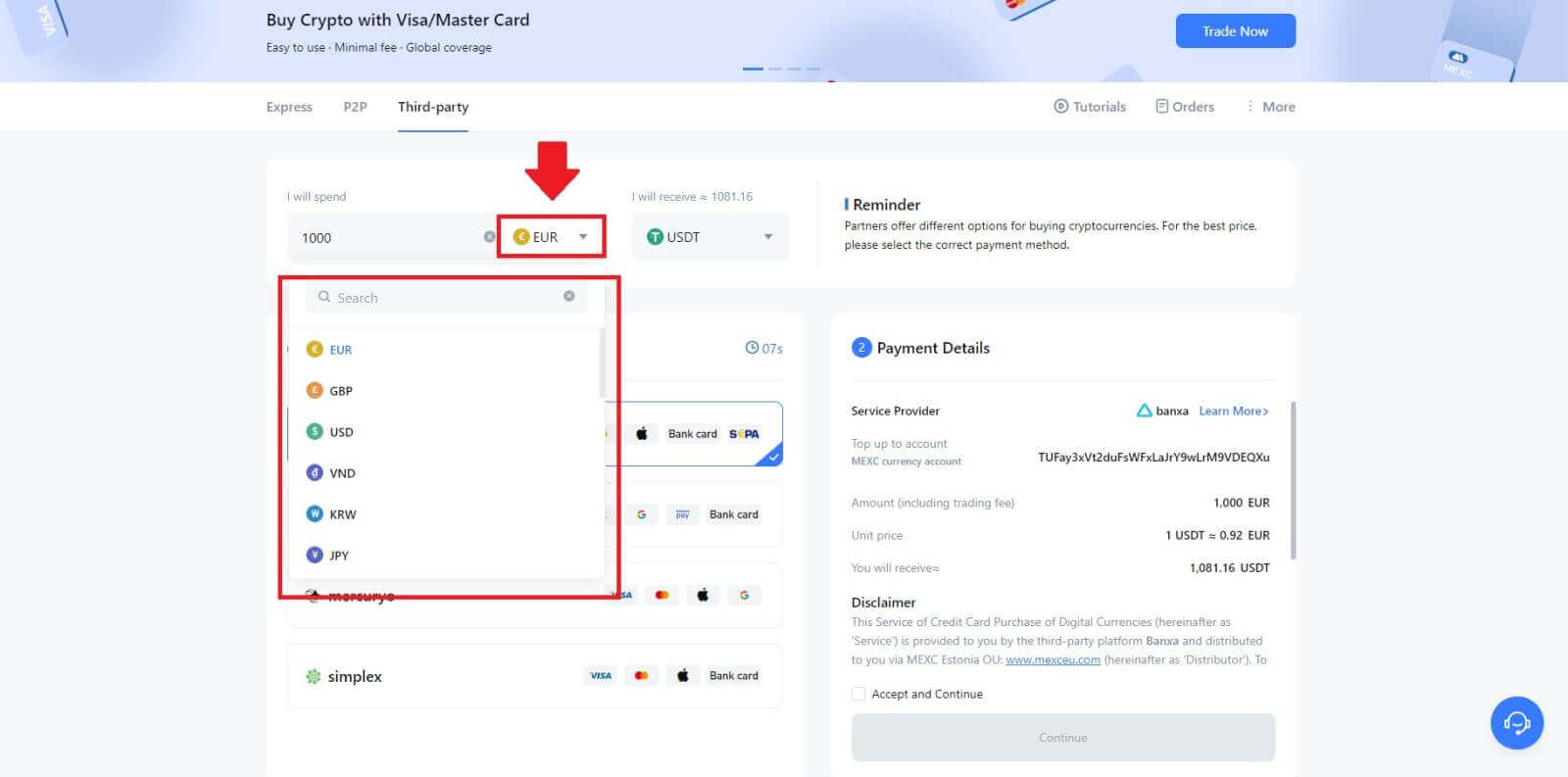

3. Enter and select the Fiat currency you want to pay for. Here, we take EUR as an example.

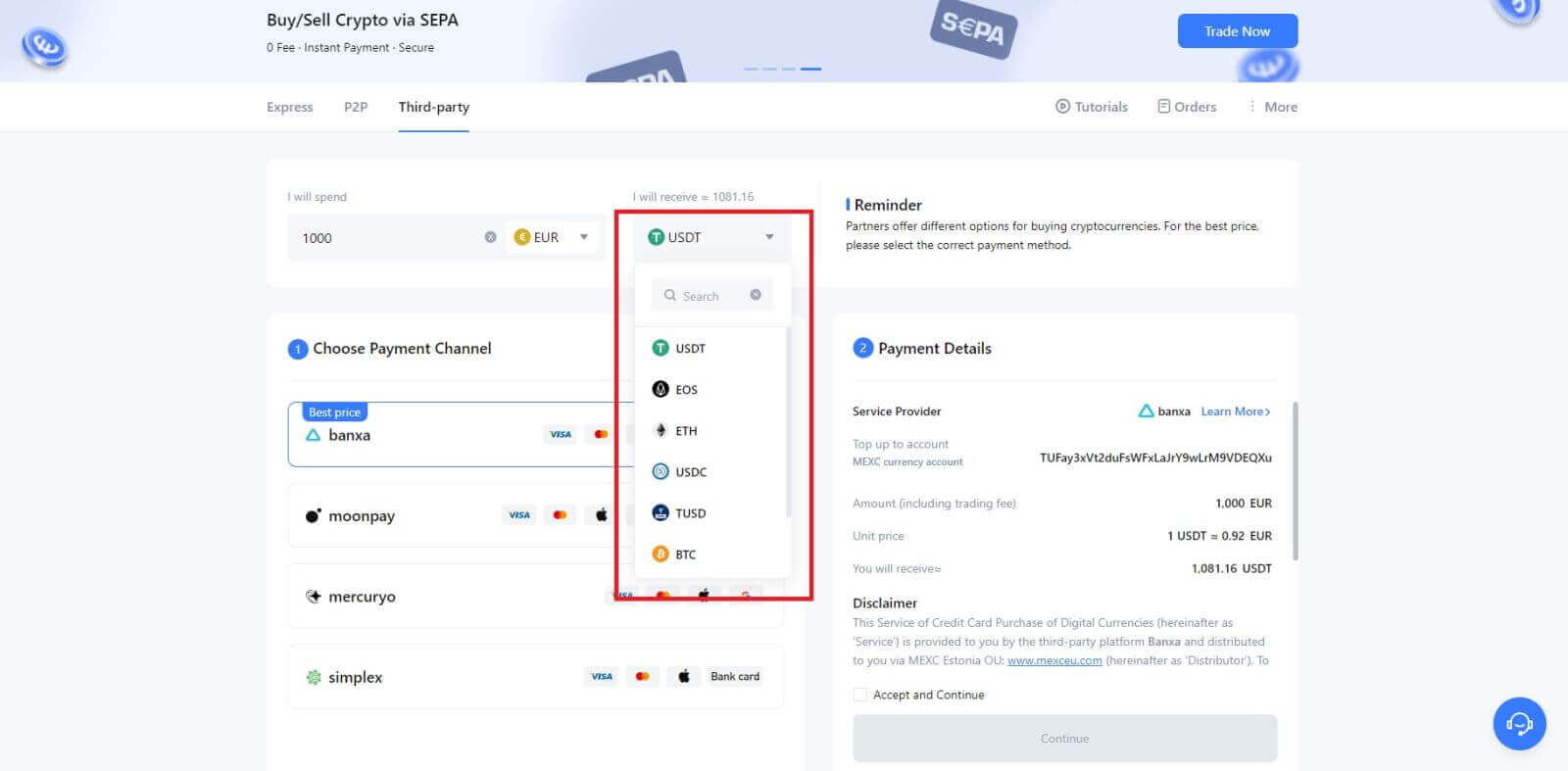

4. Choose the cryptocurrency you want to receive in your MEXC wallet. Options include USDT, USDC, BTC, and other commonly used altcoins and stablecoins.

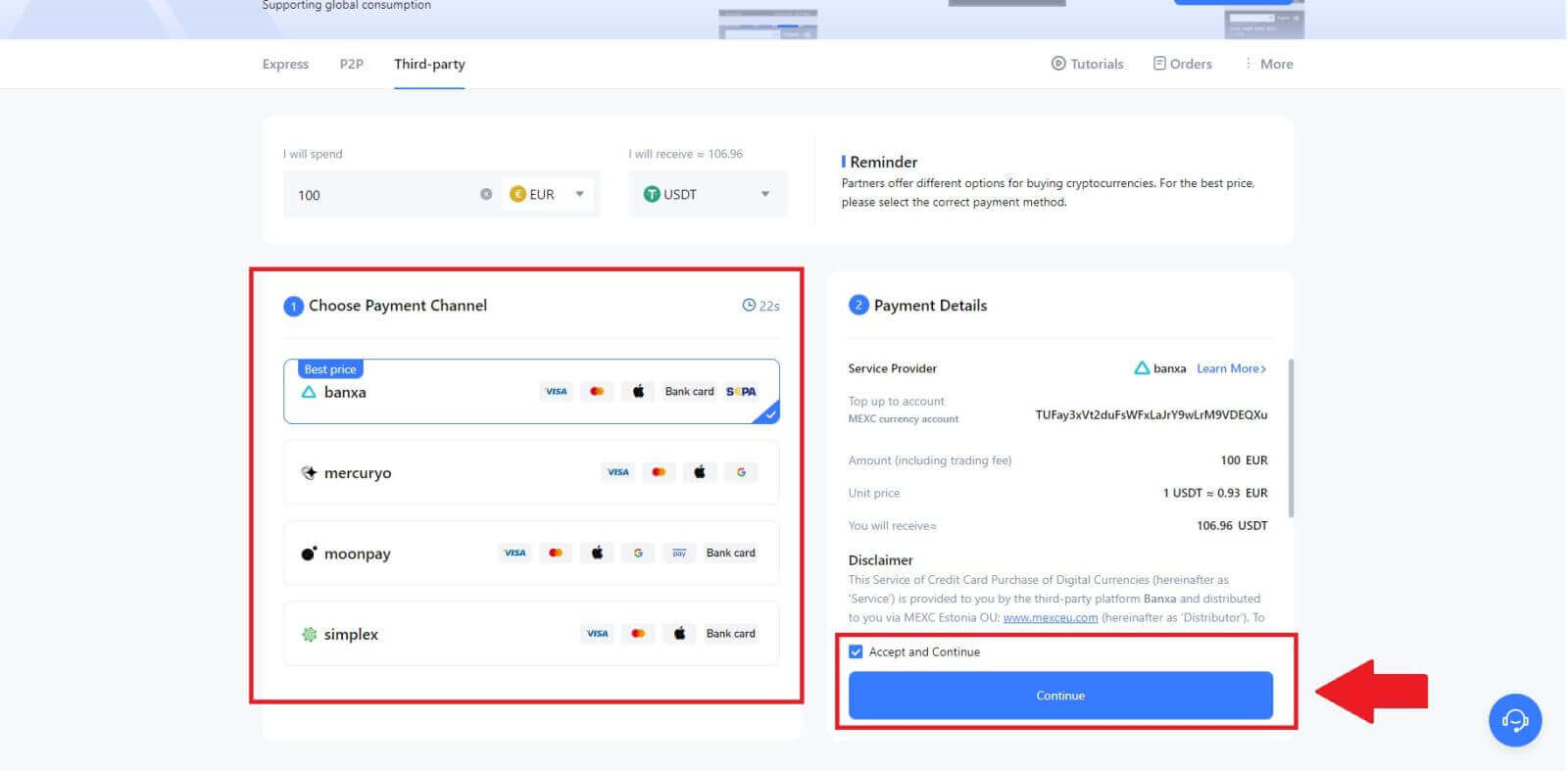

5. Choose your payment channel and you can verify the unit price in the Payment Details section.

Tick on the [Accept and Continue] and click [Continue]. You will be redirected to the Third-party service provider’s official webpage to continue with the purchase.

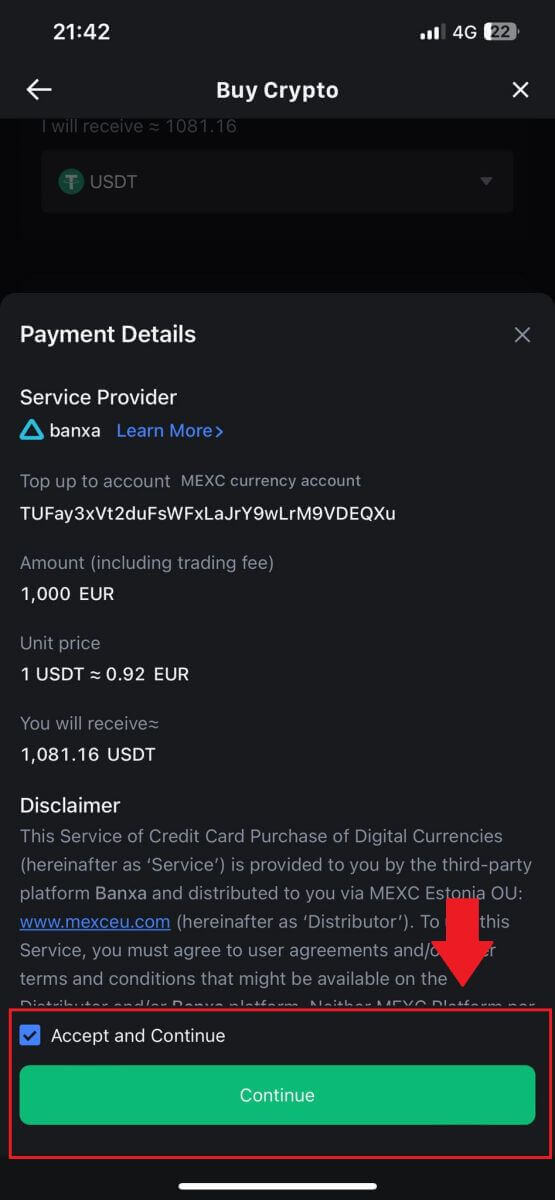

Buy Crypto via Third Party on MEXC (App)

1. Open your MEXC app, on the first page, tap [More].

2. Tap on [Buy Crypto] to continue.

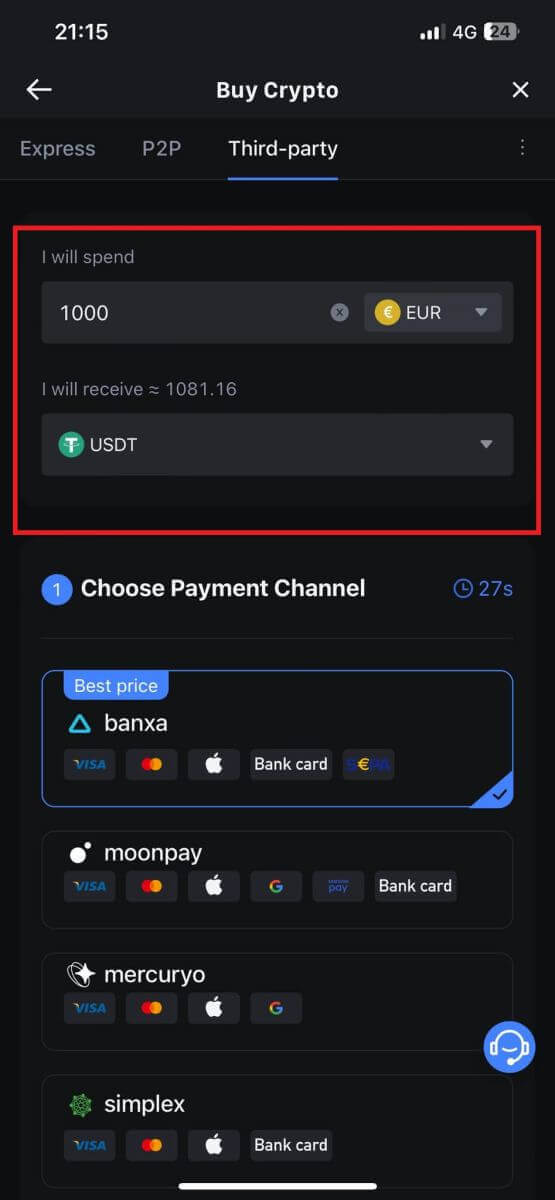

3. Choose your preferred Fiat Currency for the payment and enter the amount for your purchase.

Select the cryptocurrency you want to receive in your MEXC wallet

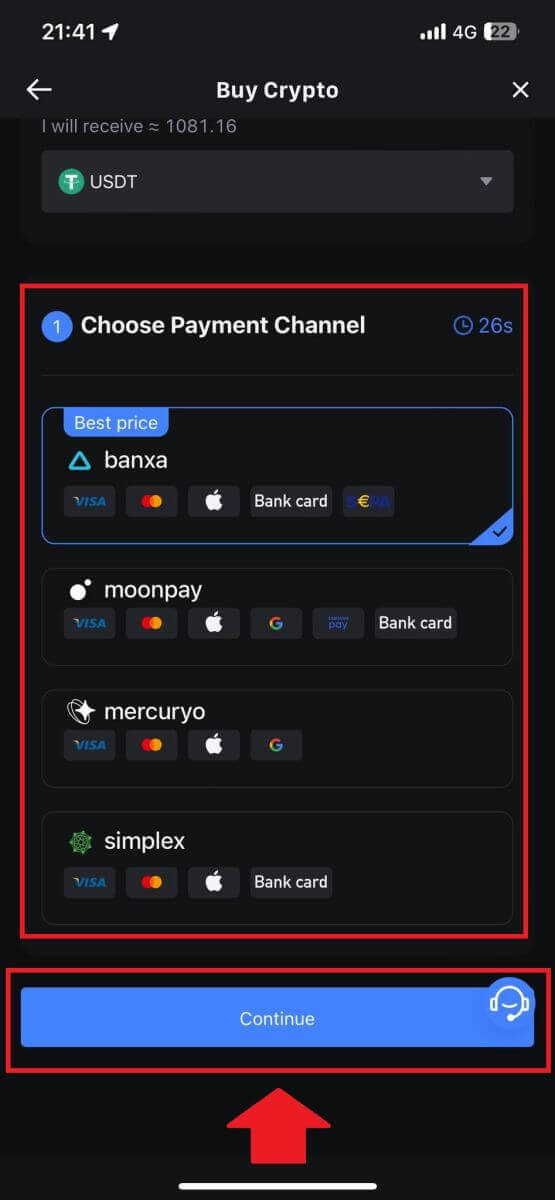

4. Choose your payment network and tap [Continue].

5. Review your details, tick on the [Accept and Continue] button and tap [Continue]. You will be redirected to the Third-party service provider’s official webpage to continue with the purchase.

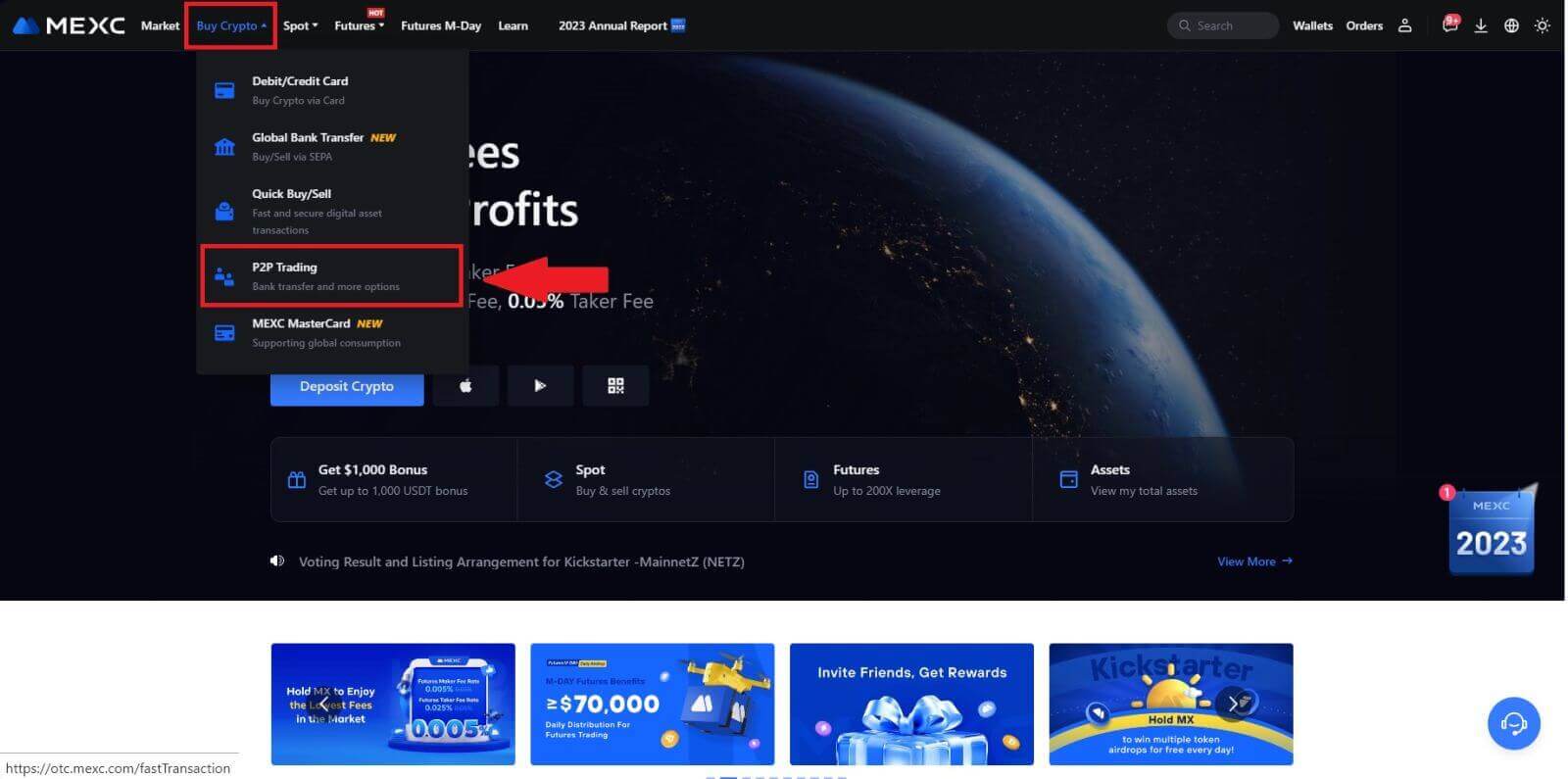

How to Buy Crypto via P2P on MEXC

Buy Crypto via P2P on MEXC (Website)

