Verify MEXC

What is KYC MEXC?

KYC stands for Know Your Customer, emphasizing a thorough understanding of customers, including the verification of their real names.

Why is KYC important?

- KYC serves to fortify the security of your assets.

- Different levels of KYC can unlock varying trading permissions and access to financial activities.

- Completing KYC is essential to elevate the single transaction limit for both buying and withdrawing funds.

- Fulfilling KYC requirements can amplify the benefits derived from futures bonuses.

MEXC KYC Classifications Differences

MEXC employs two KYC types: Primary and Advanced.

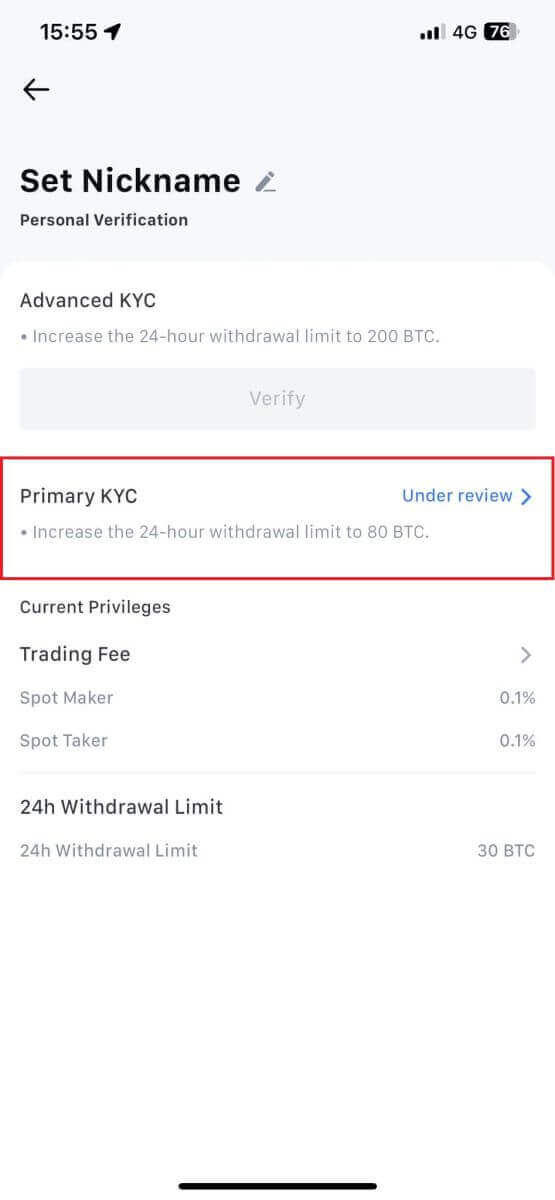

- For primary KYC, basic personal information is mandatory. Successful completion of primary KYC results in an increased 24-hour withdrawal limit, reaching up to 80 BTC, with restricted access to OTC transactions (P2P Trading in KYC-supported regions).

- Advanced KYC necessitates basic personal information and facial recognition authentication. Accomplishing advanced KYC leads to an elevated 24-hour withdrawal limit of up to 200 BTC, providing unrestricted access to OTC transactions (P2P Trading in KYC-supported regions), Global Bank Transfer, and Debit/Credit Card transactions.

How to complete Identity Verification? A step-by-step guide

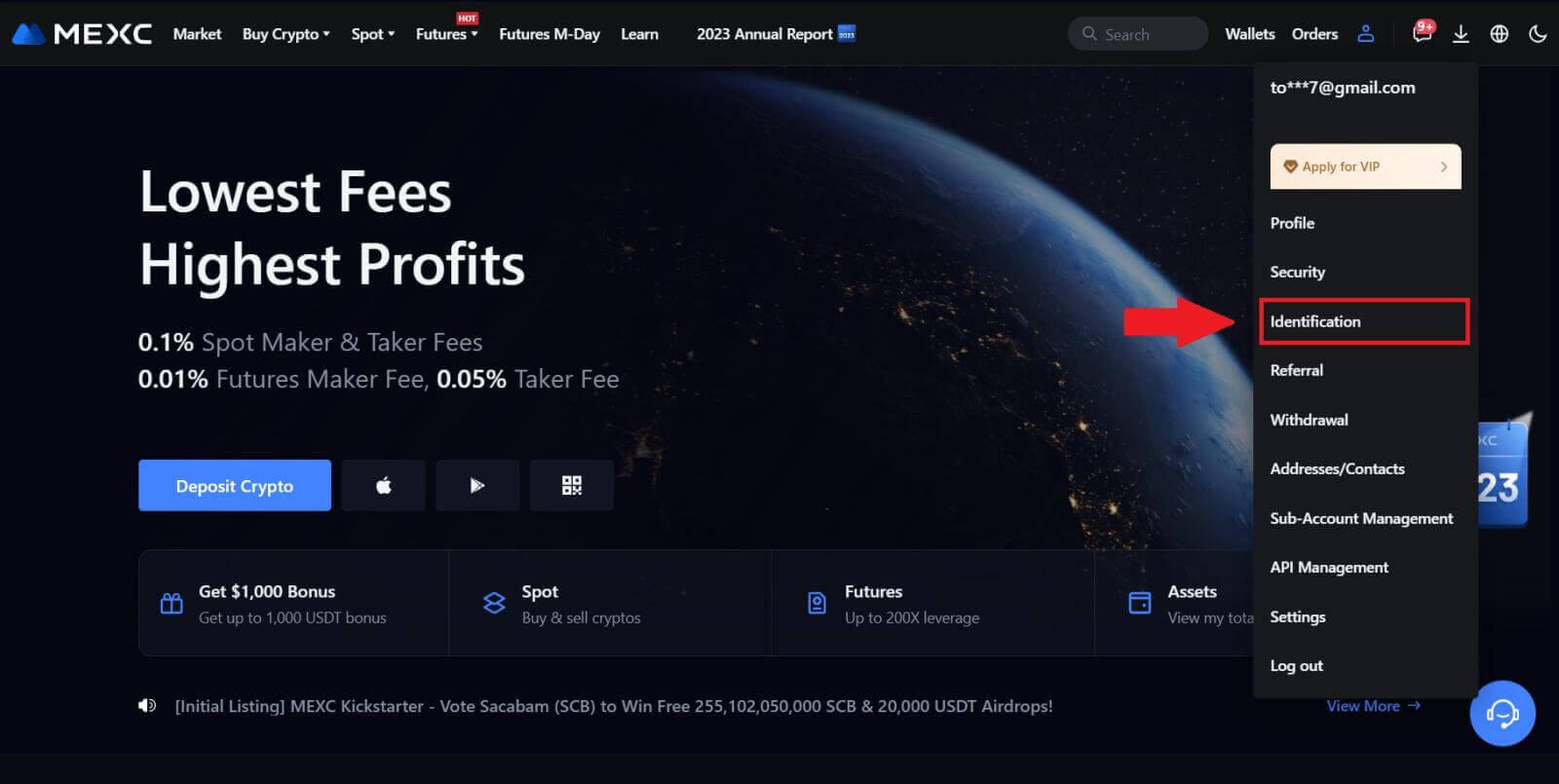

Primary KYC on MEXC (Website)