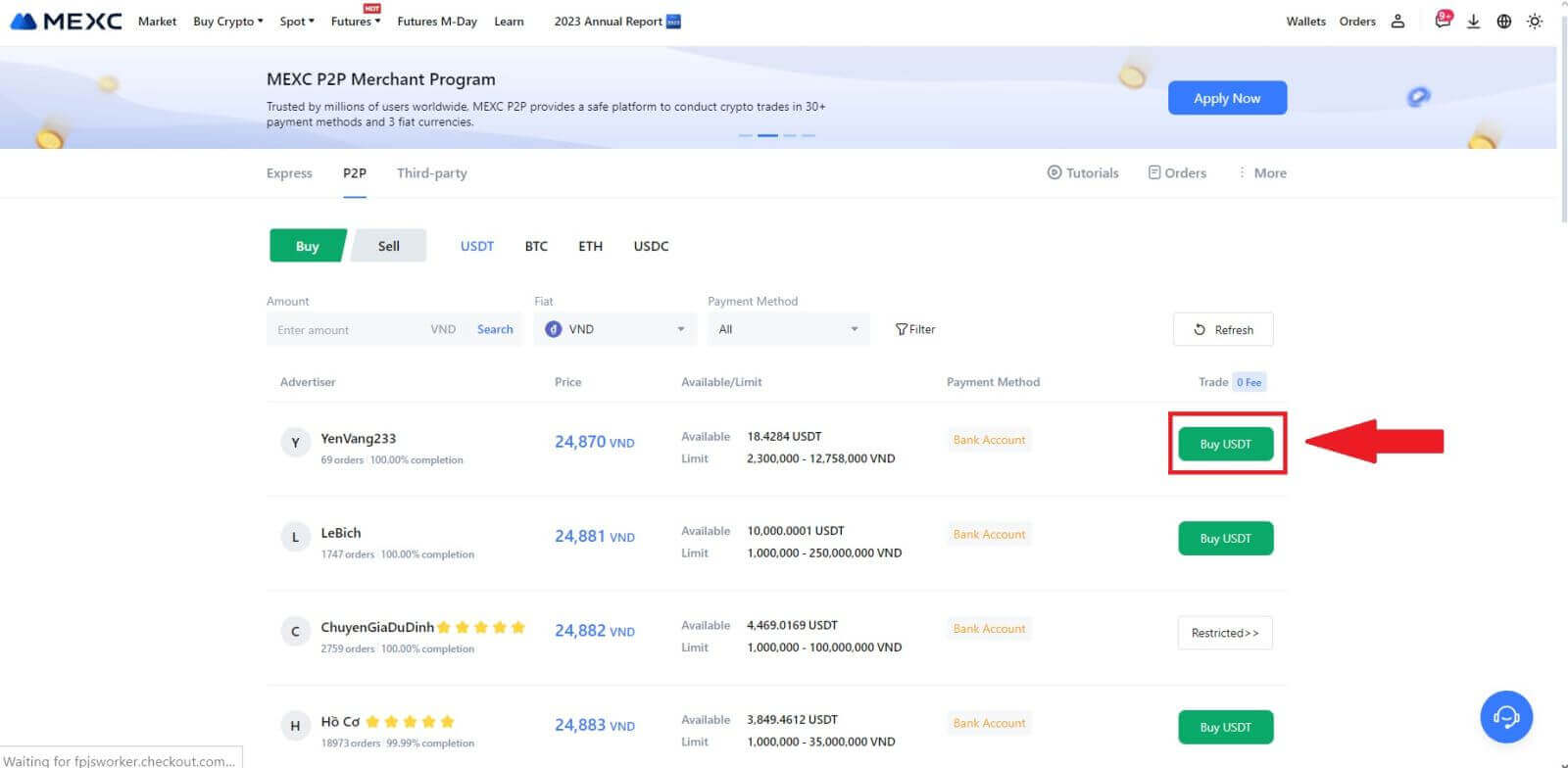

1. Log in to your MEXC, click [Buy Crypto], and select [P2P Trading].

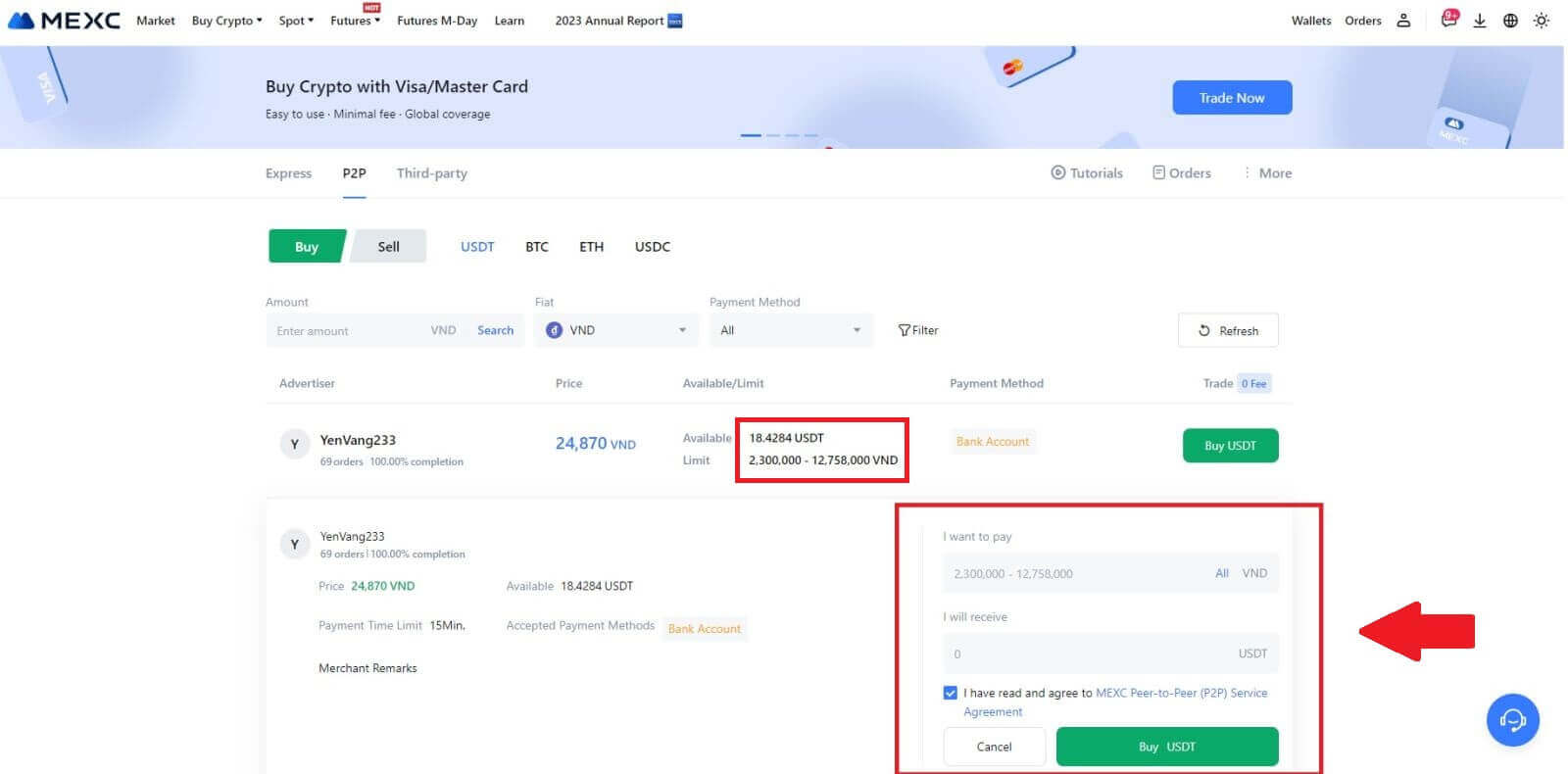

2. On the transaction page, select the merchant you want to trade with and click [Buy USDT].

3. Specify the amount of Fiat Currency you are willing to pay in the [I want to pay] column. Alternatively, you have the option to input the quantity of USDT you aim to receive in the [I will receive] column. The corresponding payment amount in Fiat Currency will be calculated automatically, or conversely, based on your input.

After following the aforementioned steps, kindly ensure to check the box indicating [I have read and agree to MEXC Peer-to-Peer (P2P) Service Agreement]. Click on [Buy USDT] and subsequently, you will be redirected to the Order page.

Note: Under the [Limit] and [Available] columns, P2P Merchants have provided details on the available cryptocurrencies for purchase. Additionally, the minimum and maximum transaction limits per P2P order, presented in fiat terms for each advertisement, are also specified.

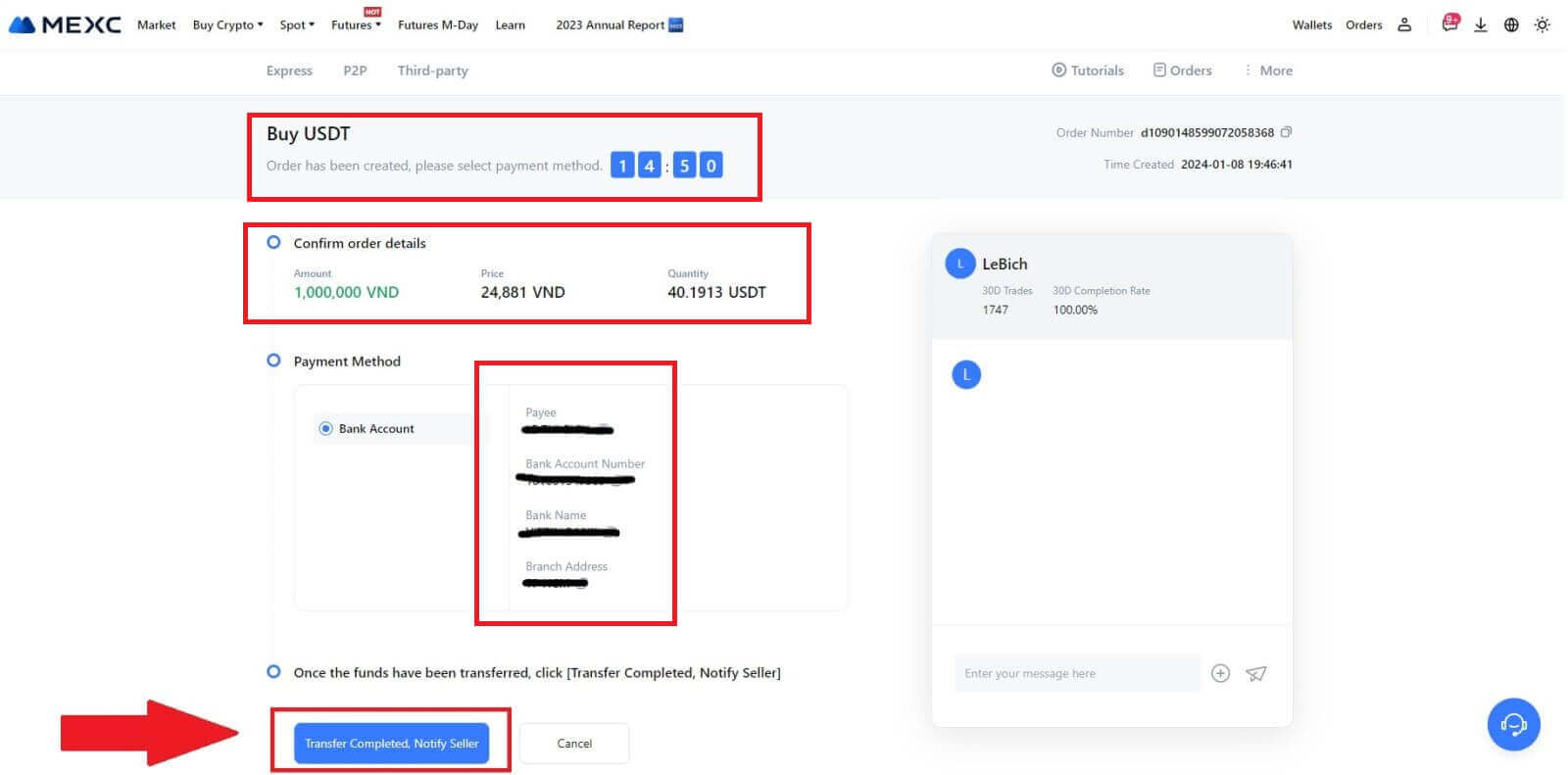

4. Reaching the order page, you are granted a 15-minute window to transfer the funds to the P2P Merchant’s bank account. Prioritize reviewing the order details to confirm that the purchase aligns with your transaction requirements.

- Examine the payment information exhibited on the Order page and proceed to finalize the transfer to the P2P Merchant’s bank account.

- Take advantage of the Live Chat box for real-time communication with P2P Merchants, ensuring seamless interaction.

- After completing the fund transfer, kindly check the box labeled [Transfer Completed, Notify Seller].

Note: MEXC P2P requires users to manually transfer fiat currency from their online banking or payment app to the designated P2P Merchant after order confirmation, as automatic payment is not supported.

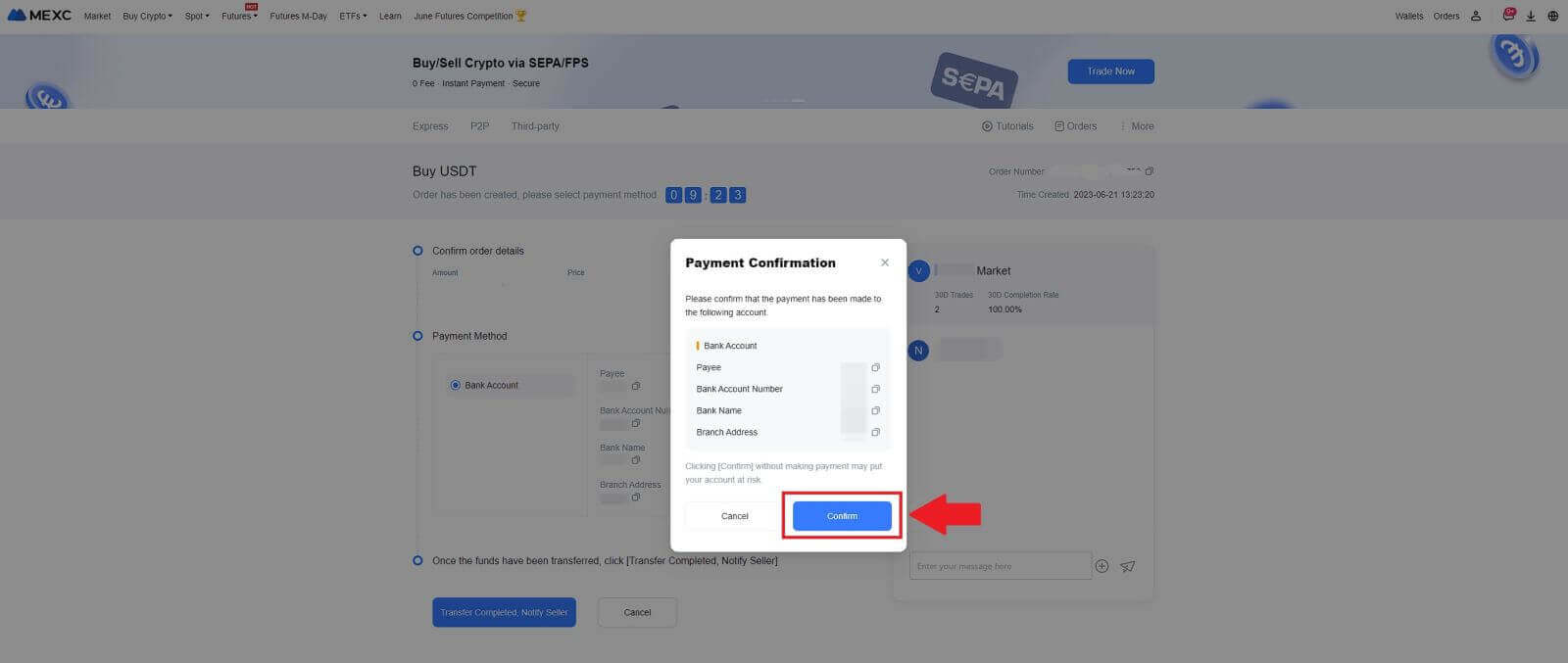

5. To proceed with the P2P buy order, simply click on [Confirm].

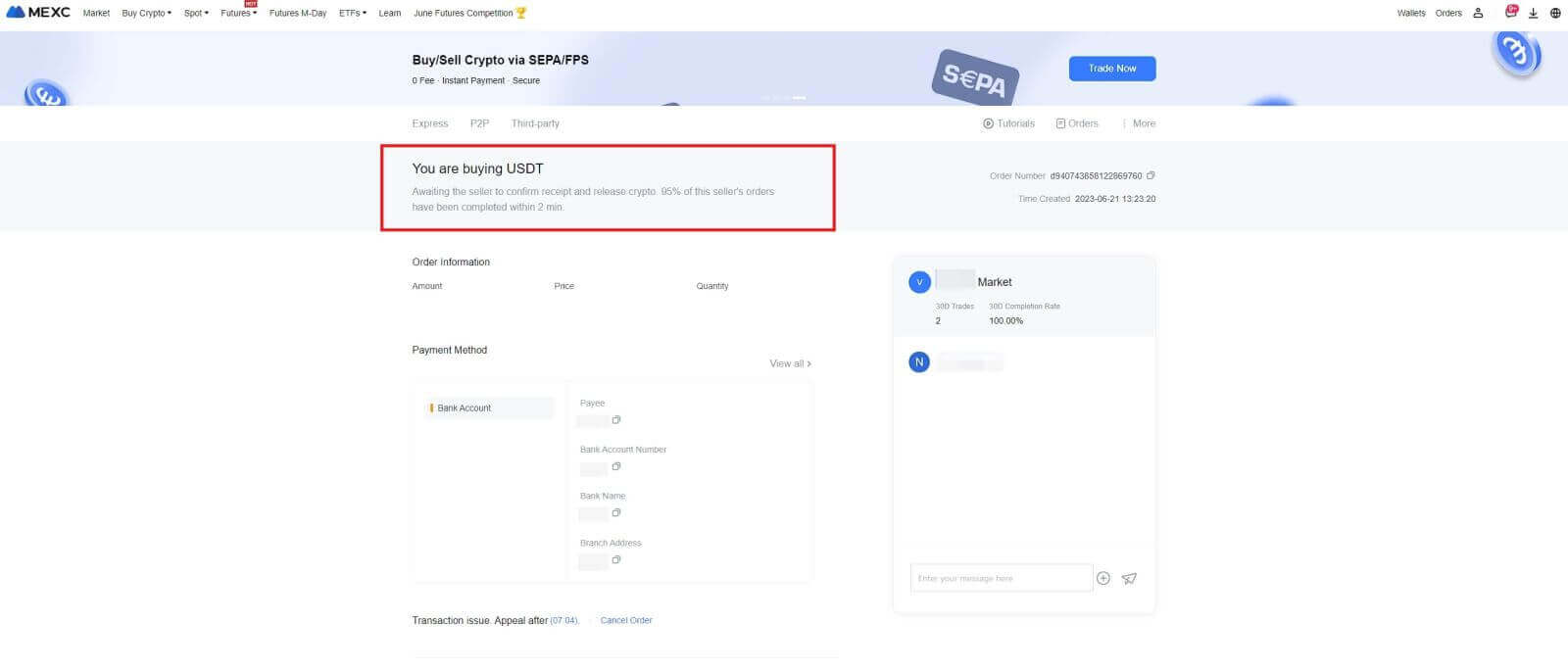

6. Please wait for the P2P Merchant to release the USDT and finalize the order.

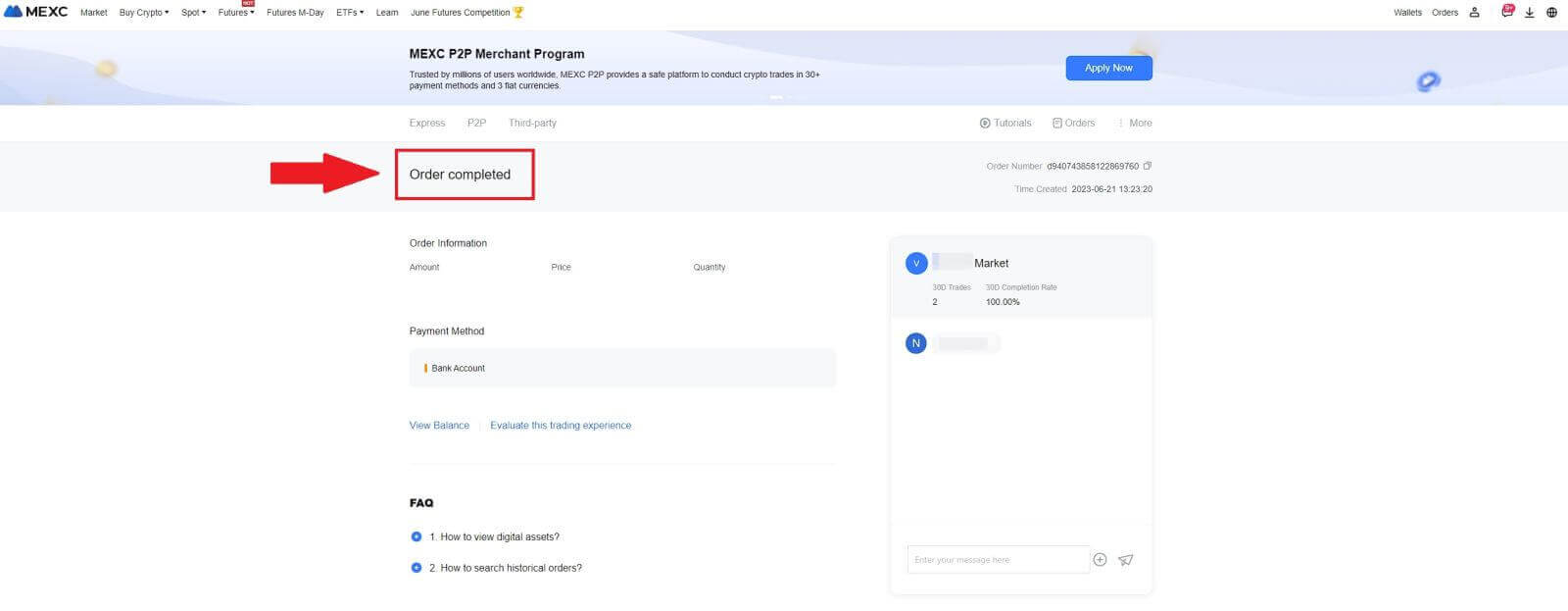

7. Congratulations! You have successfully completed the purchase of crypto through MEXC P2P.

Buy Crypto via P2P on MEXC (App)