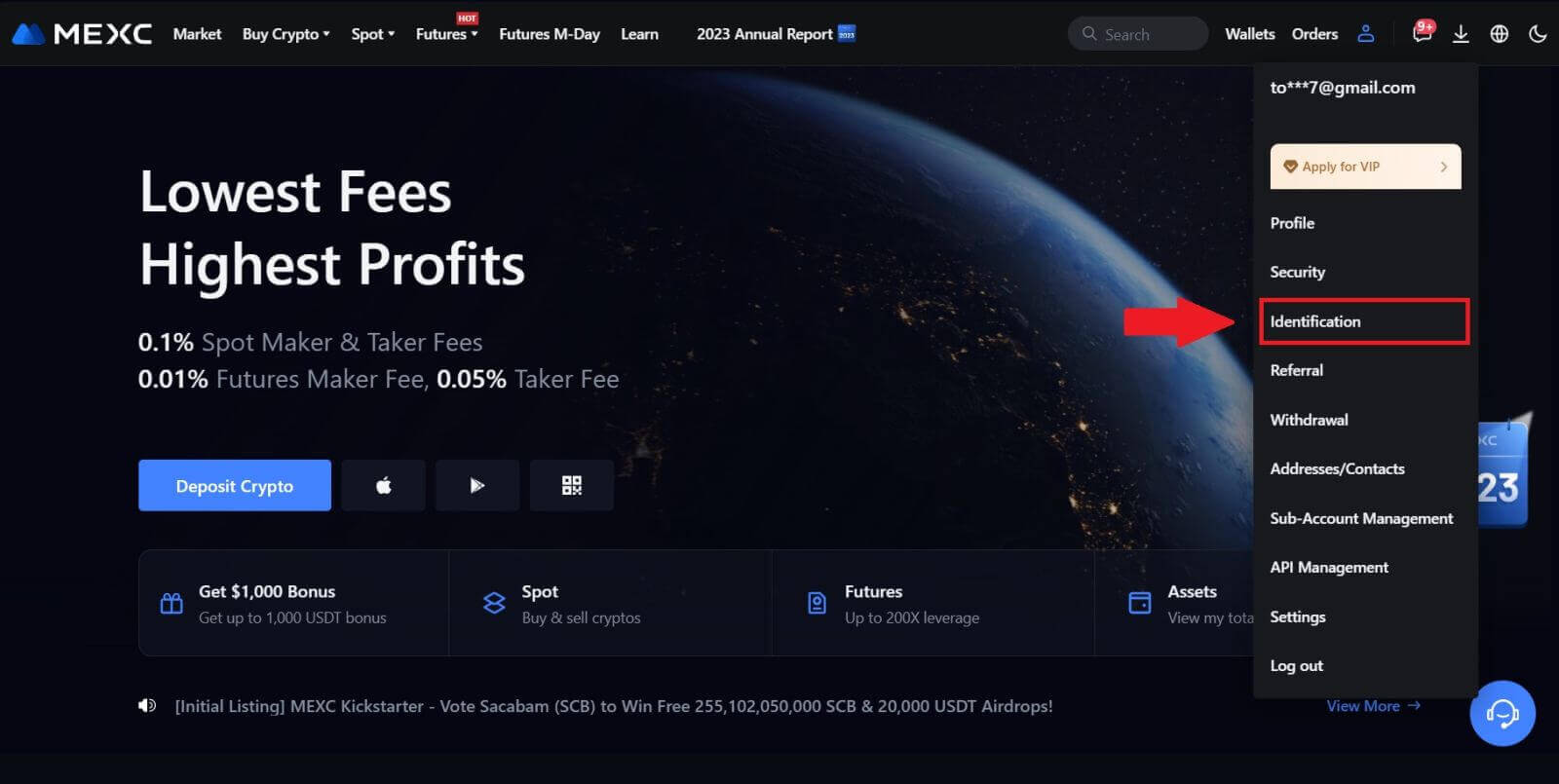

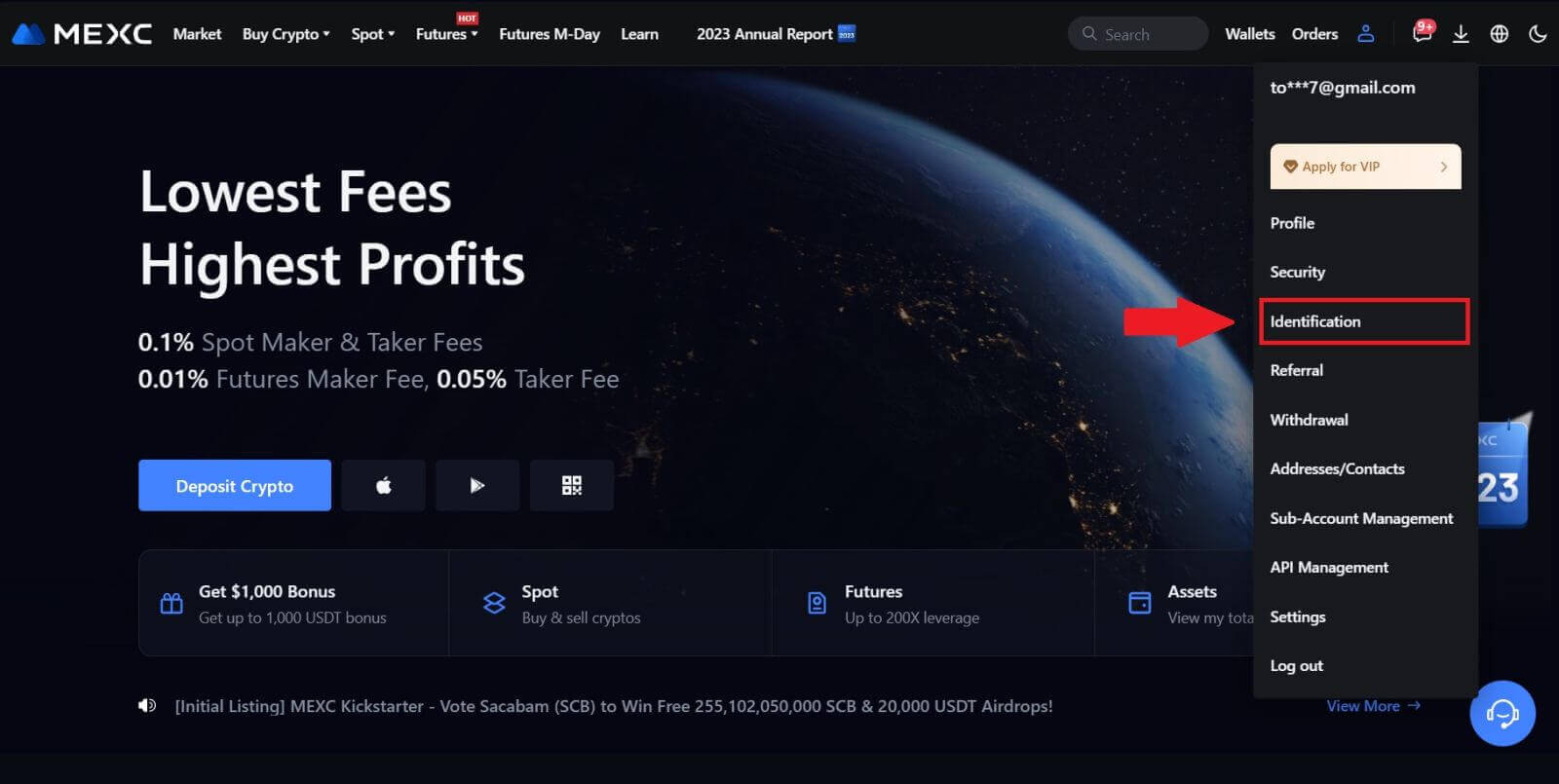

1. Log in to your MEXC account. Place your cursor on the top-right profile icon and click on [Identification].

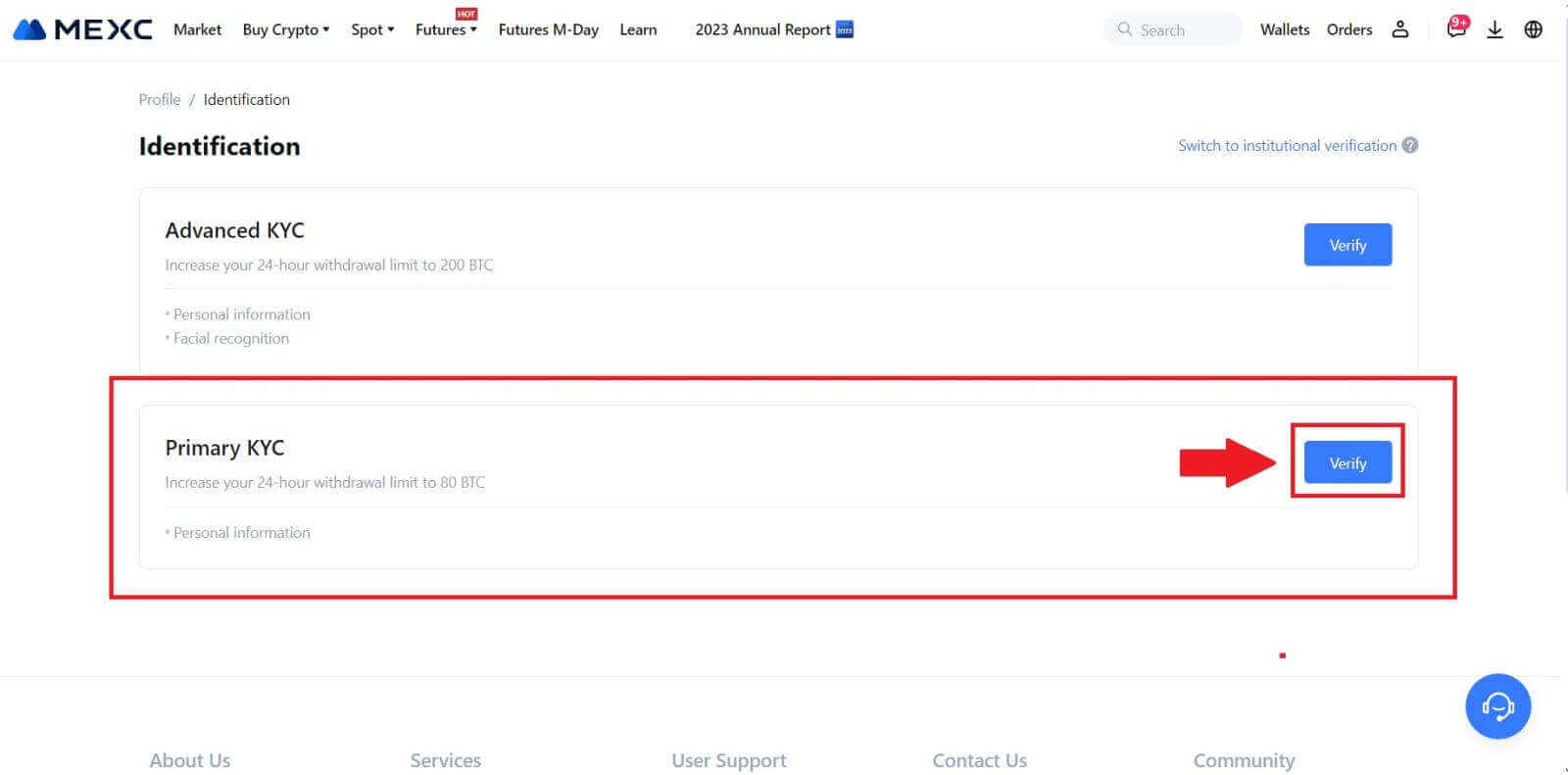

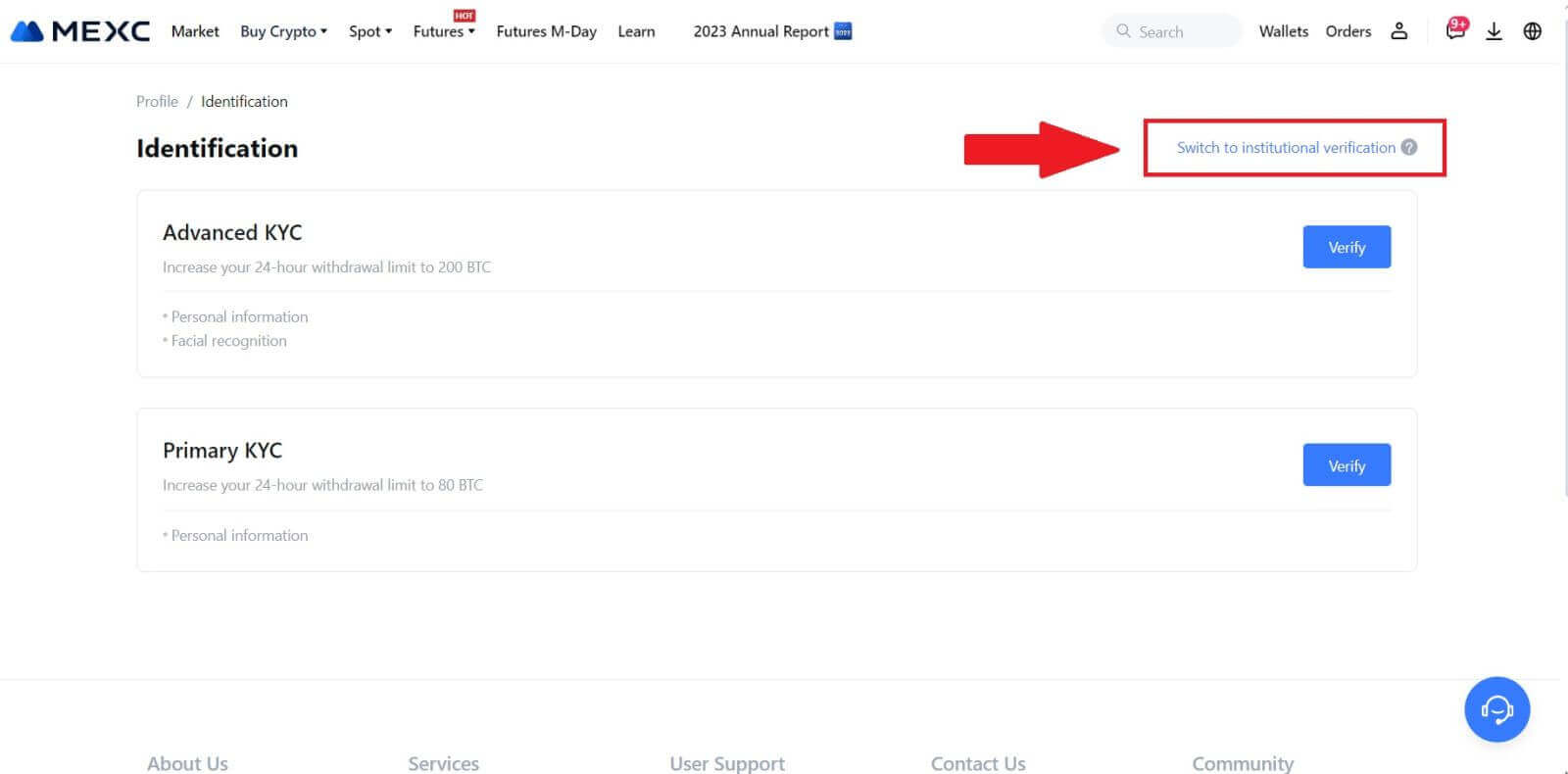

2. Start with Primary KYC and click [Verify].