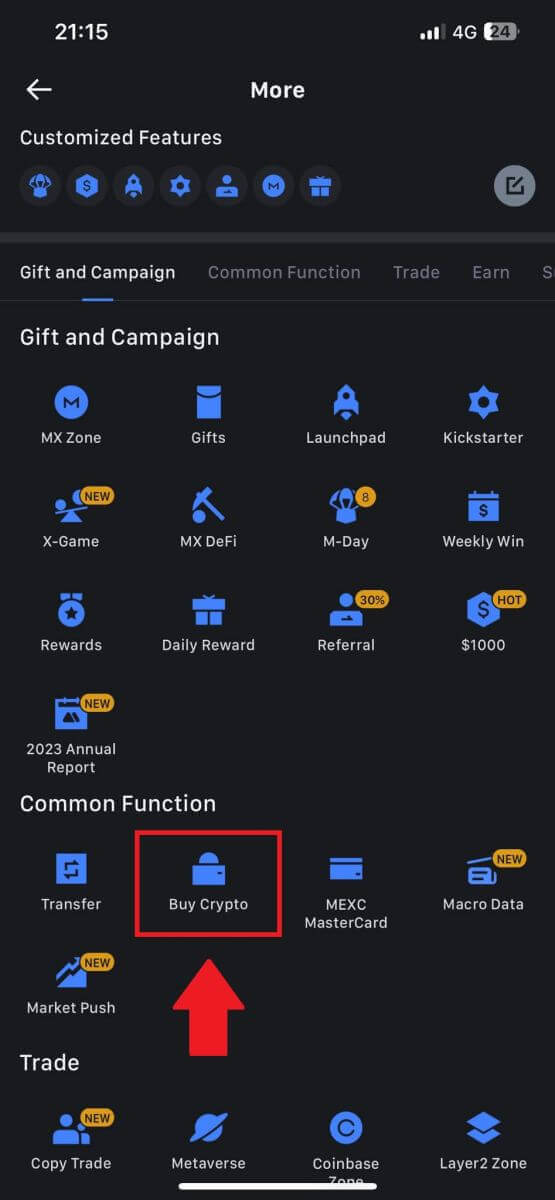

1. Open your MEXC app, on the first page, tap [More].

2. Tap on [Buy Crypto] to continue.

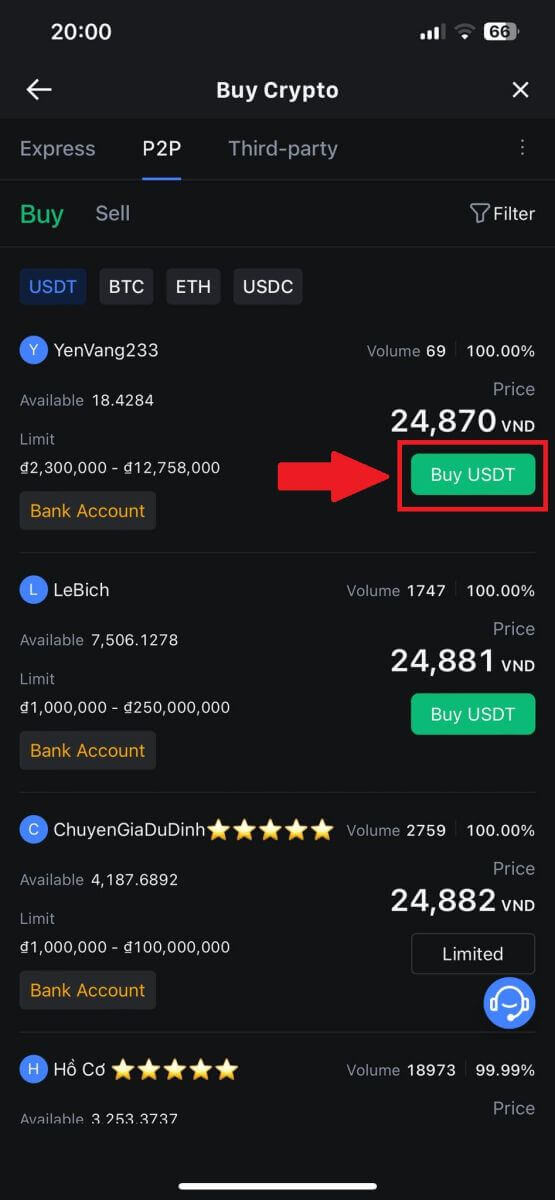

3. On the transaction page, select the merchant you want to trade with and click [Buy USDT].

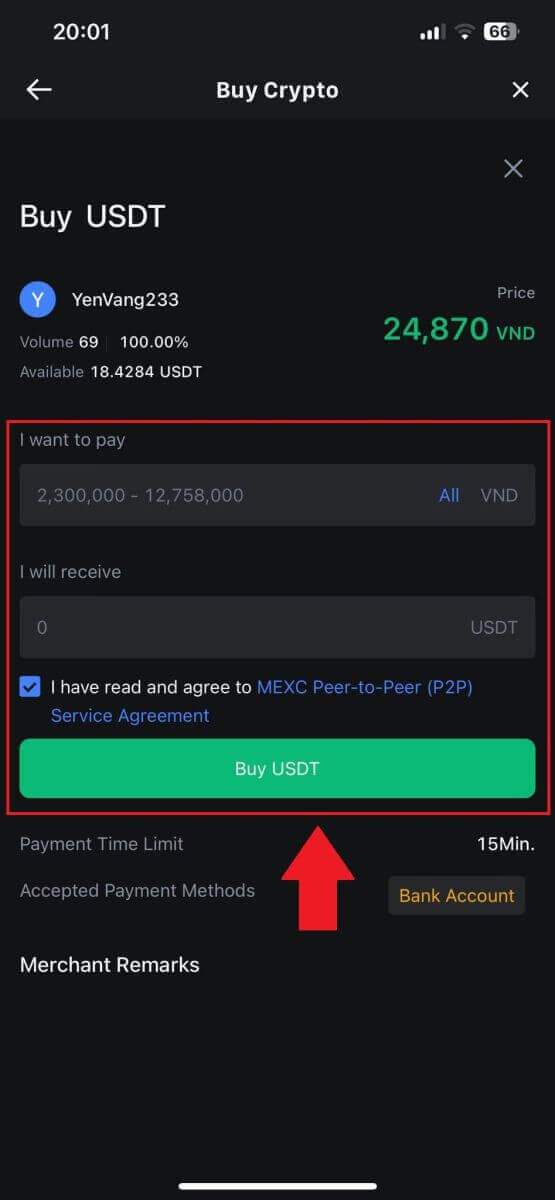

4. Specify the amount of Fiat Currency you are willing to pay in the [I want to pay] column. Alternatively, you have the option to input the quantity of USDT you aim to receive in the [I will receive] column. The corresponding payment amount in Fiat Currency will be calculated automatically, or conversely, based on your input.

After following the aforementioned steps, kindly ensure to check the box indicating [I have read and agree to MEXC Peer-to-Peer (P2P) Service Agreement]. Click on [Buy USDT] and subsequently, you will be redirected to the Order page.

Note: Under the [Limit] and [Available] columns, P2P Merchants have provided details on the available cryptocurrencies for purchase. Additionally, the minimum and maximum transaction limits per P2P order, presented in fiat terms for each advertisement, are also specified.

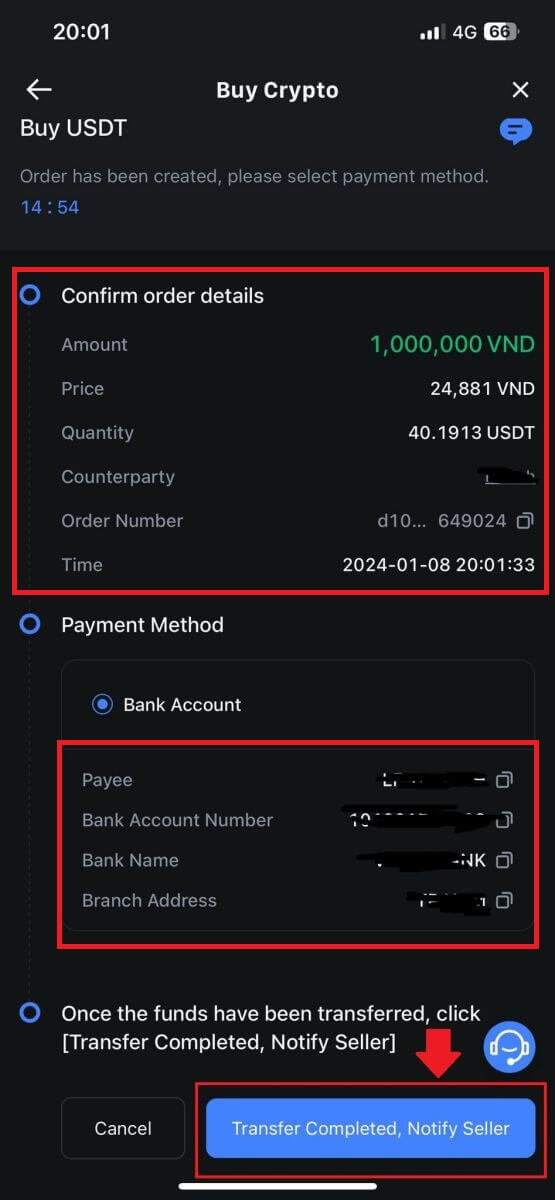

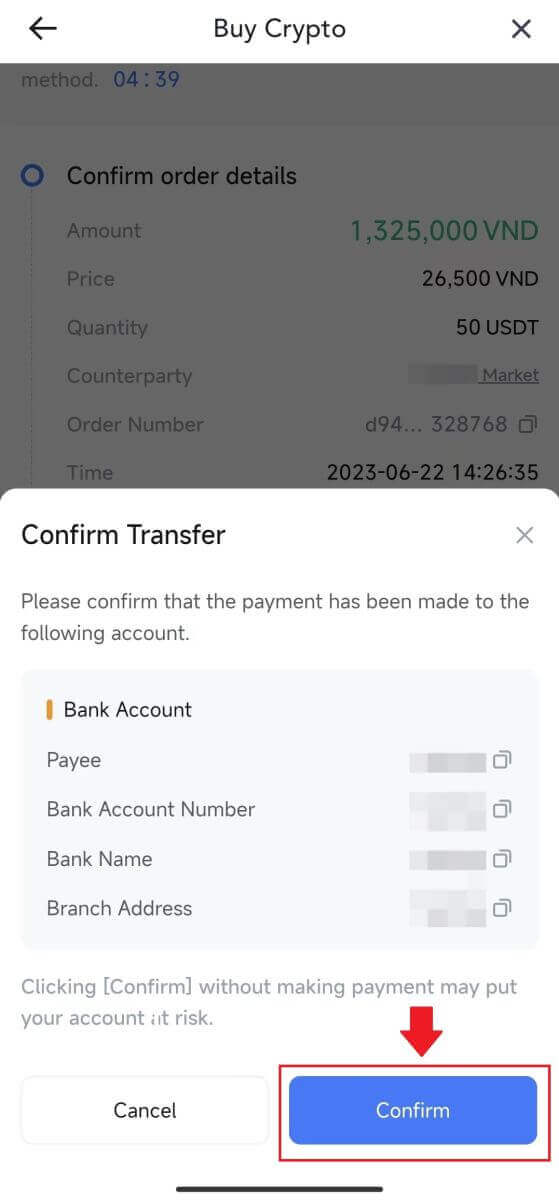

5. Please review the [order details] to ensure that the purchase aligns with your transaction requirements.

- Take a moment to examine the payment information displayed on the Order page and proceed to finalize the transfer to the P2P Merchant’s bank account.

- Take advantage of the Live Chat box for real-time communication with P2P Merchants, ensuring seamless interaction

- After completing the payment, click [Transfer Completed, Notify Seller].

- The merchant will soon confirm the payment, and the cryptocurrency will be transferred to your account.

Note: MEXC P2P requires users to manually transfer fiat currency from their online banking or payment app to the designated P2P Merchant after order confirmation, as automatic payment is not supported.

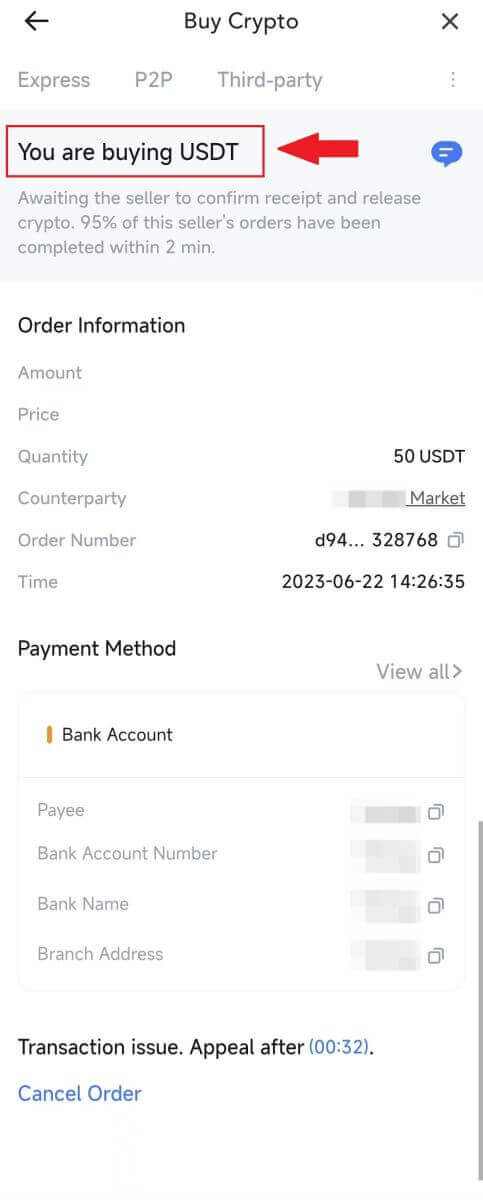

6. To proceed with the P2P buy order, simply click on [Confirm].

7. Please wait for the P2P Merchant to release the USDT and finalize the order.

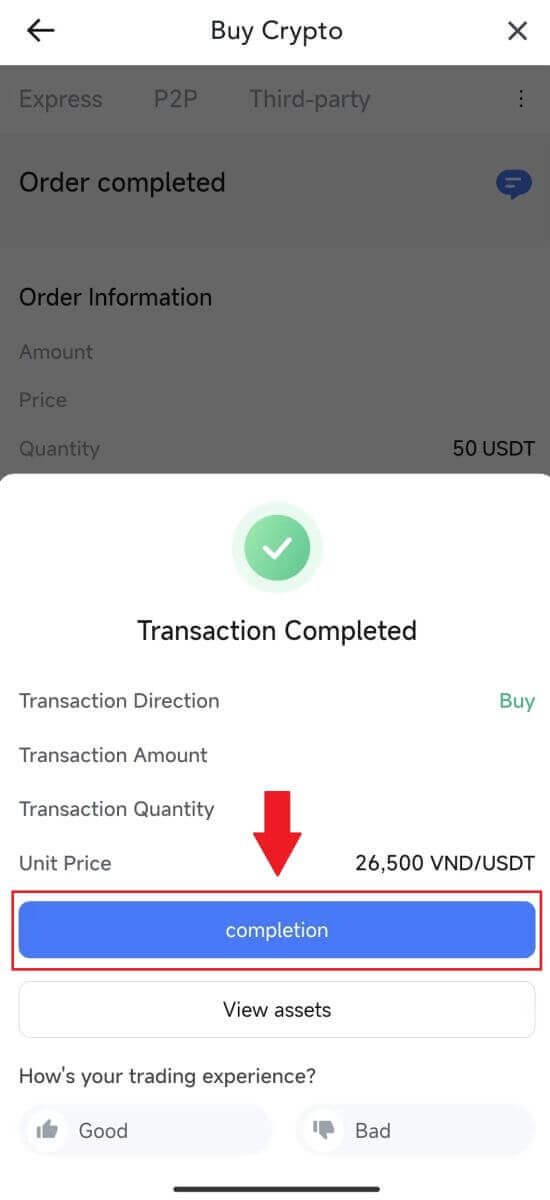

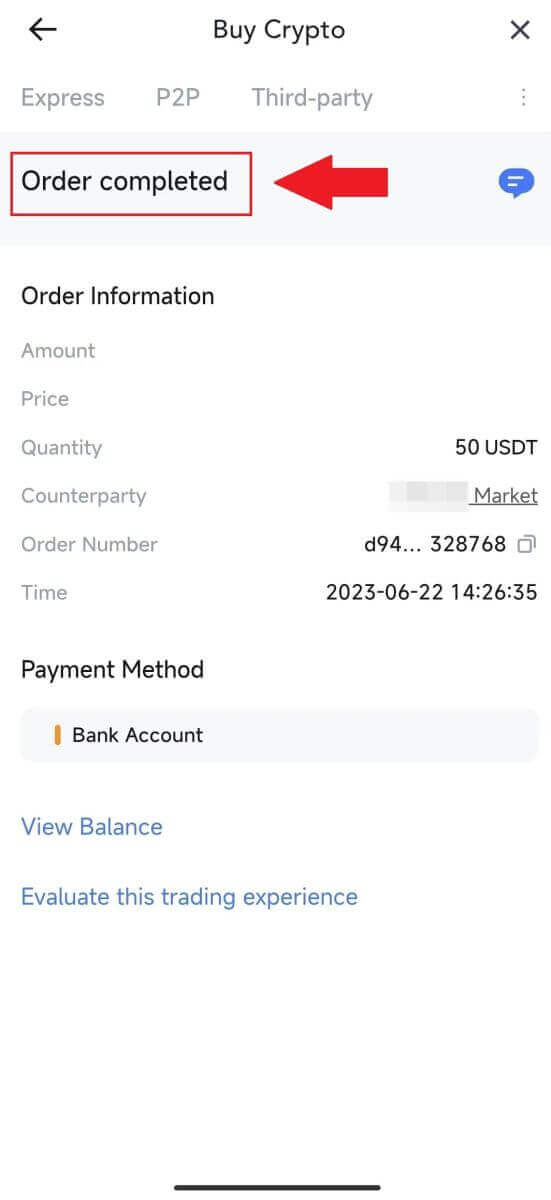

8. Congratulations! You have successfully completed the purchase of crypto through MEXC P2P.

How to Deposit on MEXC

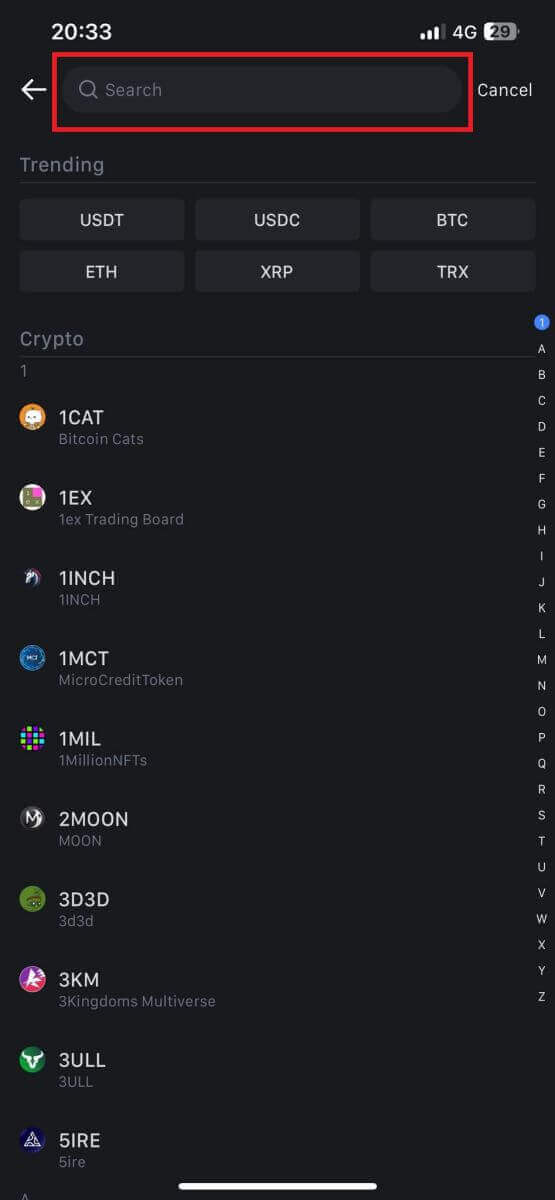

Deposit Crypto on MEXC (Website)

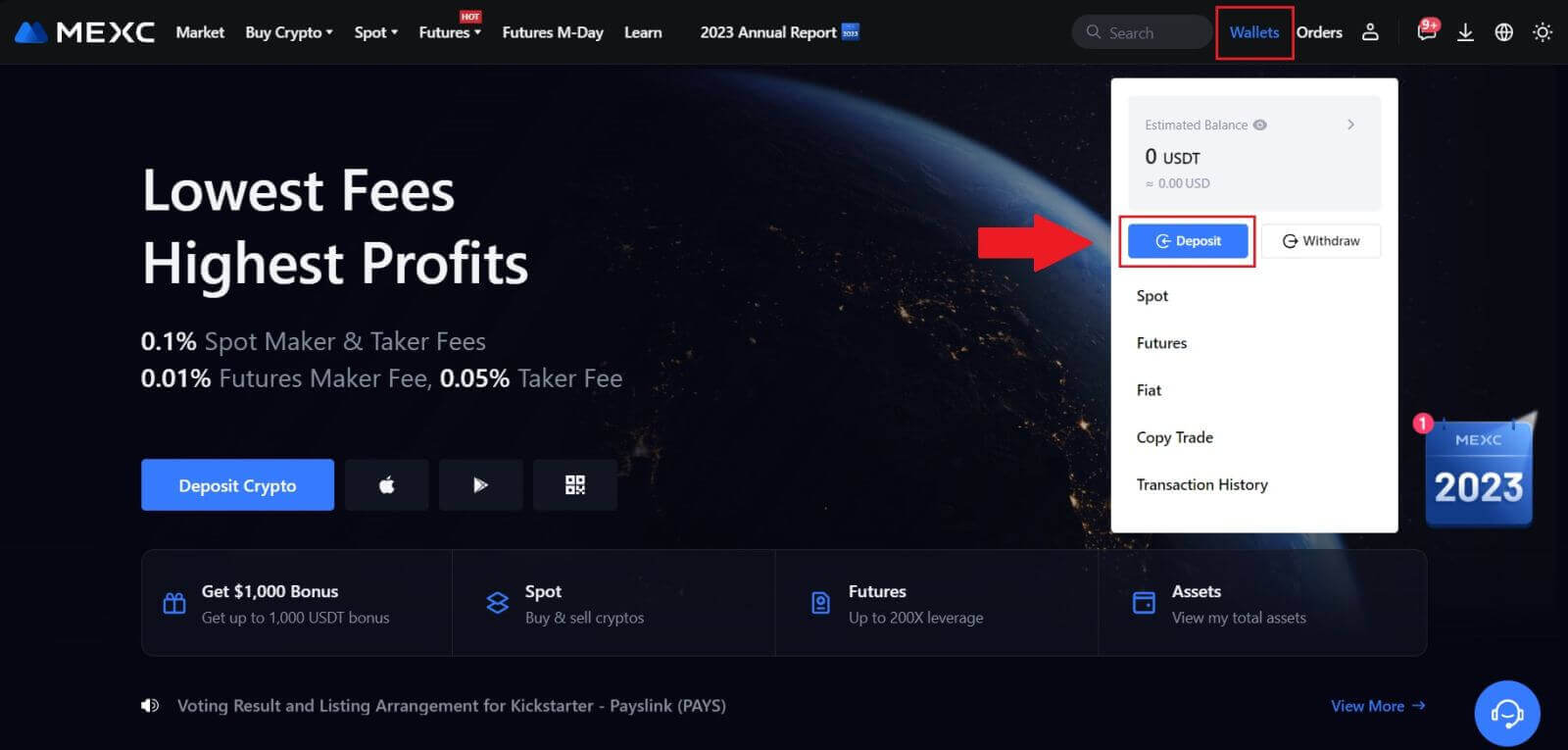

1. Log in to your MEXC, click on [Wallets] and select [Deposit].

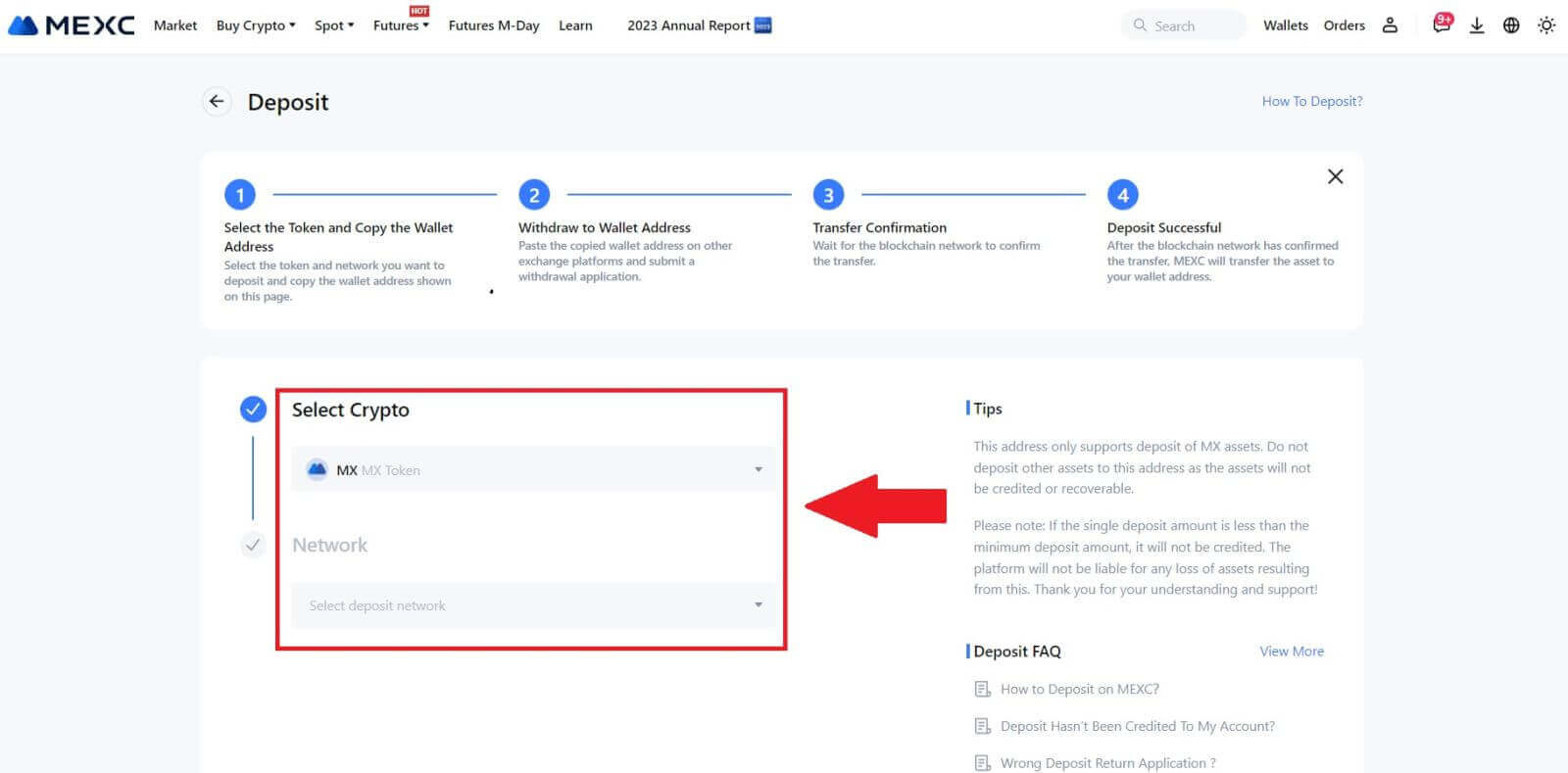

2. Select the cryptocurrency that you want to deposit and choose your network. Here, we using MX as an example.

Note: Different networks have different transaction fees. You can select a network with lower fees for your withdrawals.

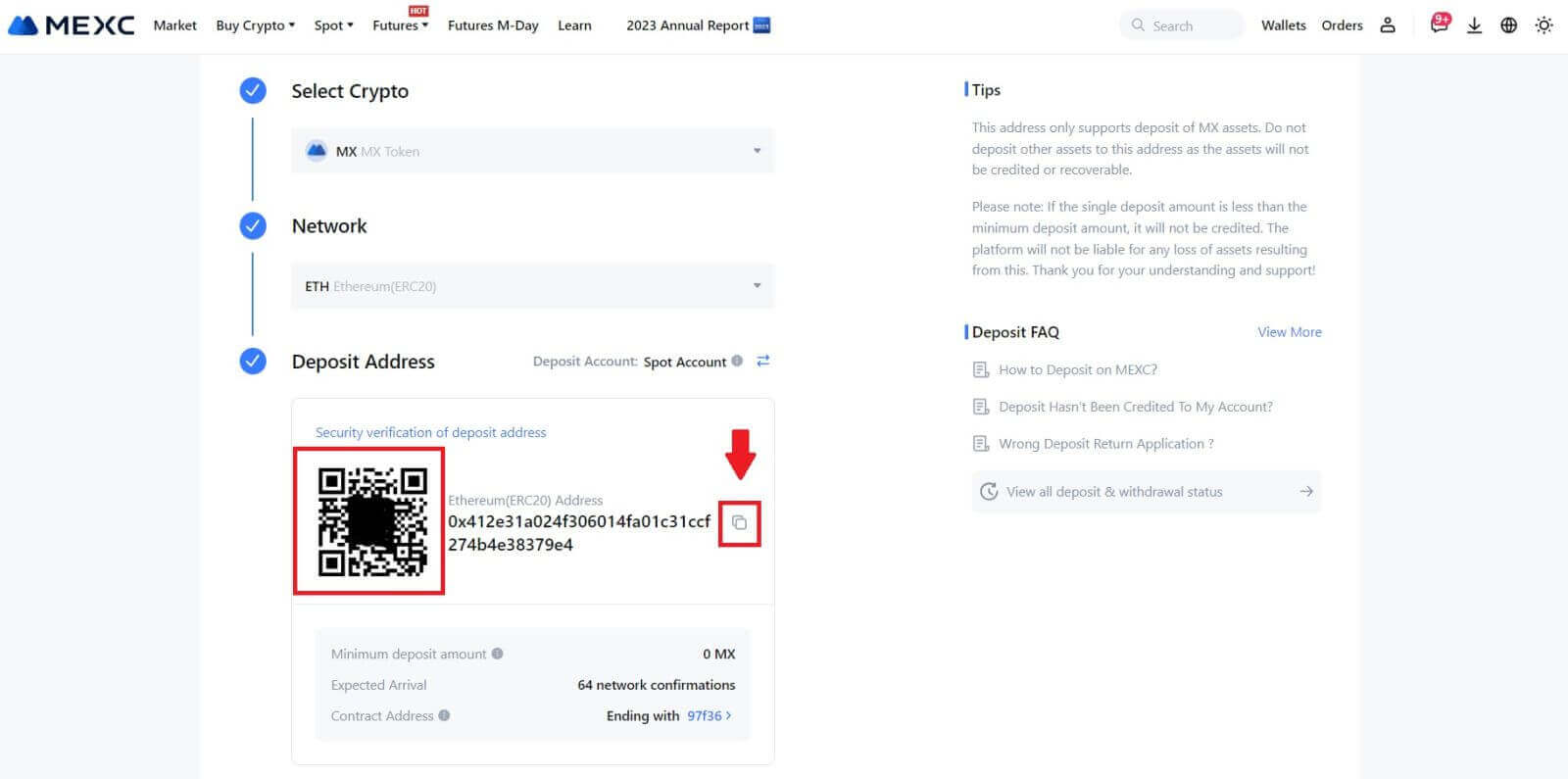

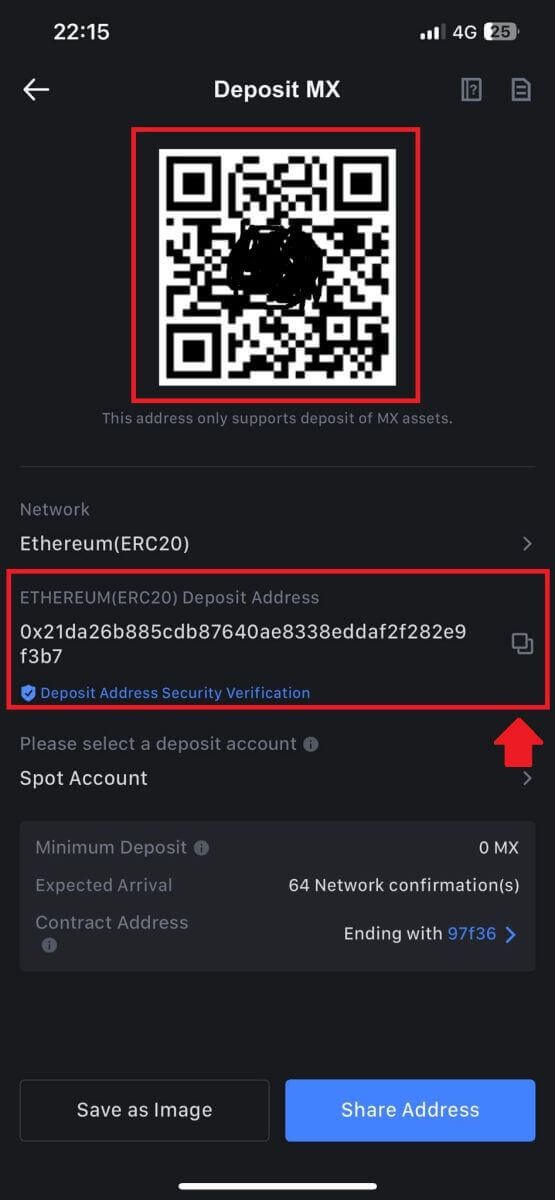

3. Click the copy button or scan the QR code to obtain the deposit address. Paste this address into the withdrawal address field on the withdrawal platform. Follow the provided instructions on the withdrawal platform to initiate the withdrawal request.

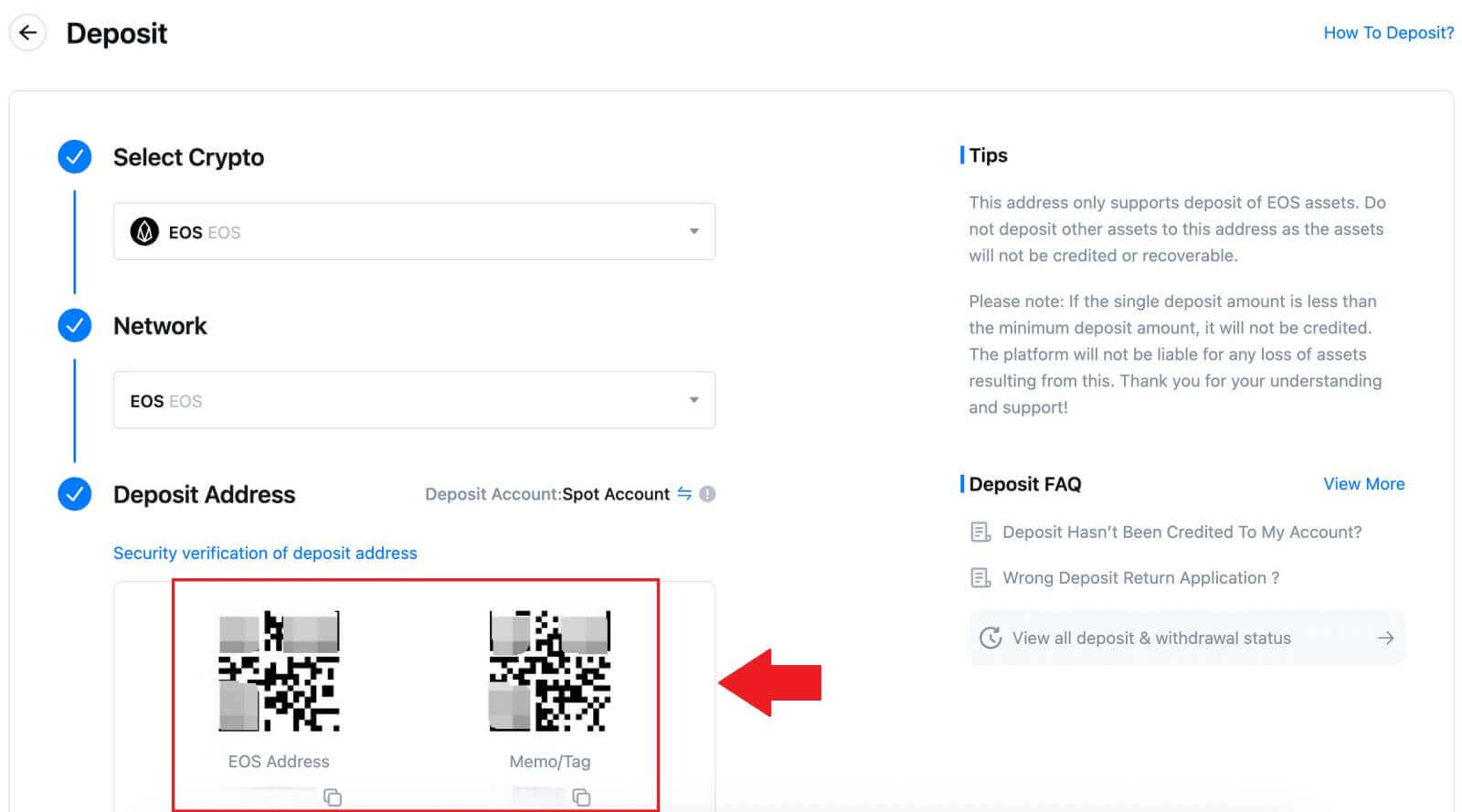

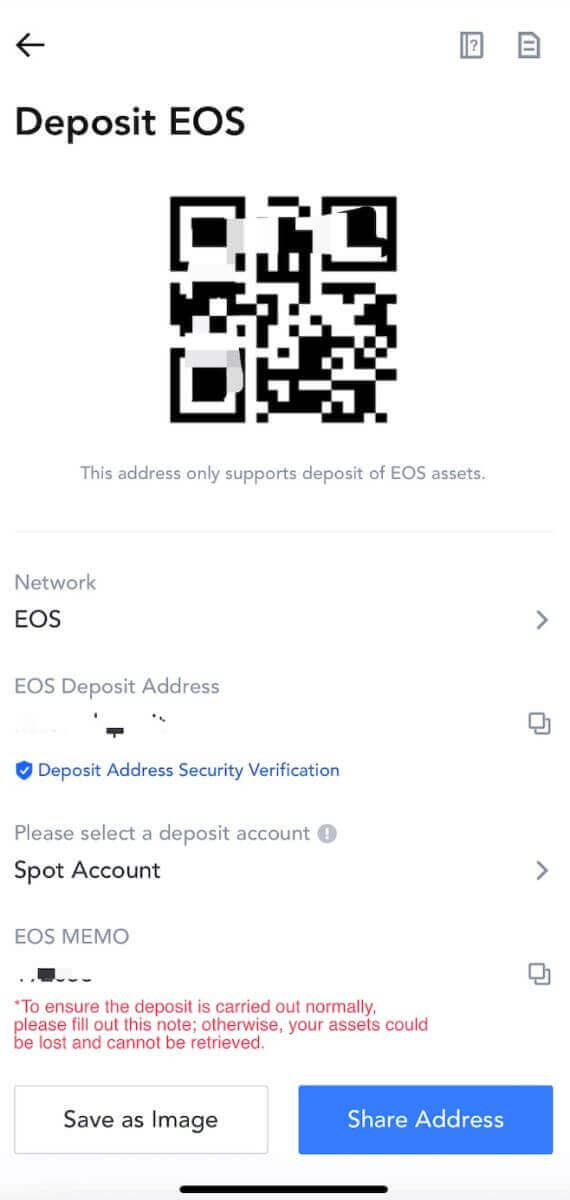

For certain networks like EOS, remember to include a Memo along with the address when making deposits. Without the Memo, your address may not be detected.

4. Let’s use MetaMask wallet as an example to demonstrate how to withdraw MX Token to the MEXC platform.

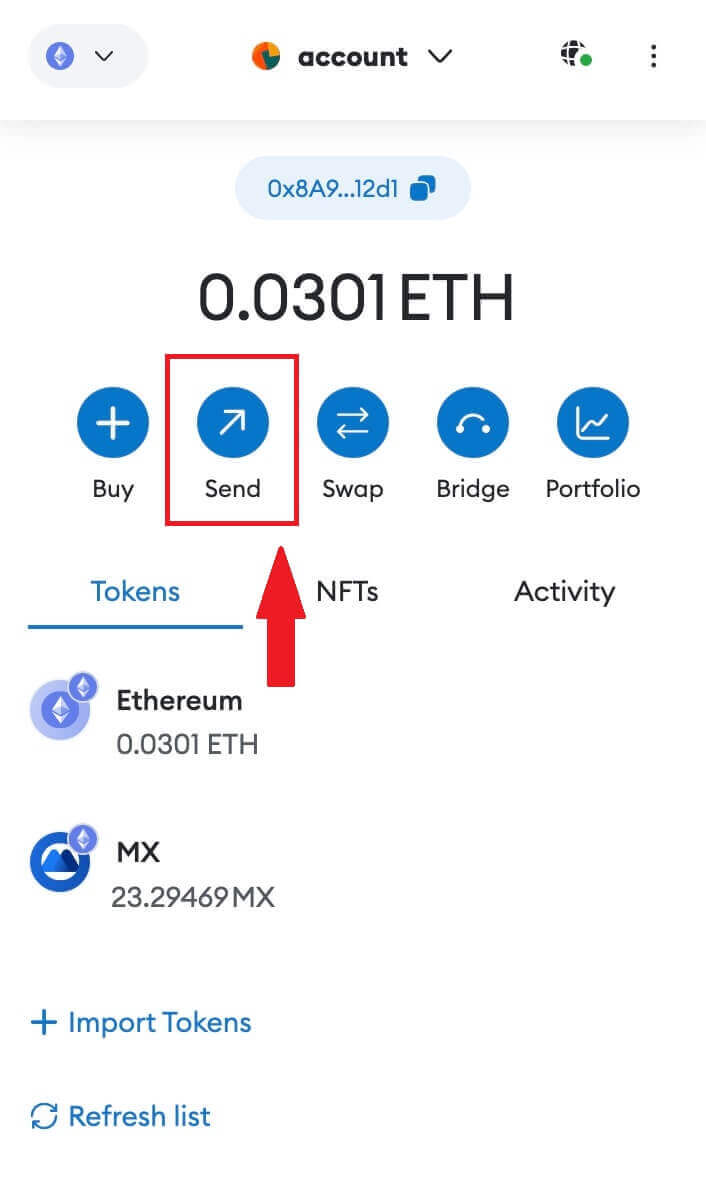

In your MetaMask wallet, select [Send].

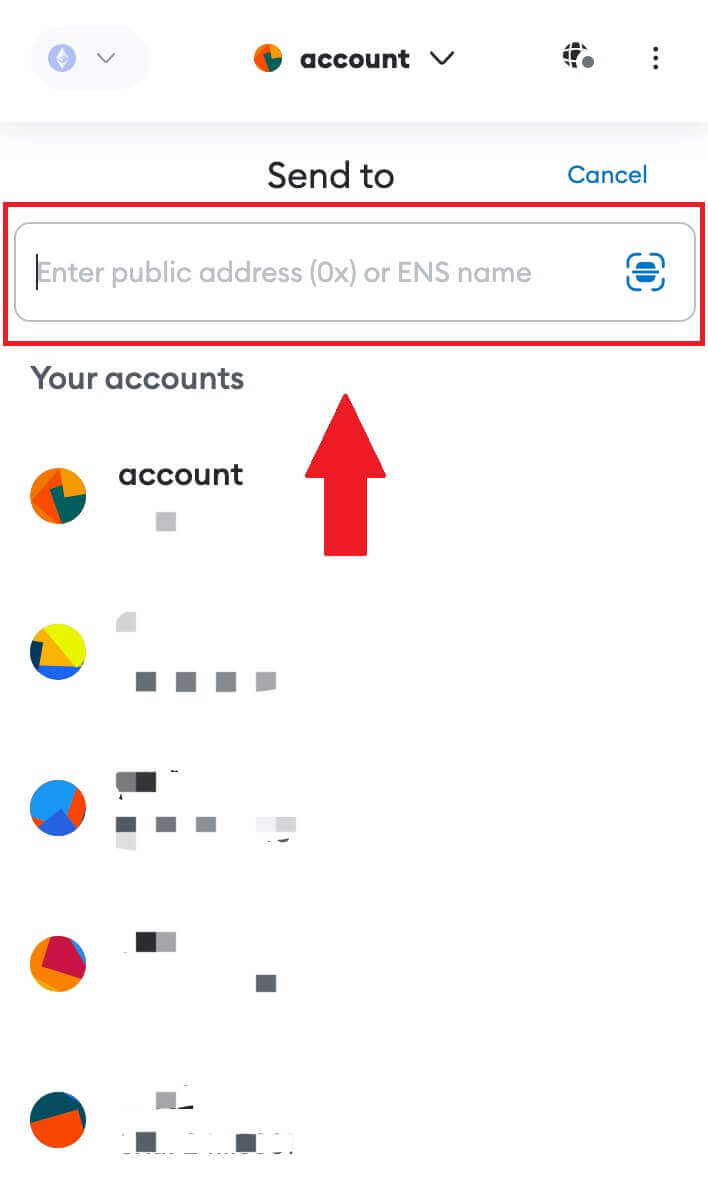

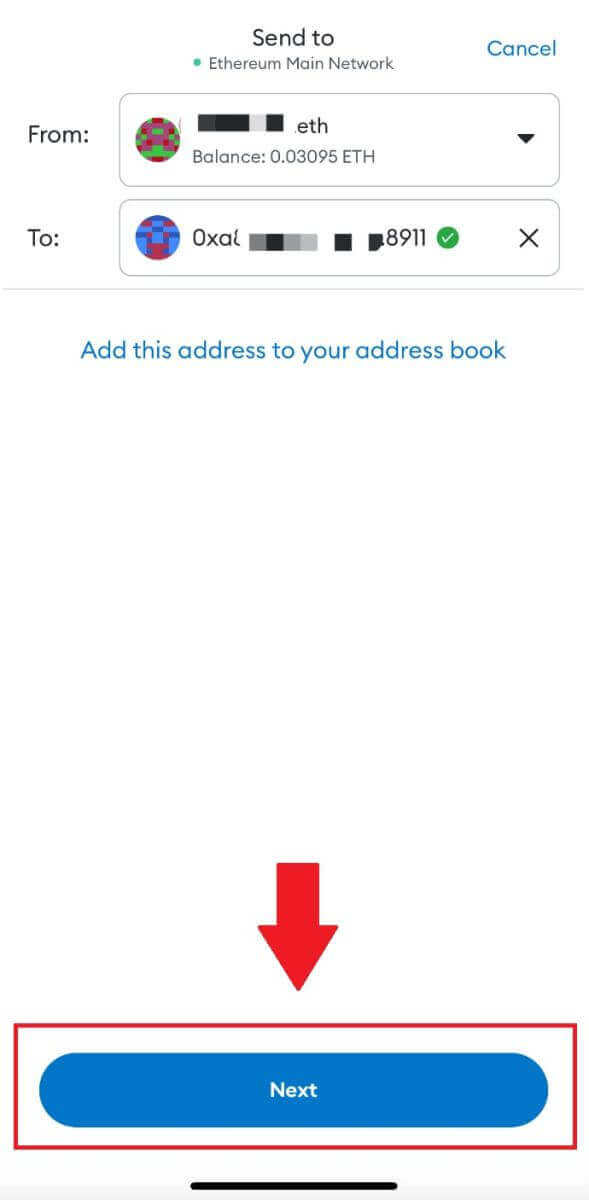

5. Copy and paste the deposit address into the withdrawal address field in MetaMask. Make sure to choose the same network as your deposit address.