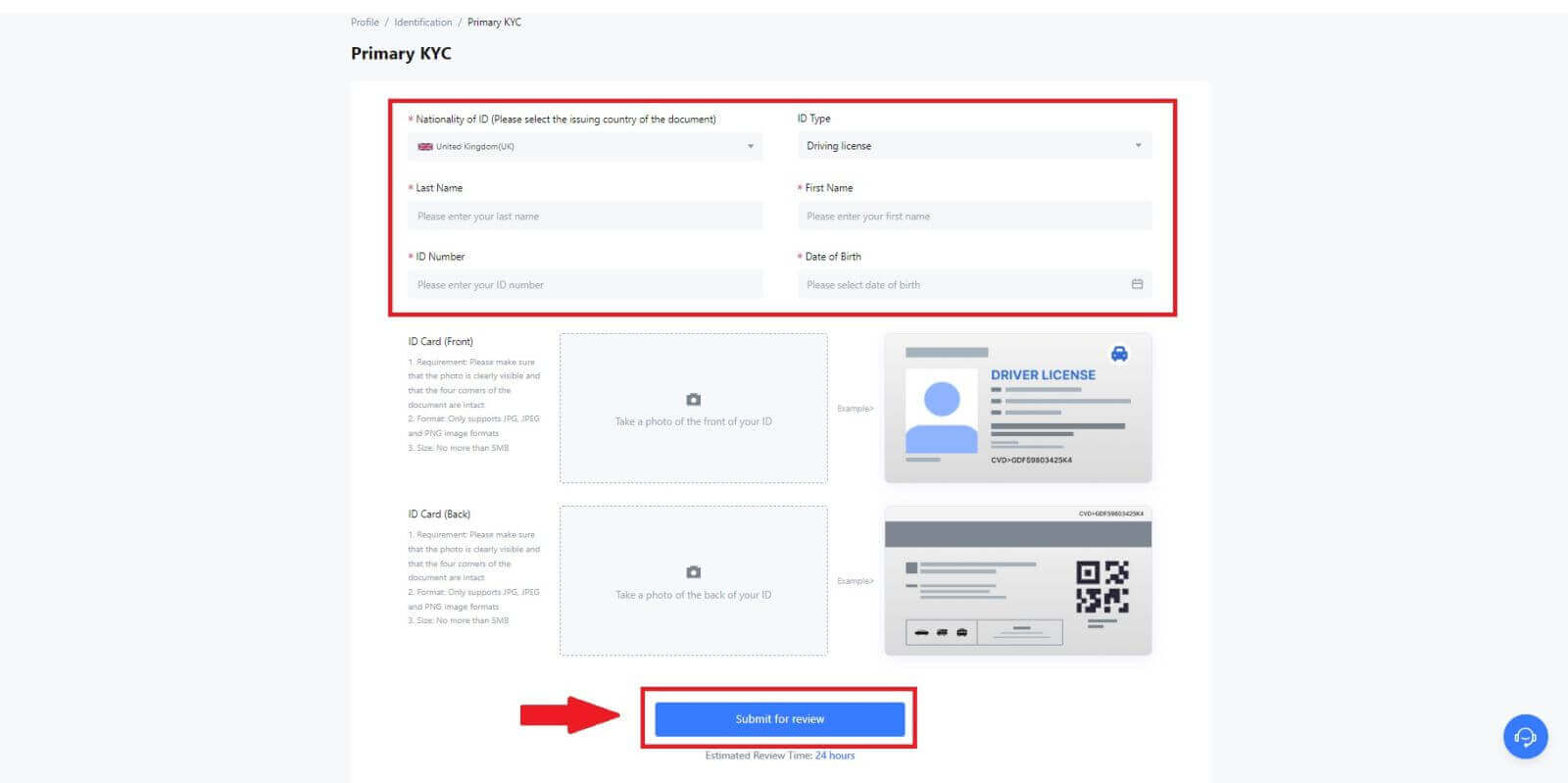

3. Select your country, input your full legal name, choose your ID Type, Date of birth, upload photos of your ID Type, and click on [Submit for review].