5. Copy and paste the deposit address into the withdrawal address field in MetaMask. Make sure to choose the same network as your deposit address.

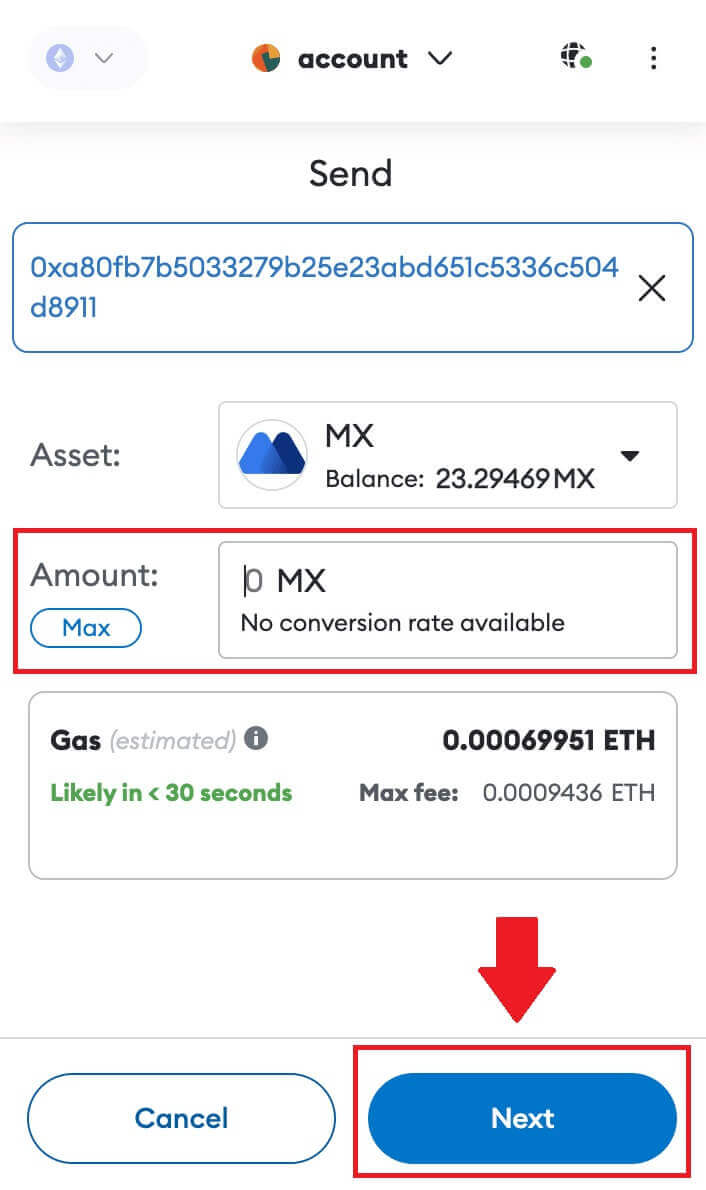

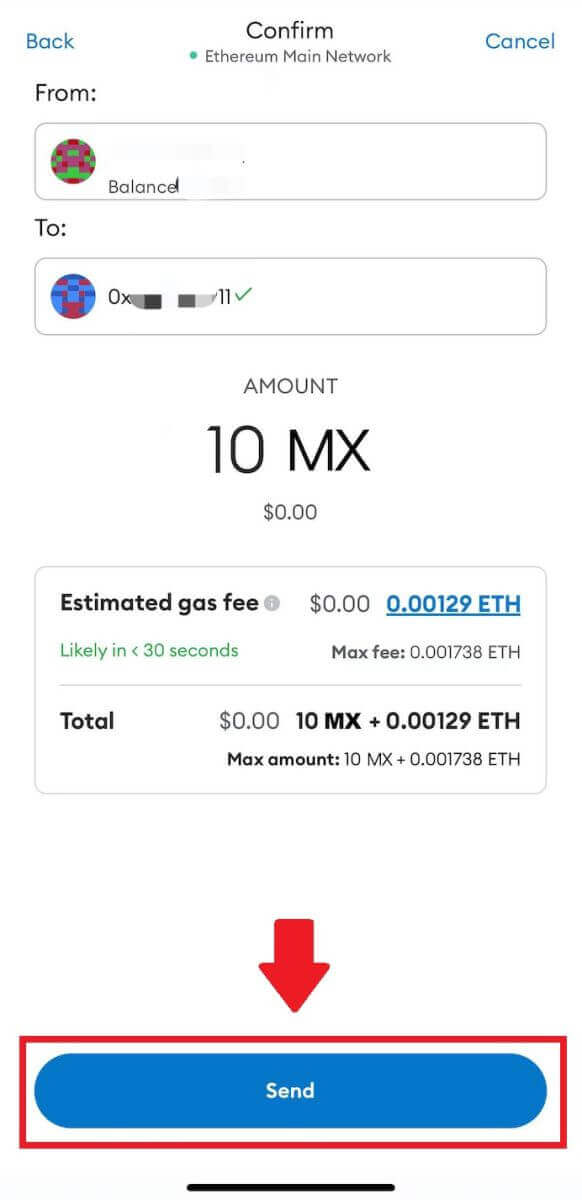

6. Enter the amount you wish to withdraw, then click on [Next].

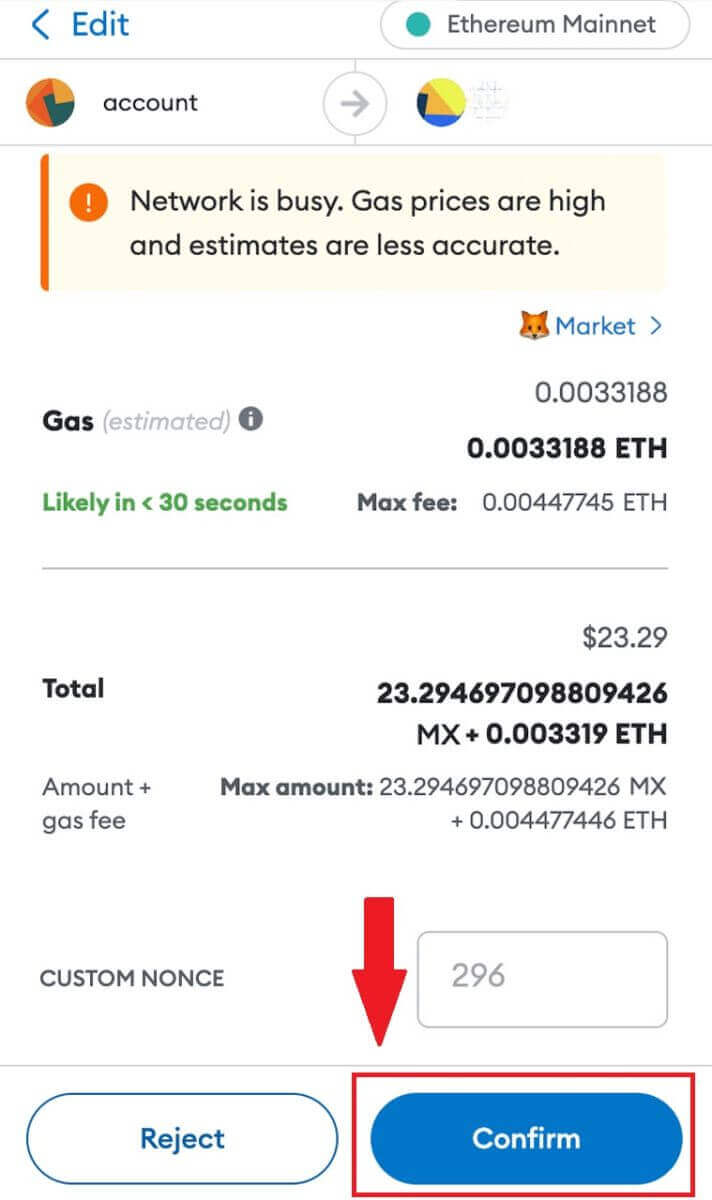

7. Review the withdrawal amount for MX Token, verify the current network transaction fee, confirm that all information is accurate, and then click on [Confirm] to finalize the withdrawal to the MEXC platform. Your funds will be deposited into your MEXC account shortly.

8. After you request a withdrawal, the token deposit needs confirmation from the blockchain. Once confirmed, the deposit will be added to your spot account.

8. After you request a withdrawal, the token deposit needs confirmation from the blockchain. Once confirmed, the deposit will be added to your spot account.

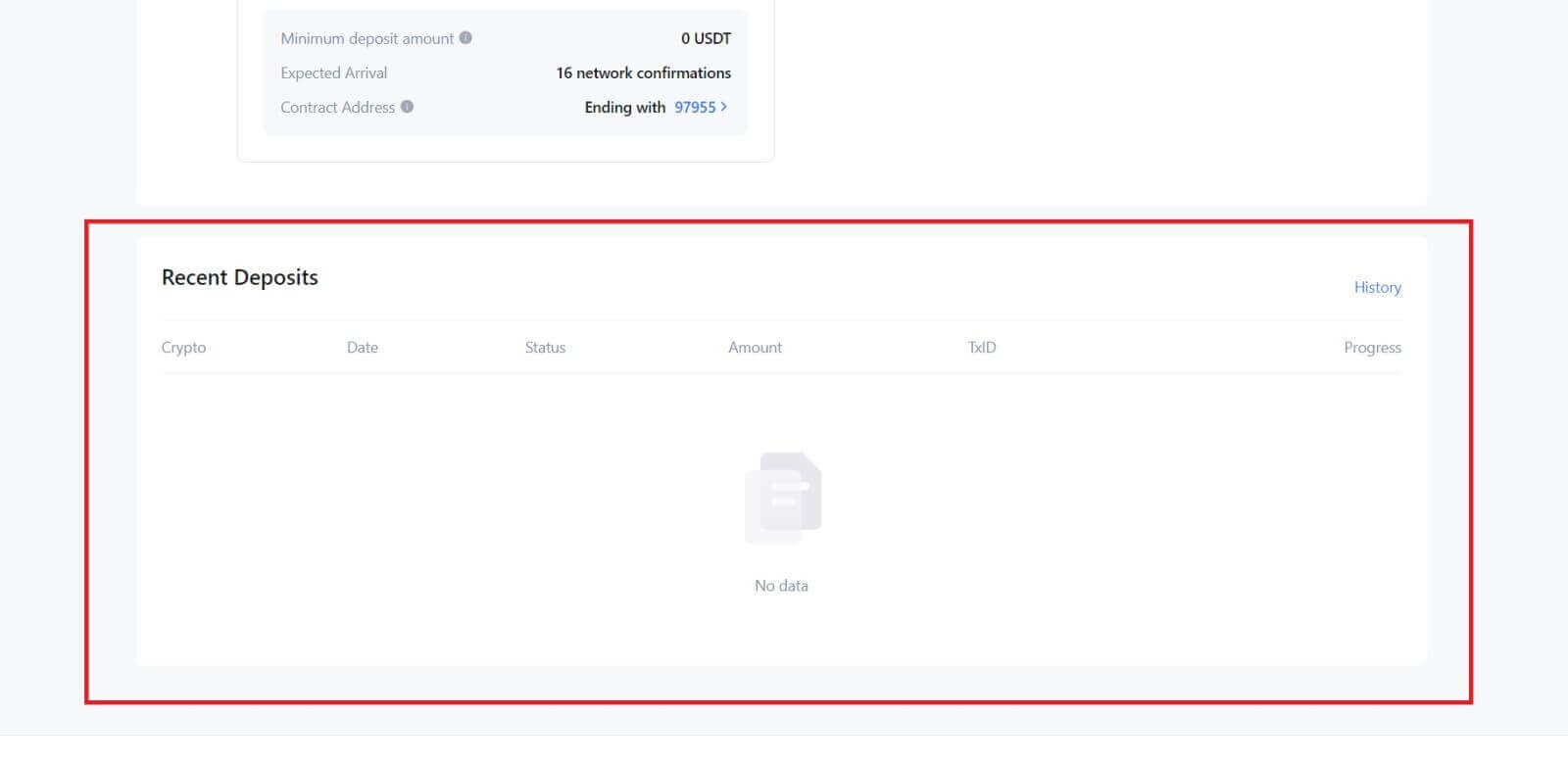

Check your [Spot] account to see the credited amount. You can find recent deposits at the bottom of the Deposit page, or view all past deposits under [History].

Deposit Crypto on MEXC (App)

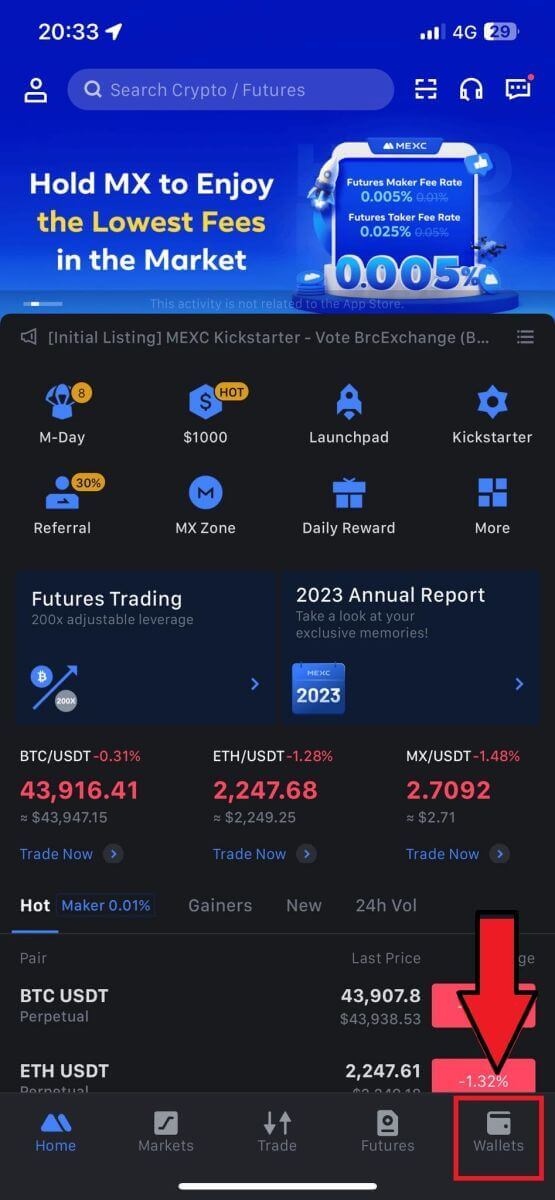

1. Open your MEXC app, on the first page, tap [Wallets].

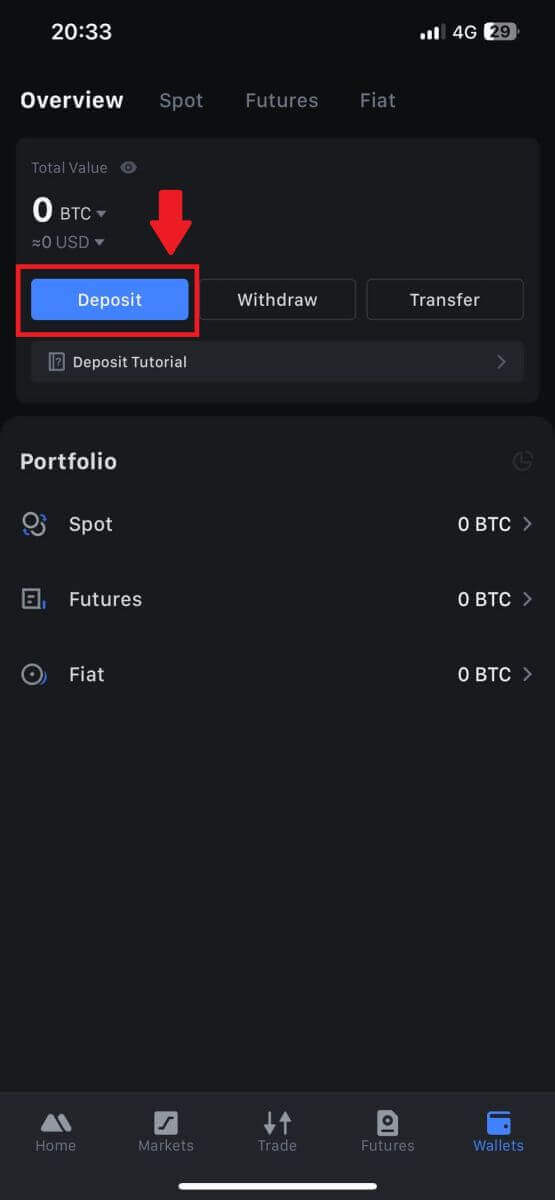

2. Tap on [Deposit] to continue.

3. Once directed to the next page, select the crypto you want to deposit. You may do so by tap on a crypto search. Here, we are using MX as an example.

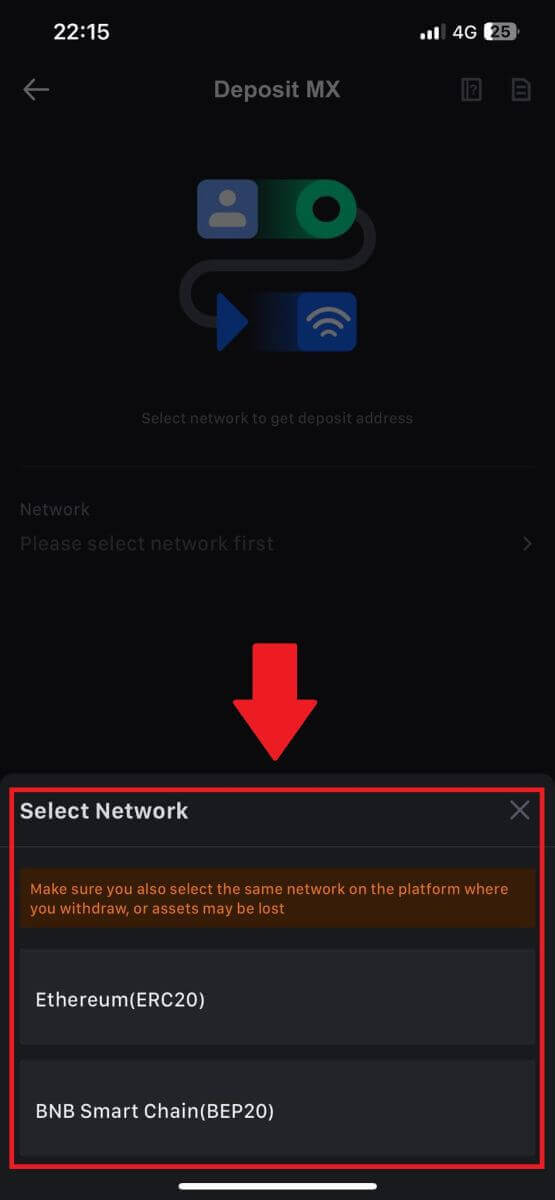

4. On the Deposit page, please select the network.

5. Once you have selected a network, the deposit address and QR code will be displayed.

For certain networks like EOS, remember to include a Memo along with the address when making deposits. Without the Memo, your address may not be detected.

6. Let’s use MetaMask wallet as an example to demonstrate how to withdraw MX Token to the MEXC platform.

Copy and paste the deposit address into the withdrawal address field in MetaMask. Make sure to choose the same network as your deposit address. Tap [Next] to continue.

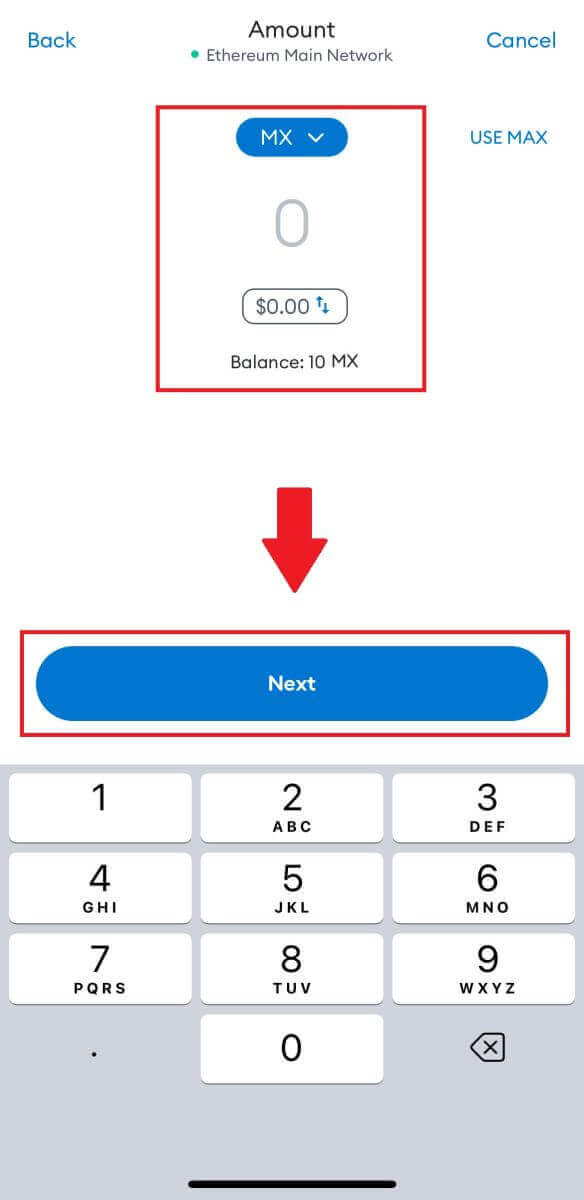

7. Enter the amount you wish to withdraw, then click on [Next].

7. Review the withdrawal amount for MX Token, verify the current network transaction fee, confirm that all information is accurate, and then click on [Send] to finalize the withdrawal to the MEXC platform. Your funds will be deposited into your MEXC account shortly.

Frequently Asked Questions (FAQ)

What is a tag or meme, and why do I need to enter it when depositing crypto?

A tag or memo is a unique identifier assigned to each account for identifying a deposit and crediting the appropriate account. When depositing certain crypto, such as BNB, XEM, XLM, XRP, KAVA, ATOM, BAND, EOS, etc., you need to enter the respective tag or memo for it to be successfully credited.How to check my transaction history?

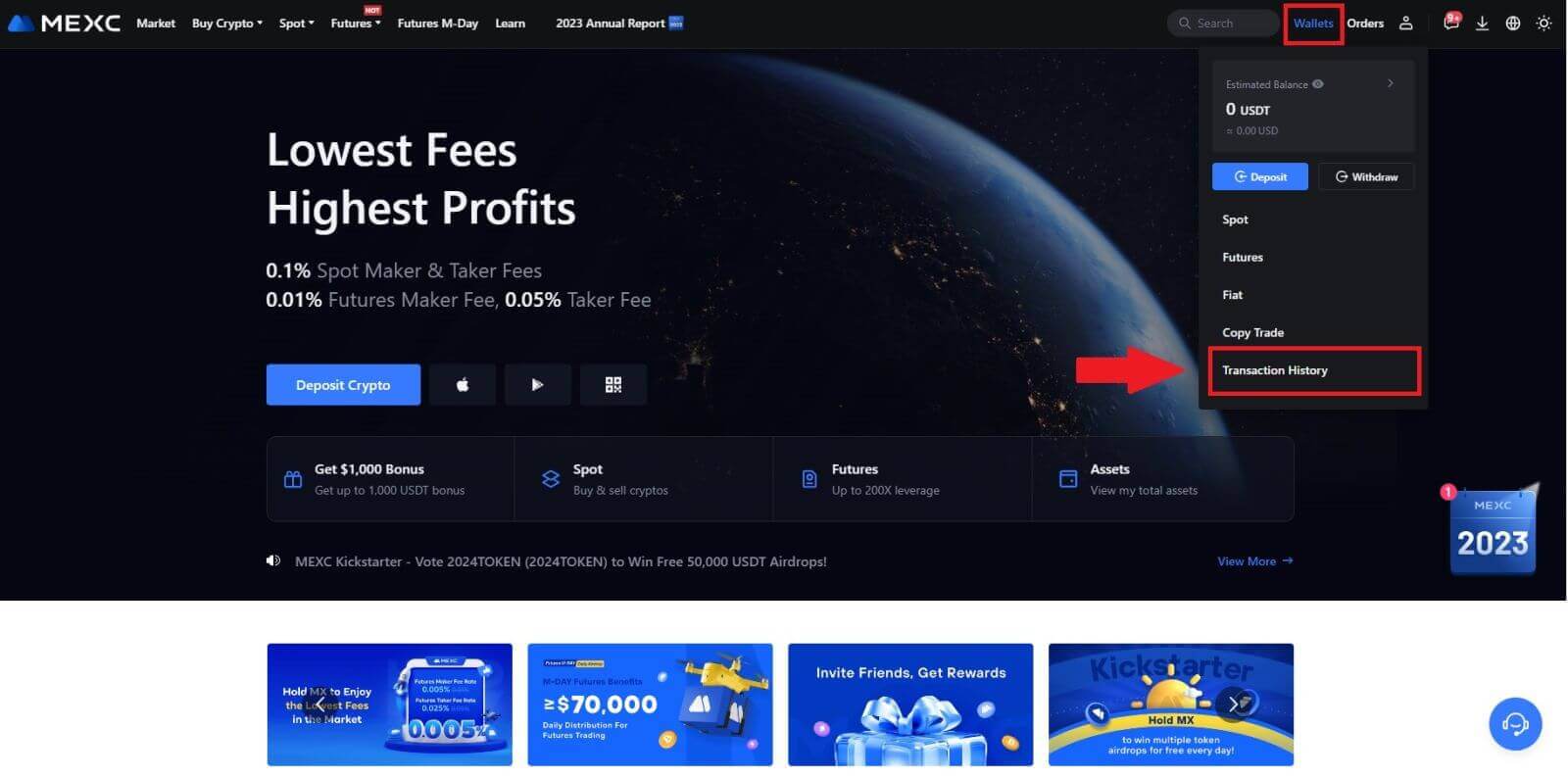

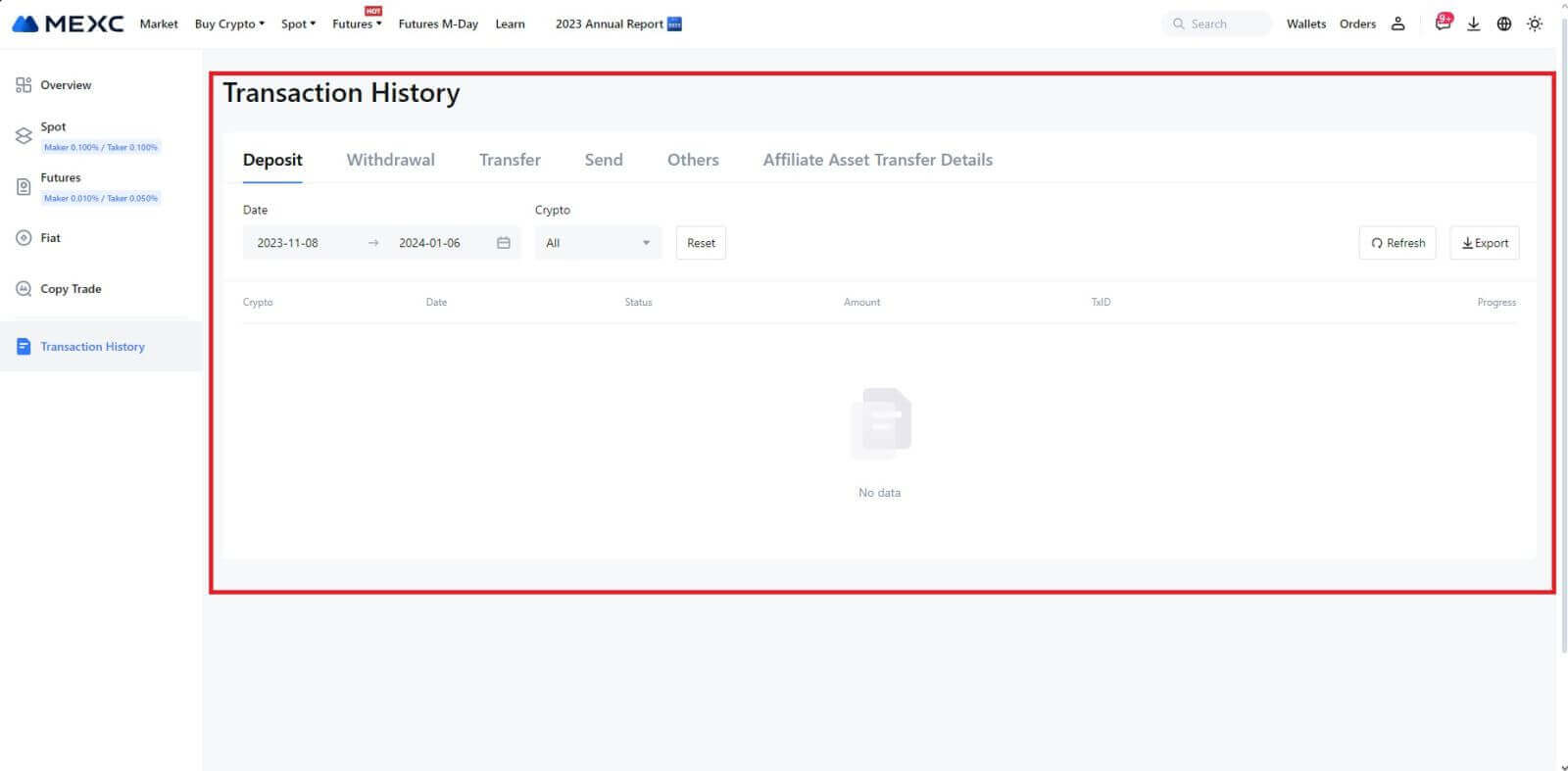

1. Log in to your MEXC account, click on [Wallets], and select [Transaction History].

2. You can check the status of your deposit or withdrawal from here.

Reasons for Uncredited Deposits

1. Insufficient number of block confirmations for a normal deposit

Under normal circumstances, each crypto requires a certain number of block confirmations before the transfer amount can be deposited into your MEXC account. To check the required number of block confirmations, please go to the deposit page of the corresponding crypto.

Please ensure that the cryptocurrency you intend to deposit on the MEXC platform matches the supported cryptocurrencies. Verify the full name of the crypto or its contract address to prevent any discrepancies. If inconsistencies are detected, the deposit may not be credited to your account. In such cases, submit a Wrong Deposit Recovery Application for assistance from the technical team in processing the return.

3. Depositing through an unsupported smart contract methodAt present, some cryptocurrencies cannot be deposited on the MEXC platform using the smart contract method. Deposits made through smart contracts will not reflect in your MEXC account. As certain smart contract transfers necessitate manual processing, please promptly reach out to online customer service to submit your request for assistance.

4. Depositing to an incorrect crypto address or selecting the wrong deposit network

Ensure that you have accurately entered the deposit address and selected the correct deposit network before initiating the deposit. Failure to do so may result in the assets not being credited. In such a scenario, kindly submit a [Wrong Deposit Recovery Application] for the technical team to facilitate the return processing.

How to Trade Crypto on MEXC

How to Trade Spot on MEXC (Web)

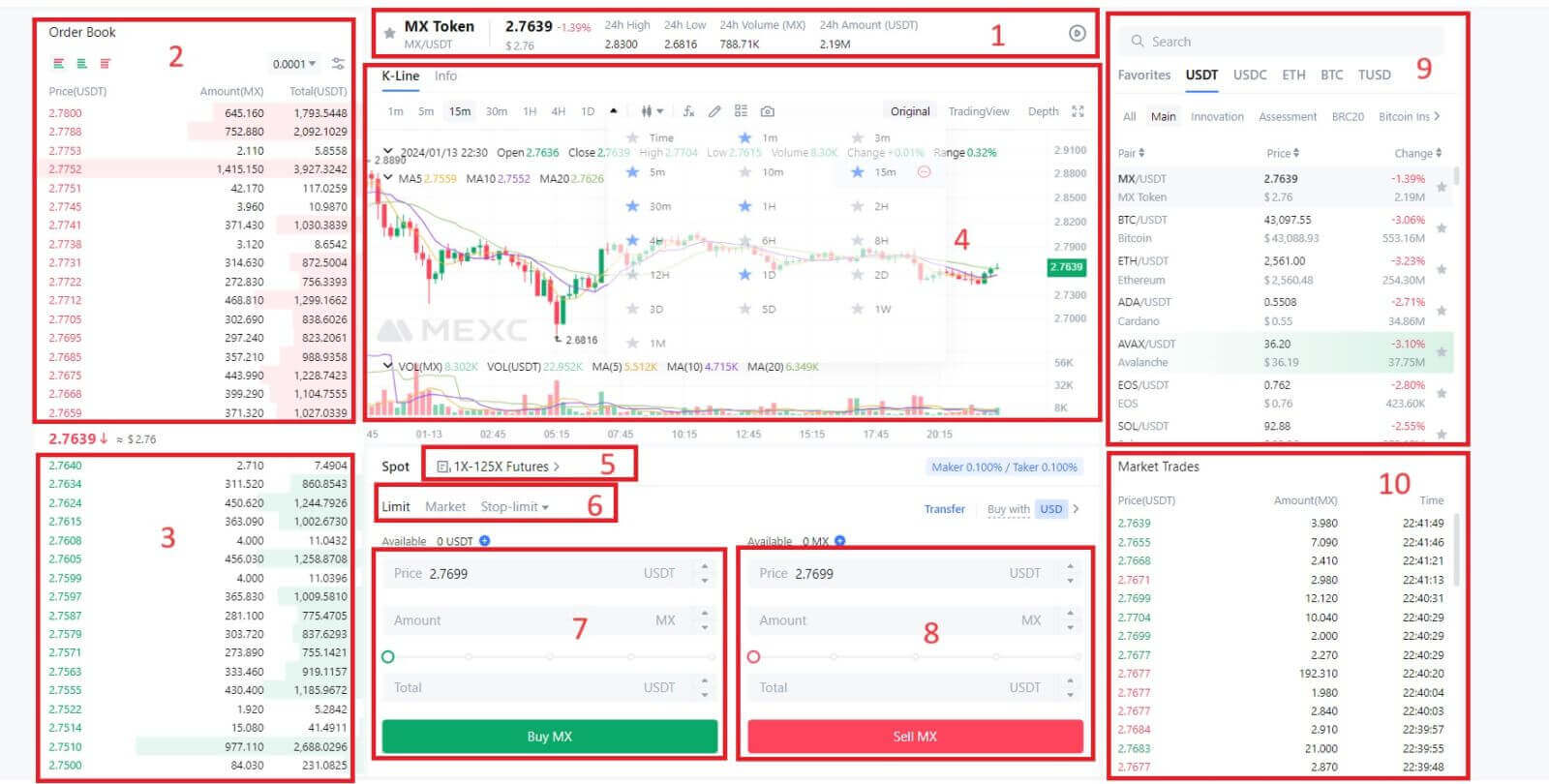

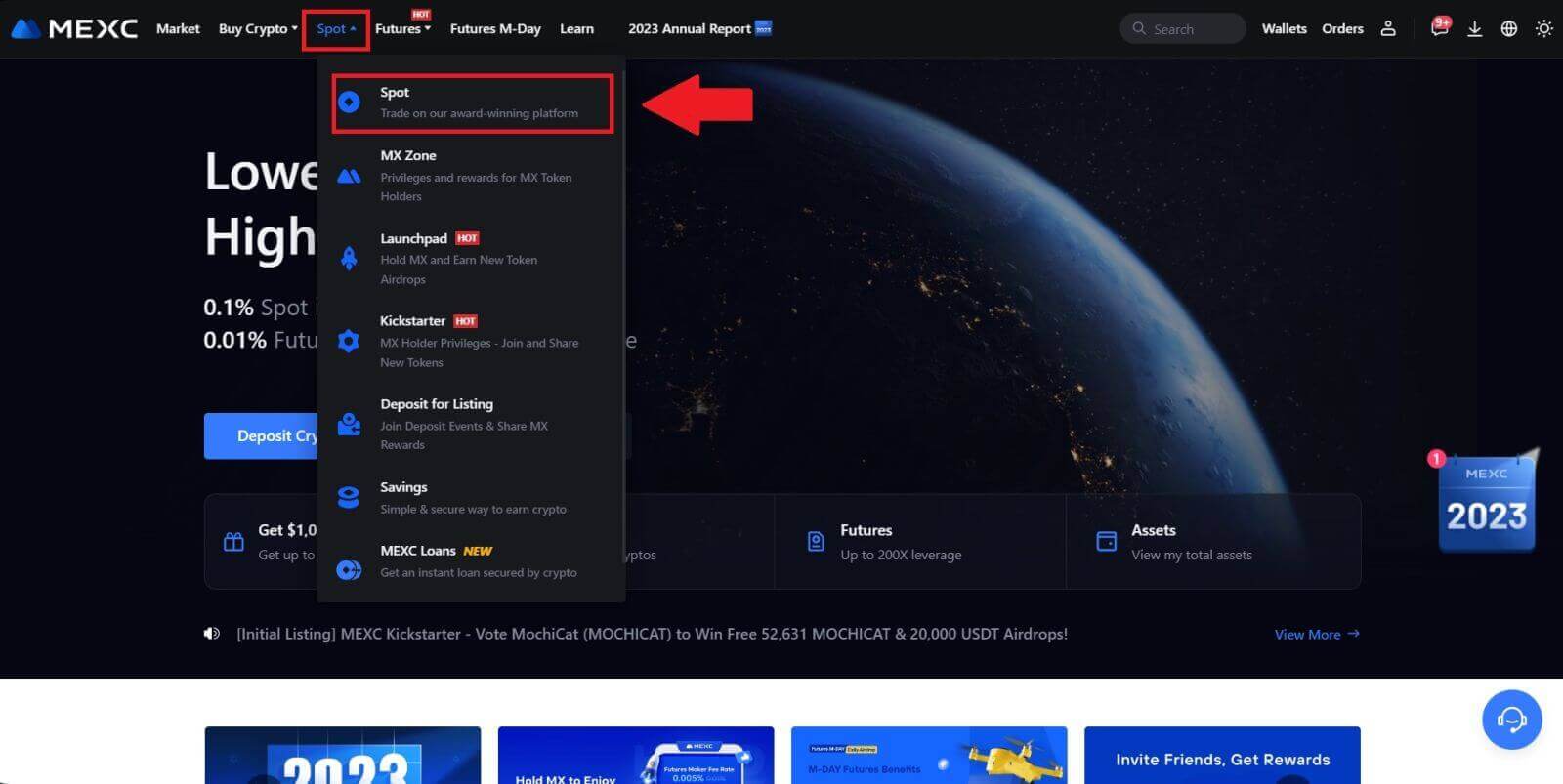

Step 1: Login to your MEXC account, and select [Spot].

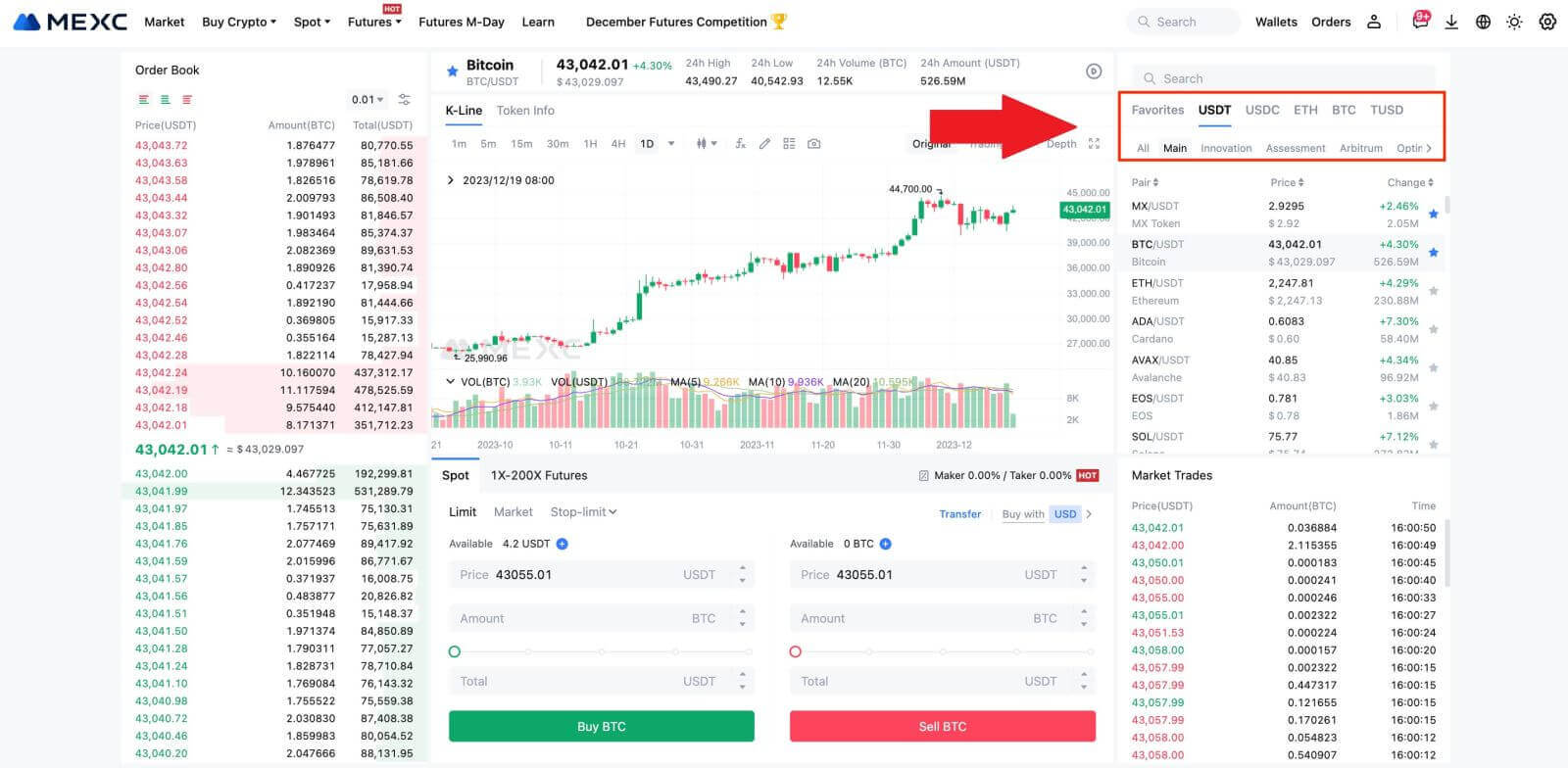

- Market PriceTrading volume of trading pair in 24 hours.

- Asks (Sell orders) book.

- Bids (Buy orders) book.

- Candlestick chart and Technical Indicators.

- Trading Type: Spot / Margin / Futures / OTC.

- Type of order: Limit / Market / Stop-limit.

- Buy Cryptocurrency.

- Sell Cryptocurrency.

- Market and Trading pairs.

- Market latest completed transaction.

- Your Limit Order / Stop-limit Order / Order History.

Step 3: Transfer Funds to Spot Account

In order to initiate spot trading, it is essential to have cryptocurrency in your spot account. You can acquire cryptocurrency through various methods.

One option is to purchase cryptocurrency through the P2P Market. Click on "Buy Crypto" in the top menu bar to access the OTC trading interface and transfer funds from your fiat account to your spot account.

Alternatively, you can deposit cryptocurrency directly into your spot account.

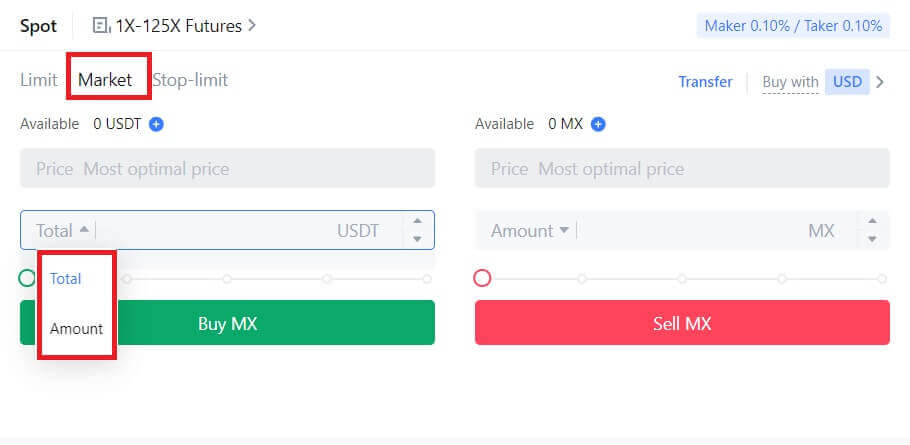

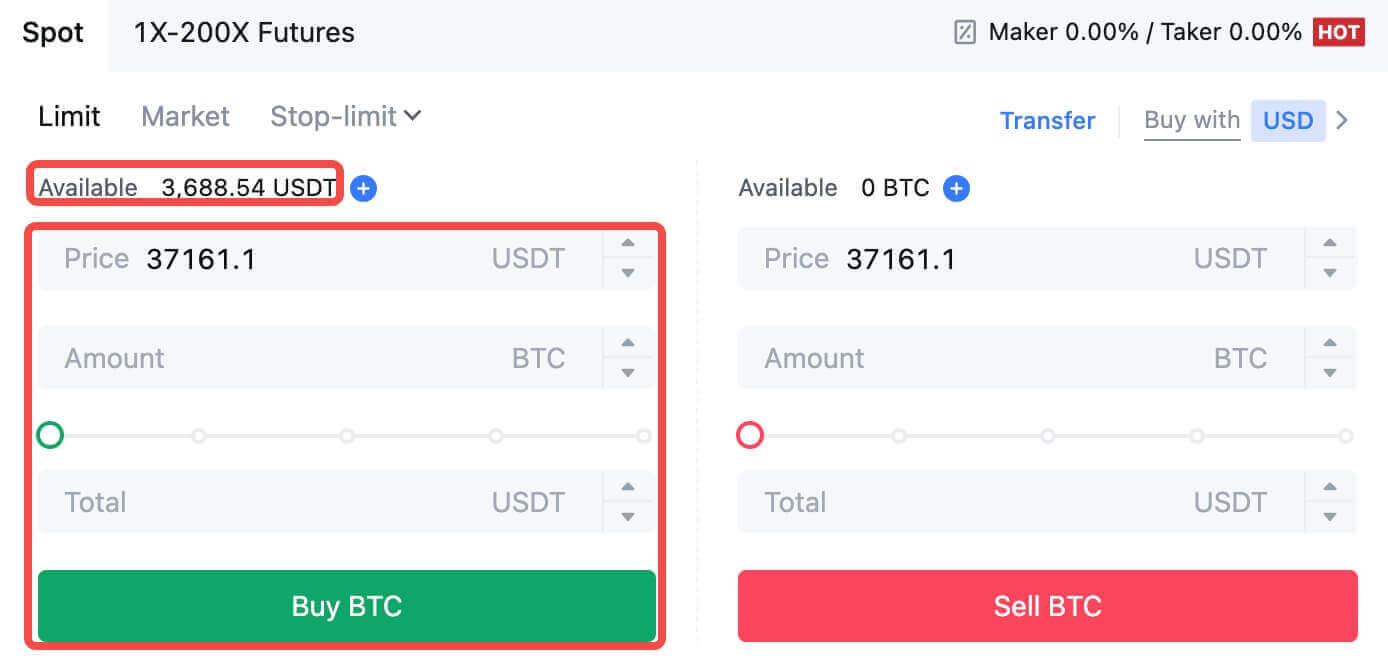

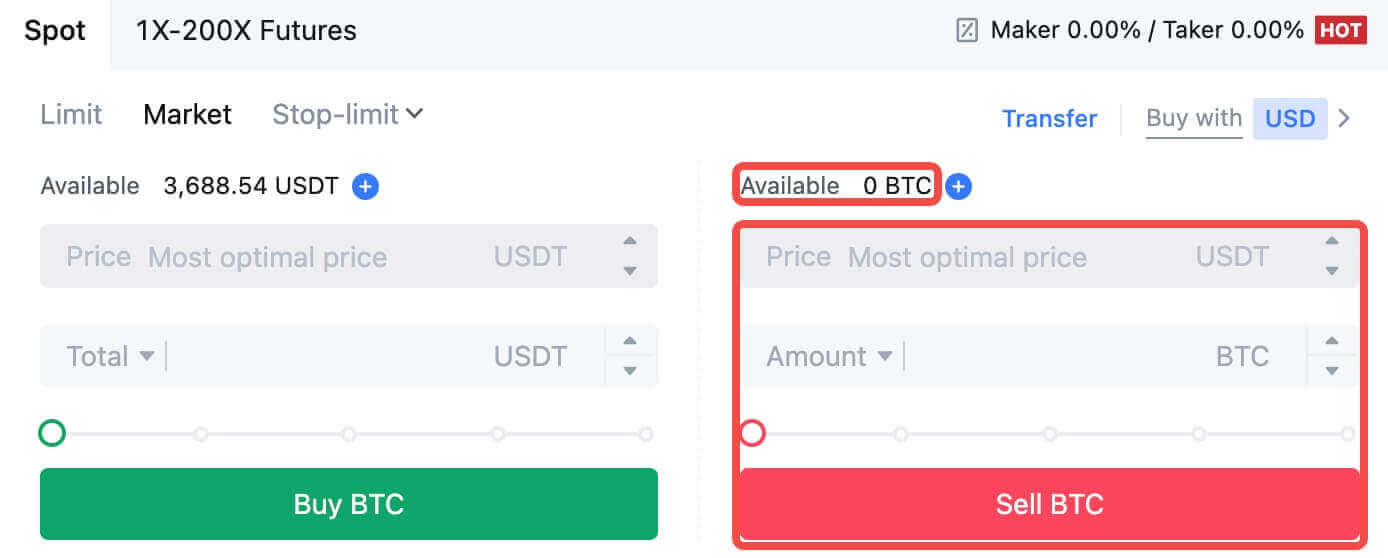

Step 4: Buy Crypto

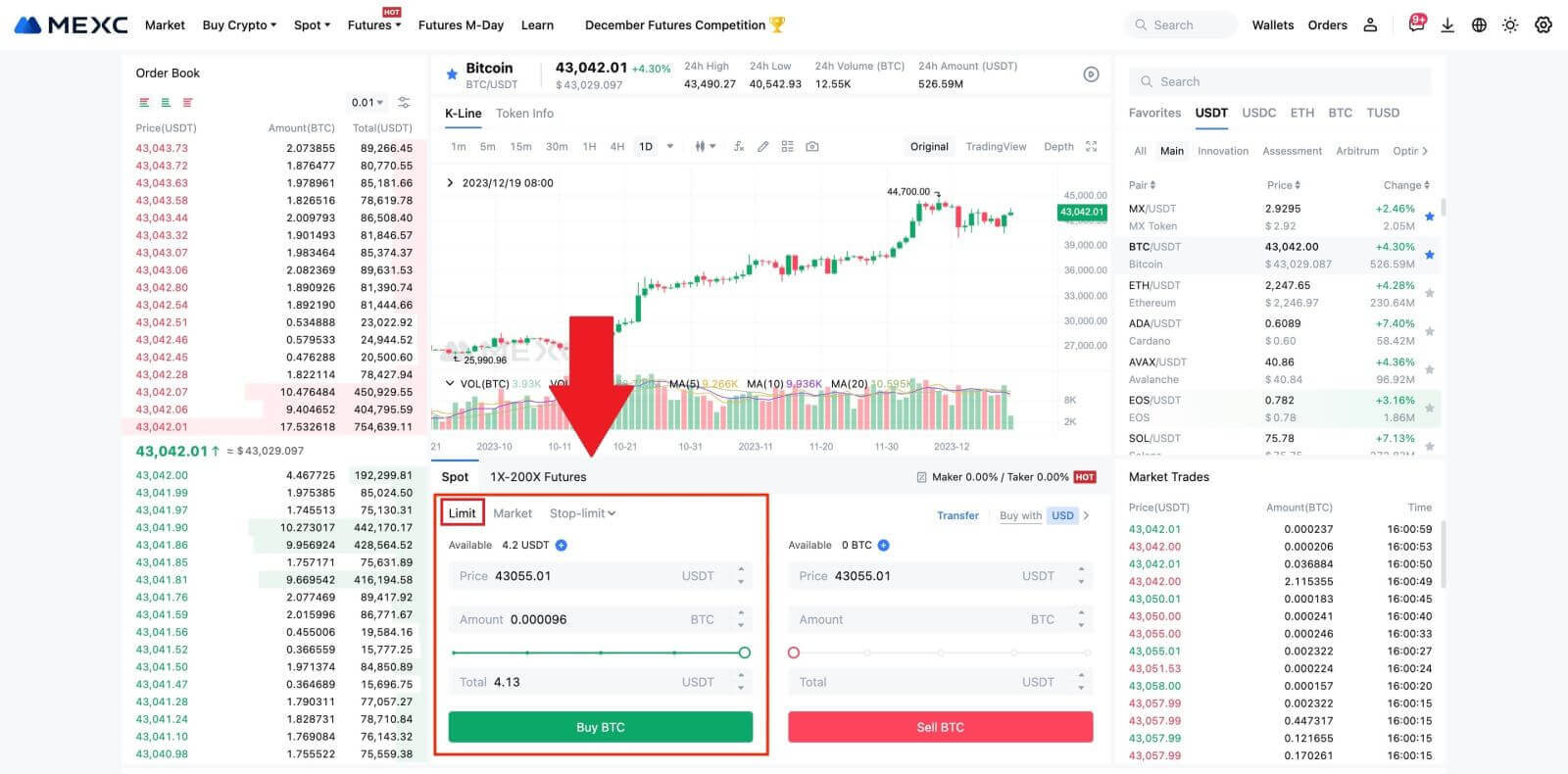

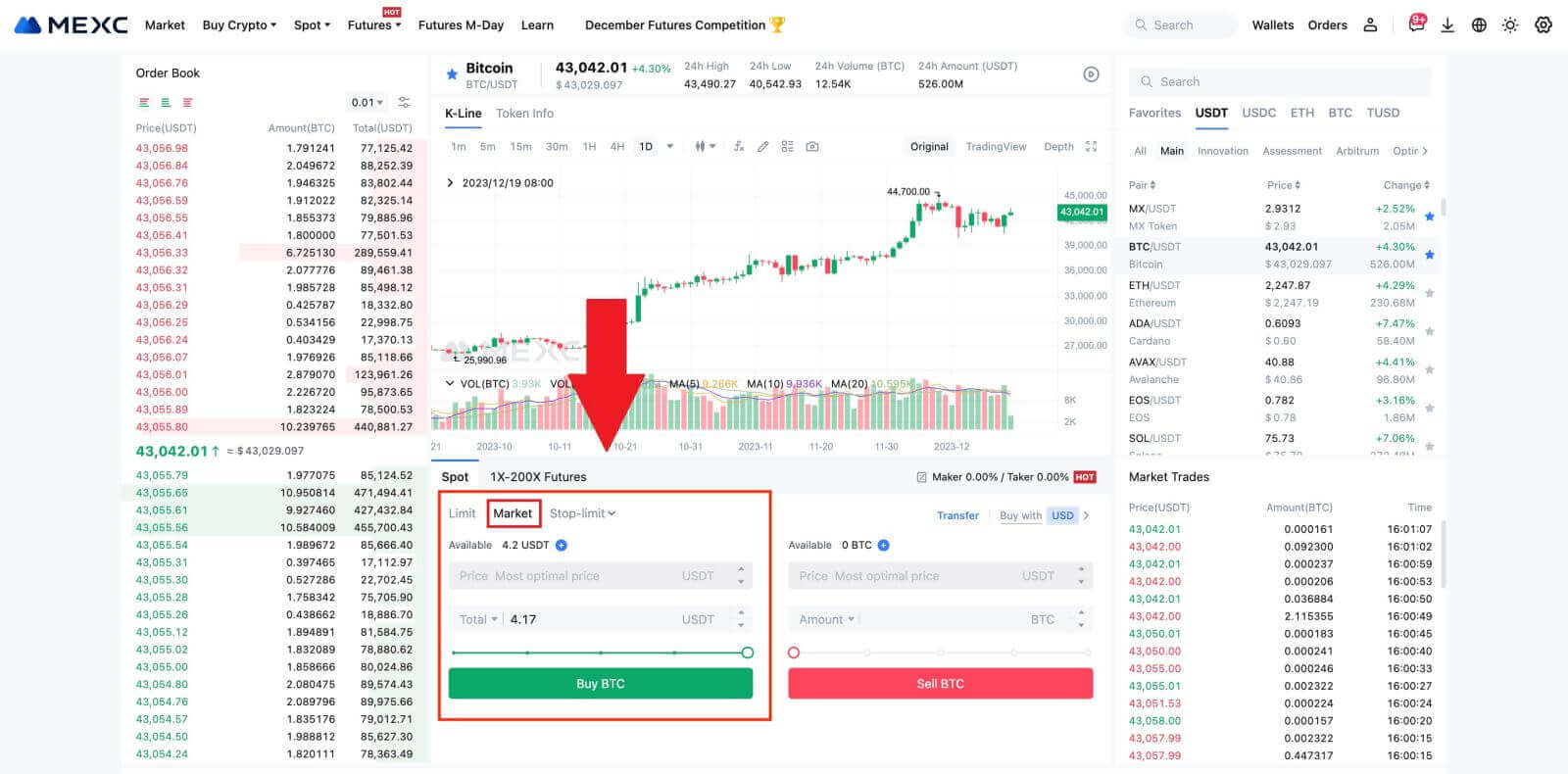

The default order type is a limit order, which allows you to specify a particular price for buying or selling crypto. However, if you wish to execute your trade promptly at the current market price, you can switch to a [Market] Order. This enables you to trade instantly at the prevailing market rate.

For instance, if the current market price of BTC/USDT is $61,000, but you desire to purchase 0.1 BTC at a specific price, say $60,000, you can place a [Limit] order.

Once the market price reaches your specified amount of $60,000, your order will be executed, and you will find 0.1 BTC (excluding commission) credited to your spot account.

To promptly sell your BTC, consider switching to a [Market] order. Enter the selling quantity as 0.1 to complete the transaction instantly.

For example, if the current market price of BTC is $63,000 USDT, executing a [Market] Order will result in 6,300 USDT (excluding commission) being credited to your Spot account immediately.

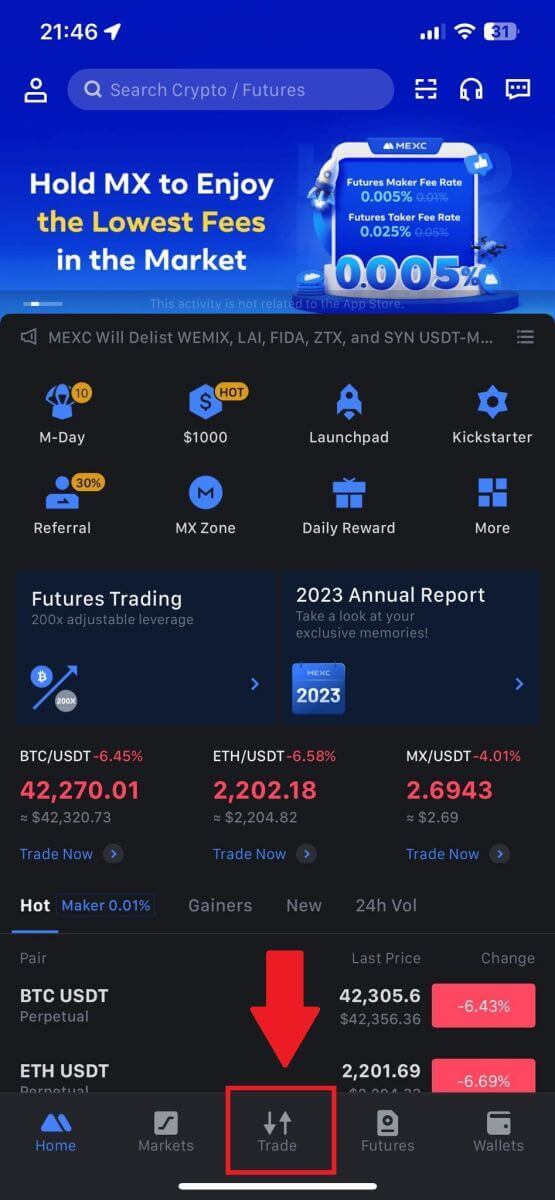

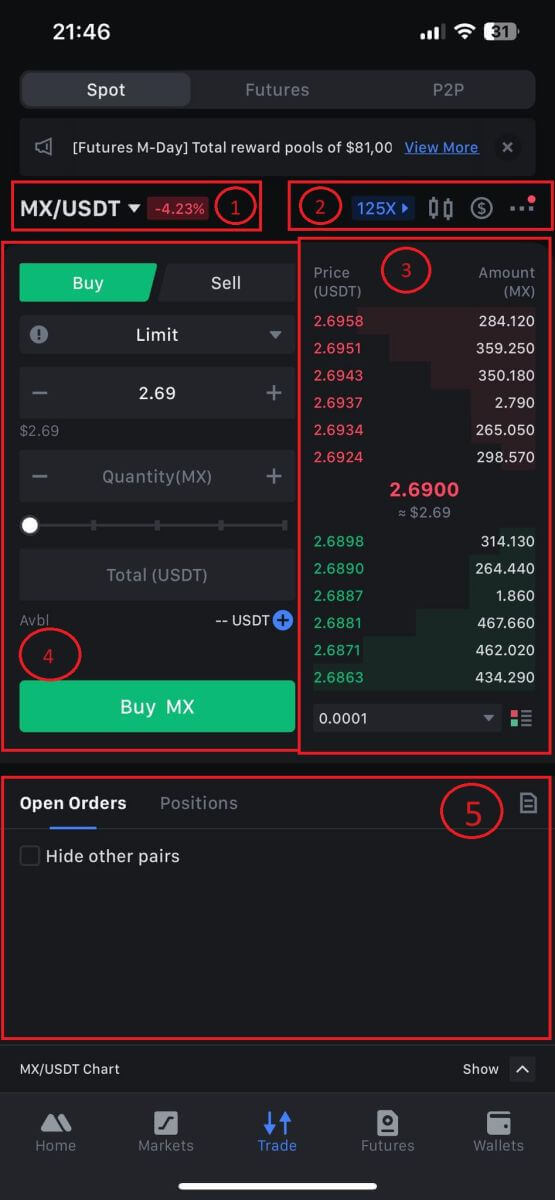

How to Trade Spot on MEXC (App)

Here’s how to start trading Spot on MEXCs App:1. On your MEXC App, tap [Trade] on the bottom to head to the spot trading interface.

2. Here is the trading page interface.

1. Market and Trading pairs.

2. Real-time market candlestick chart, supported trading pairs of the cryptocurrency, “Buy Crypto” section.

3. Sell/Buy order book.

4. Buy/Sell Cryptocurrency.

5. Open orders.

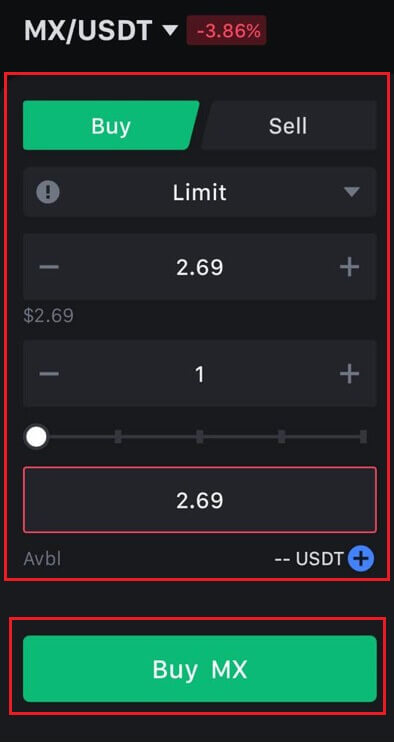

3. As an example, we will make a "Limit order" trade to buy MX.

Enter the order placing section of the trading interface, refer to the price in the buy/sell order section, and enter the appropriate MX buying price and the quantity or trade amount.

Click [Buy MX] to complete the order. (Same for sell order)

How To Buy Bitcoin in under One Minute on MEXC

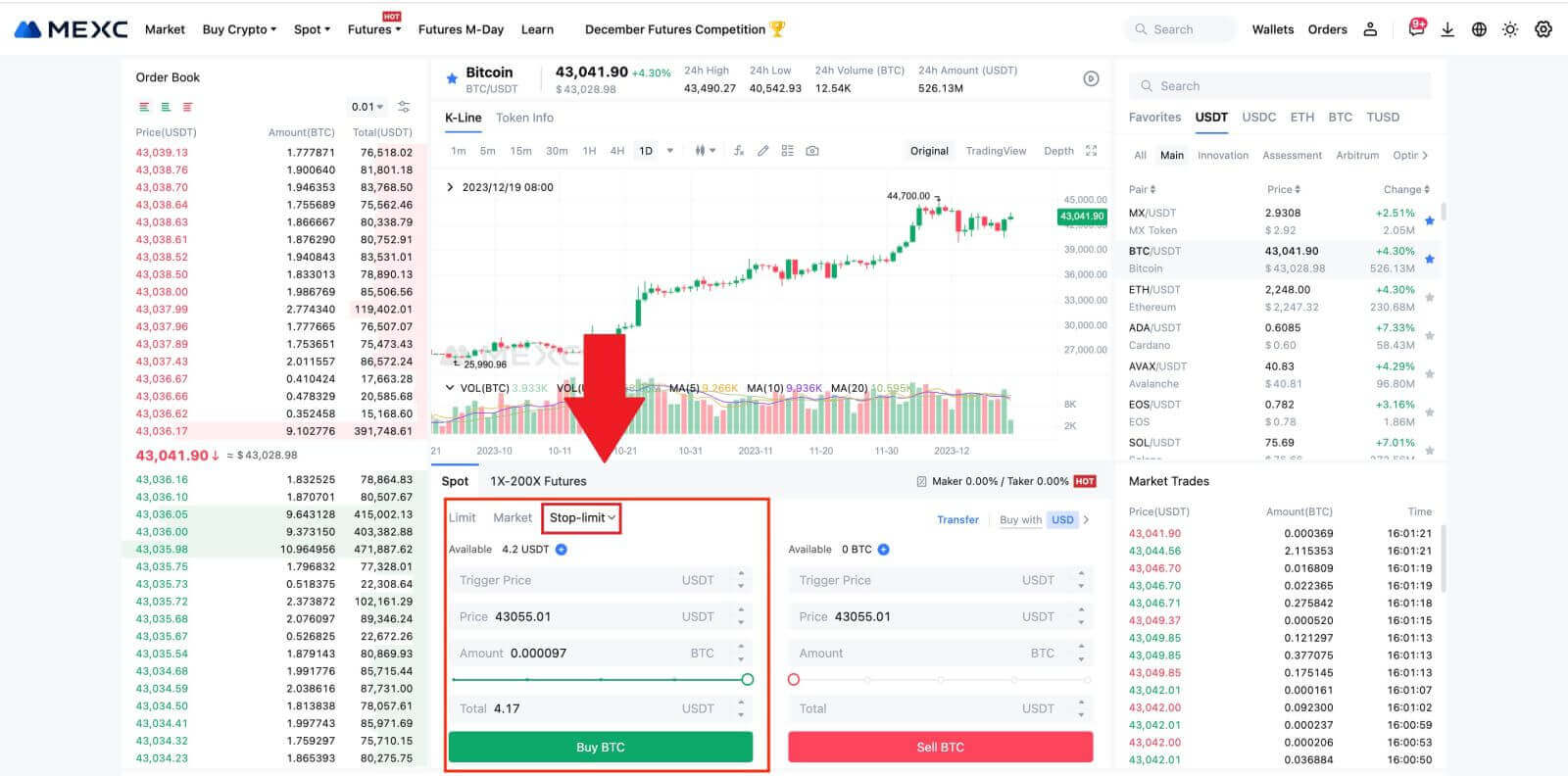

Buying Bitcoin on MEXC Website

1. Log in to your MEXC, click and select [Spot].

2. In the trading zone, pick your trading pair. MEXC currently offers support for popular trading pairs like BTC/USDT, BTC/USDC, BTC/TUSD, and more.

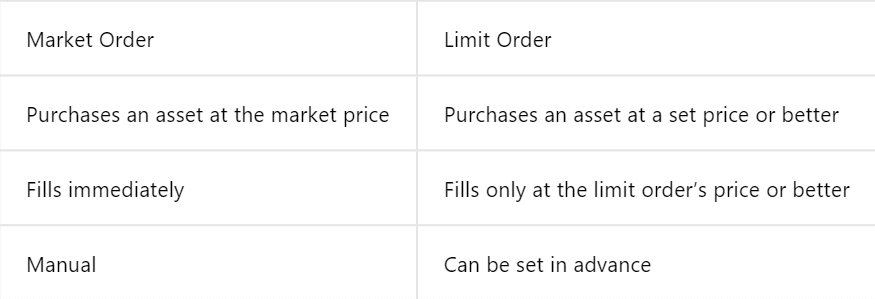

3. Consider making a purchase with the BTC/USDT trading pair. You have three order types to choose from: Limit , Market , Stop-limit, each with distinct characteristics.

- Limit Price Purchase:

Specify your desired buying price and quantity, then click [Buy BTC]. Keep in mind that the minimum order amount is 5 USDT. If your set buying price significantly differs from the market price, the order may not be filled immediately and will be visible in the "Open Orders" section below.

- Market Price Purchase:

- Stop-limit Order:

With stop-limit orders, you can pre-set trigger prices, buying amounts, and quantities. When the market price reaches the trigger price, the system will automatically place a limit order at the specified price.

Let’s consider the BTC/USDT pair. Suppose the current market price of BTC is 27,250 USDT, and based on technical analysis, you anticipate a breakthrough at 28,000 USDT initiating an upward trend. In this case, you can use a stop-limit order with a trigger price set at 28,000 USDT and a buying price set at 28,100 USDT. Once BTC reaches 28,000 USDT, the system will promptly place a limit order to buy at 28,100 USDT. The order may be filled at 28,100 USDT or a lower price. Note that 28,100 USDT is a limit price, and rapid market fluctuations might affect order execution.

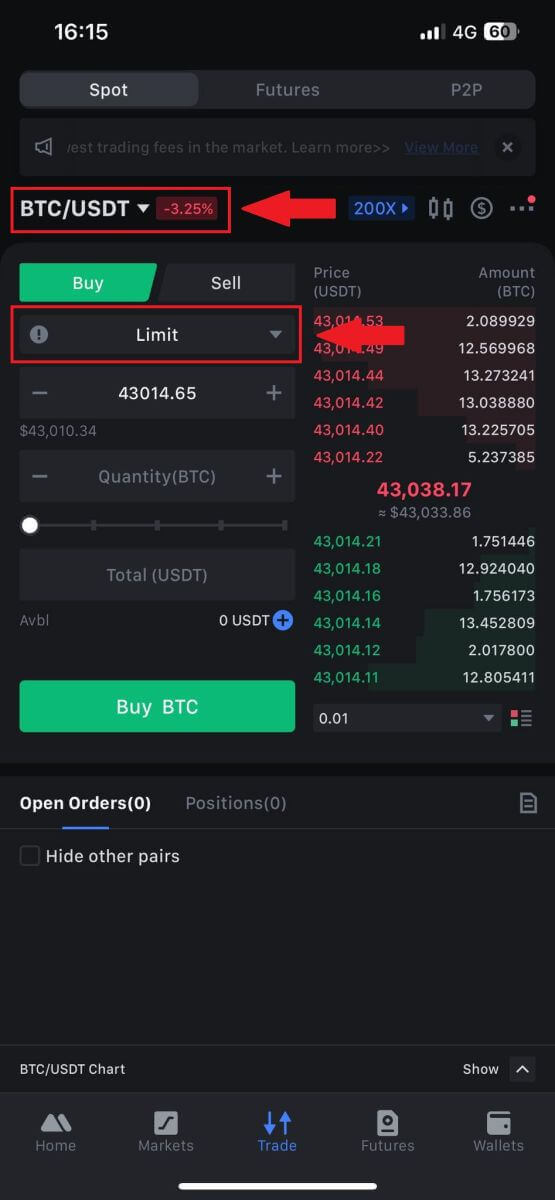

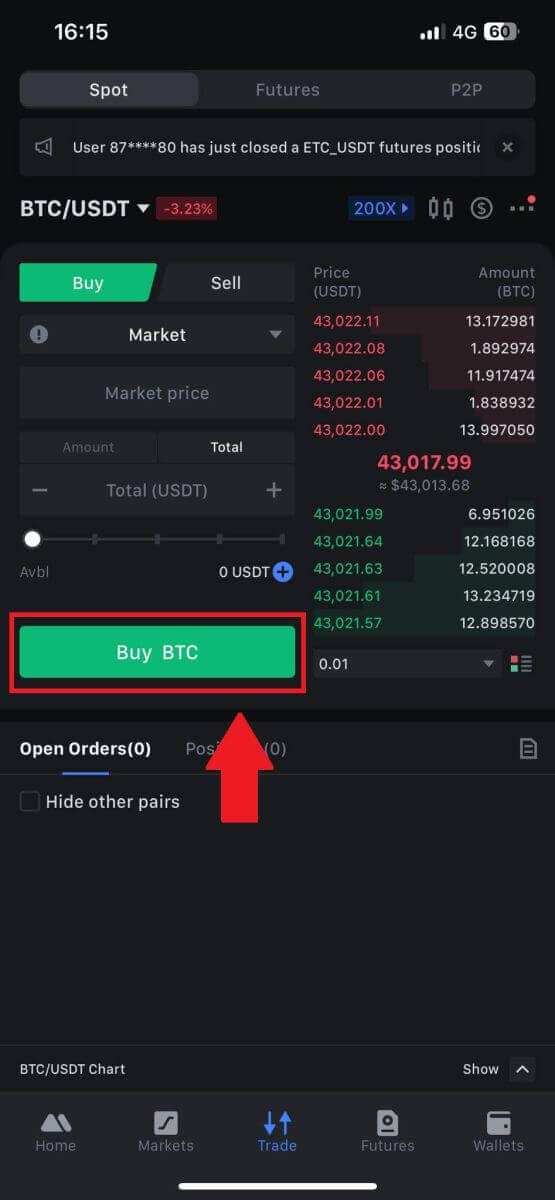

Buying Bitcoin on MEXC App

1. Log in to the MEXC App and tap on [Trade].

2. Choose the order type and trading pair. Select from the three available order types: Limit , Market , and stop-limit. Alternatively, you can tap on [BTC/USDT] to switch to a different trading pair.

3. Consider placing a market order with the BTC/USDT trading pair as an example. Simply tap on [Buy BTC].

Frequently Asked Questions (FAQ)

What is Limit Order

A limit order is an instruction to buy or sell an asset at a specified limit price, which is not executed immediately like a market order. Instead, the limit order is activated only if the market price reaches the designated limit price or surpasses it favorably. This allows traders to aim for specific buying or selling prices different from the prevailing market rate.

For instance:

-

If you set a buy limit order for 1 BTC at $60,000 while the current market price is $50,000, your order will be promptly filled at the prevailing market rate of $50,000. This is because it represents a more favorable price than your specified limit of $60,000.

-

Similarly, if you place a sell limit order for 1 BTC at $40,000 when the current market price is $50,000, your order will be immediately executed at $50,000, as it is a more advantageous price compared to your designated limit of $40,000.

In summary, limit orders provide a strategic way for traders to control the price at which they buy or sell an asset, ensuring execution at the specified limit or a better price in the market.

What is Market Order

A market order is a type of trading order that is executed promptly at the current market price. When you place a market order, it is fulfilled as swiftly as possible. This order type can be utilized for both buying and selling financial assets.

When placing a market order, you have the option to specify either the quantity of the asset you want to buy or sell, denoted as [Amount], or the total amount of funds you wish to spend or receive from the transaction, denoted as [Total].

For instance, if you intend to purchase a specific quantity of MX, you can directly enter the amount. Conversely, if you aim to acquire a certain amount of MX with a specified sum of funds, like 10,000 USDT, you can use the [Total] option to place the buy order. This flexibility allows traders to execute transactions based on either a predetermined quantity or a desired monetary value.

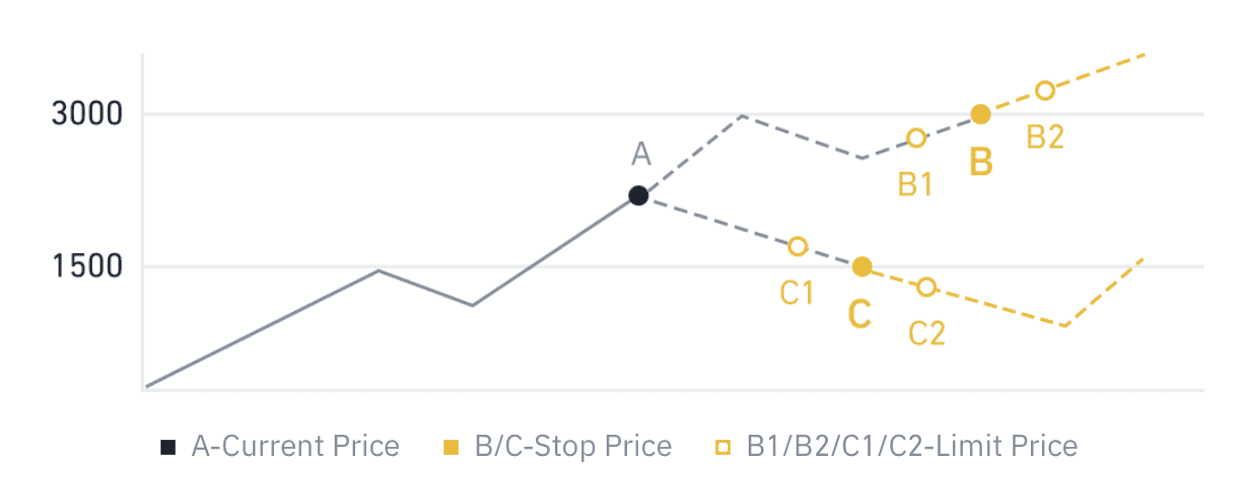

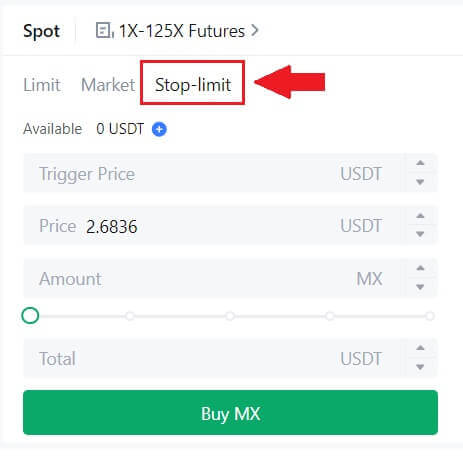

What is the Stop-Limit Function and How to use it

A stop-limit order is a specific type of limit order used in trading financial assets. It involves setting both a stop price and a limit price. Once the stop price is reached, the order is activated, and a limit order is placed on the market. Subsequently, when the market reaches the specified limit price, the order is executed.

Here’s how it works:

- Stop Price: This is the price at which the stop-limit order is triggered. When the asset’s price hits this stop price, the order becomes active, and the limit order is added to the order book.

- Limit Price: The limit price is the designated price or a potentially better one at which the stop-limit order is intended to be executed.

It’s advisable to set the stop price slightly higher than the limit price for sell orders. This price difference provides a safety margin between the activation of the order and its fulfillment. Conversely, for buy orders, setting the stop price slightly lower than the limit price helps minimize the risk of the order not being executed.

It’s important to note that once the market price reaches the limit price, the order is executed as a limit order. Setting the stop and limit prices appropriately is crucial; if the stop-loss limit is too high or the take-profit limit is too low, the order may not be filled because the market price may not reach the specified limit.

The current price is 2,400 (A). You can set the stop price above the current price, such as 3,000 (B), or below the current price, such as 1,500 (C). Once the price goes up to 3,000 (B) or drops to 1,500 (C), the stop-limit order will be triggered, and the limit order will be automatically placed on the order book.

Note

Limit price can be set above or below the stop price for both buy and sell orders. For example, stop price B can be placed along with a lower limit price B1 or a higher limit price B2.

A limit order is invalid before the stop price is triggered, including when the limit price is reached ahead of the stop price.

When the stop price is reached, it only indicates that a limit order is activated and will be submitted to the order book, rather than the limit order being filled immediately. The limit order will be executed according to its own rules.

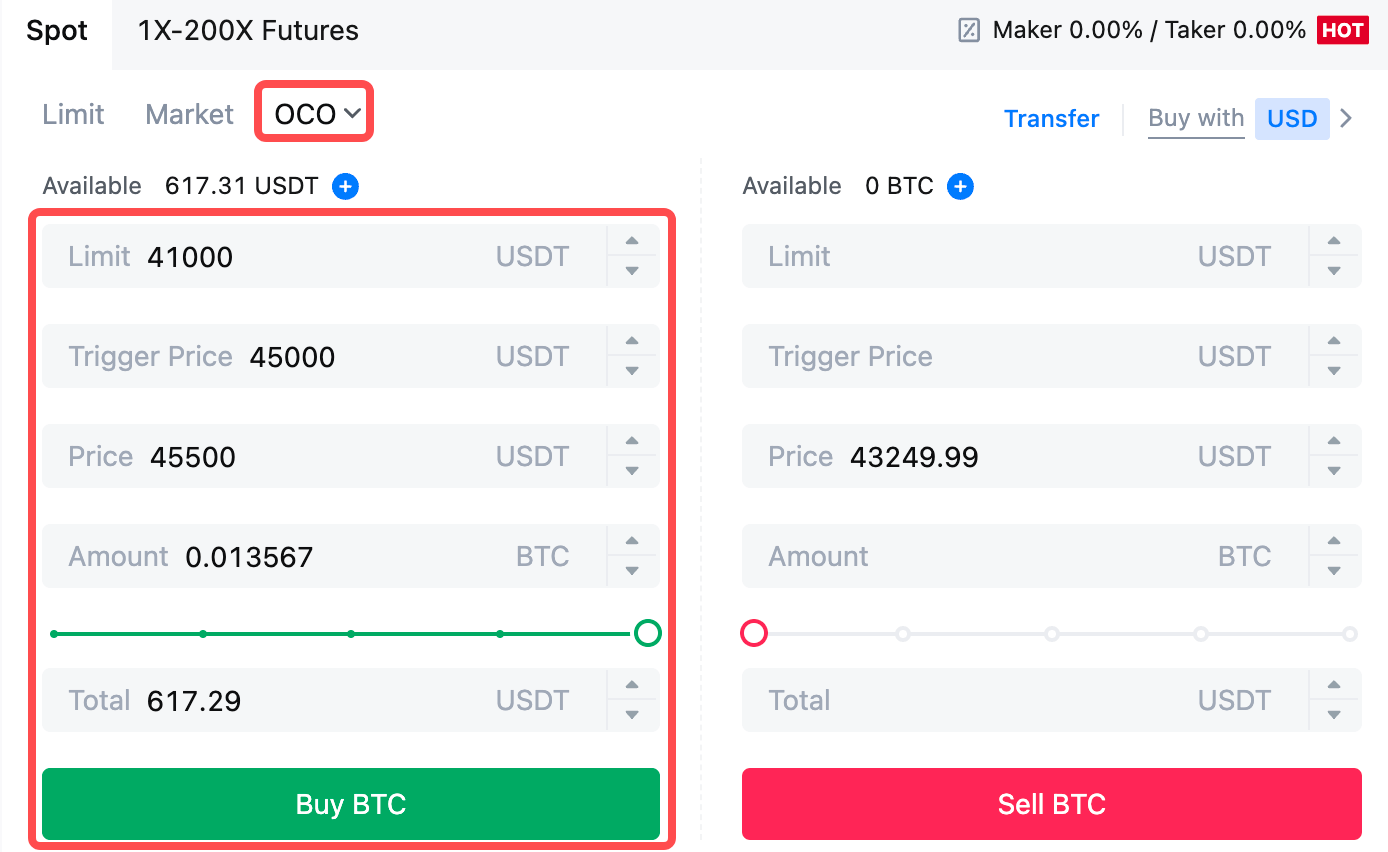

What is One-Cancels-the-Other (OCO) Order

A limit order and a TP/SL order are combined into a single OCO order for placement, known as an OCO (One-Cancels-the-Other) order. The other order is automatically canceled if the limit order is performed or partially executed, or if the TP/SL order is activated. When one order is manually canceled, the other order is also canceled at the same time.

OCO orders can help get better execution prices when buying/selling is assured. This trading approach can be used by investors who want to set a limit order and a TP/SL order at the same time during spot trading.

OCO orders are currently only supported for a few tokens, notably Bitcoin. We’ll use Bitcoin as an illustration:

Let’s say you wish to purchase Bitcoin when its price drops to $41,000 from its current $43,400. But, if the price of Bitcoin keeps rising and you think it will keep rising even after crossing $45,000, you would prefer to be able to purchase when it hits $45,500.

Under the "Spot" section on the BTC trading website, click [ᐯ] next to "Stop-limit," then choose [OCO]. Put 41,000 in the "Limit" field, 45,000 in the "Trigger Price" field, and 45,500 in the "Price" field in the left section. Then, to place the order, enter the purchase price in the "Amount" section and choose [Buy BTC].

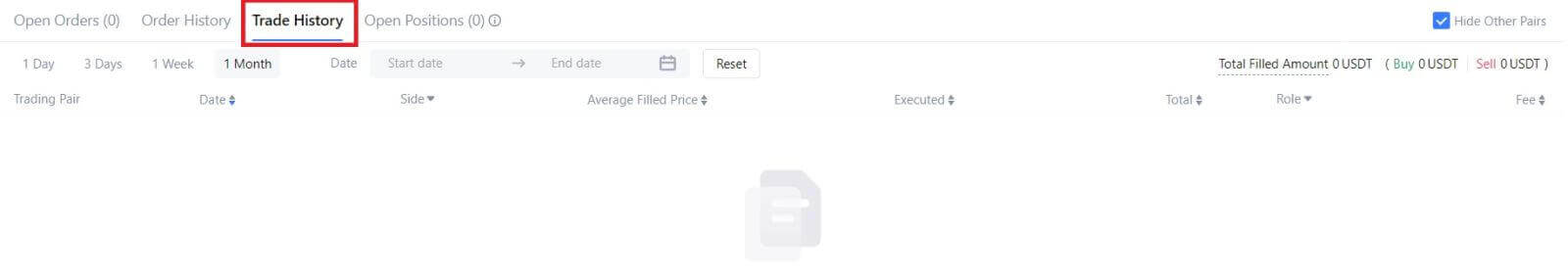

How to View my Spot Trading Activity

You can view your spot trading activities from the Orders and Positions panel at the bottom of the trading interface. Simply switch between the tabs to check your open order status and previously executed orders.

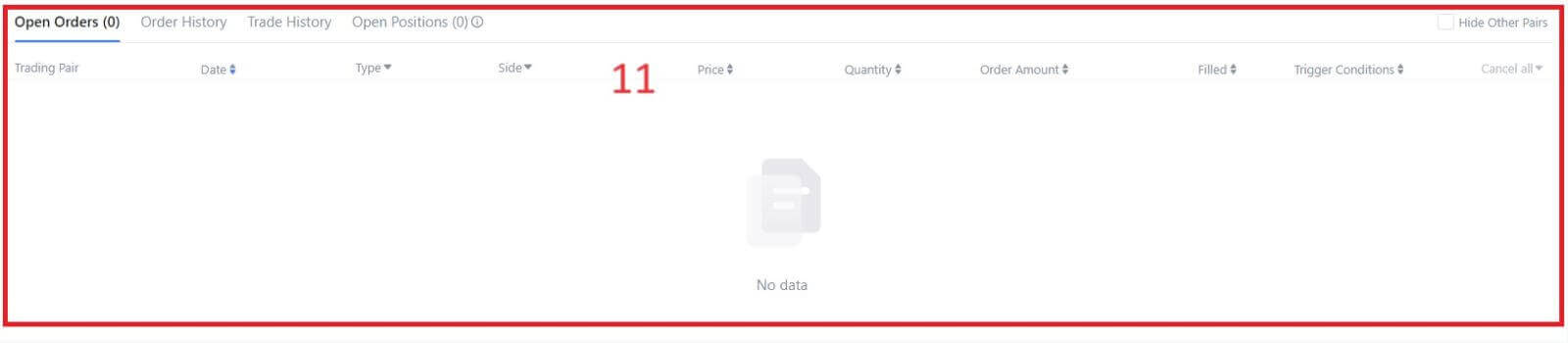

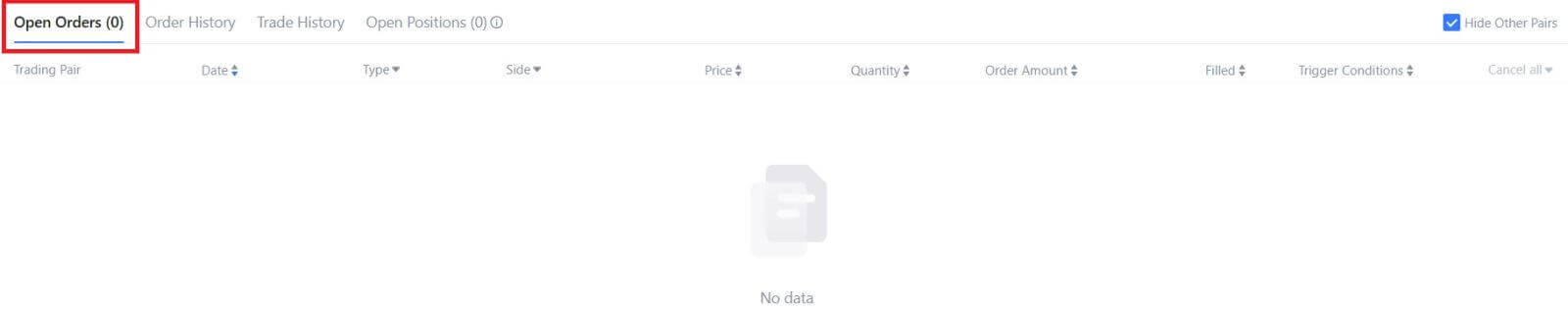

1. Open orders

Under the [Open Orders] tab, you can view details of your open orders, including:

-

Trading pair.

-

Order Date.

-

Order Type.

-

Side.

-

Order price.

-

Order Quantity.

-

Order amount.

-

Filled %.

-

Trigger conditions.

To display current open orders only, check the [Hide Other Pairs] box.

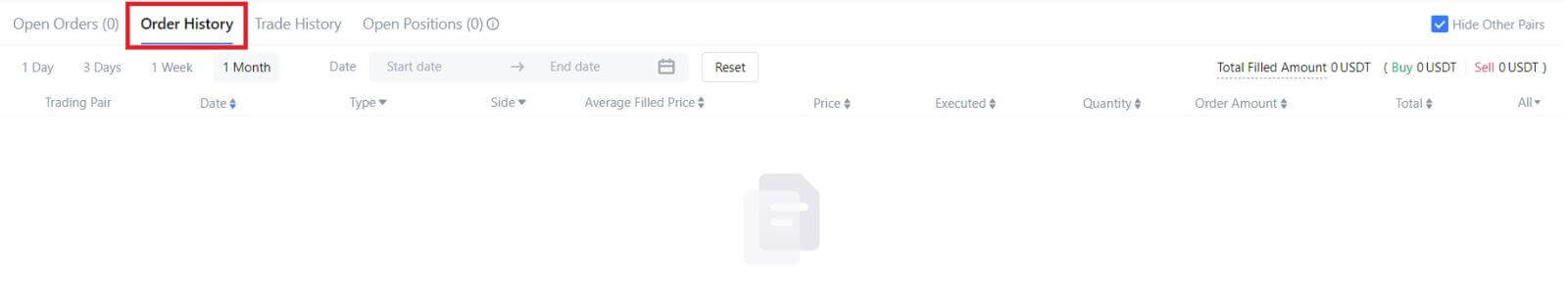

2. Order history

Order history displays a record of your filled and unfilled orders over a certain period. You can view order details, including:

-

Trading Pair.

-

Order Date.

-

Order Type.

-

Side.

-

Average Filled Price.

-

Order Price.

-

Executed.

-

Order Quantity.

-

Order Amount.

-

Total amount.

3. Trade history

Trade history shows a record of your filled orders over a given period. You can also check the transaction fees and your role (market maker or taker).

To view trade history, use the filters to customize the dates.