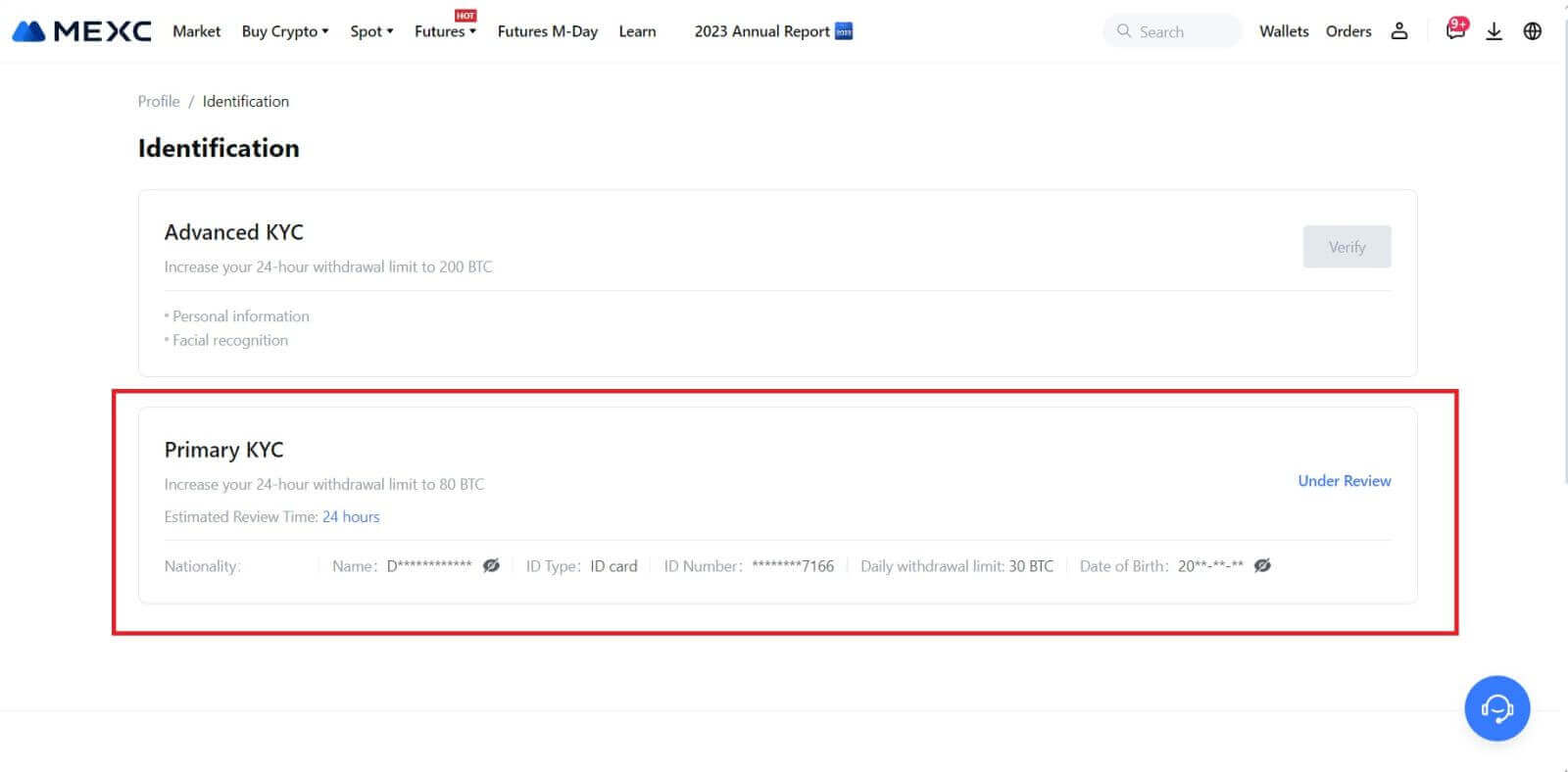

4. After verification, you will see your verification is under review, wait for the confirmation email or access your profile to check the KYC status.

Note

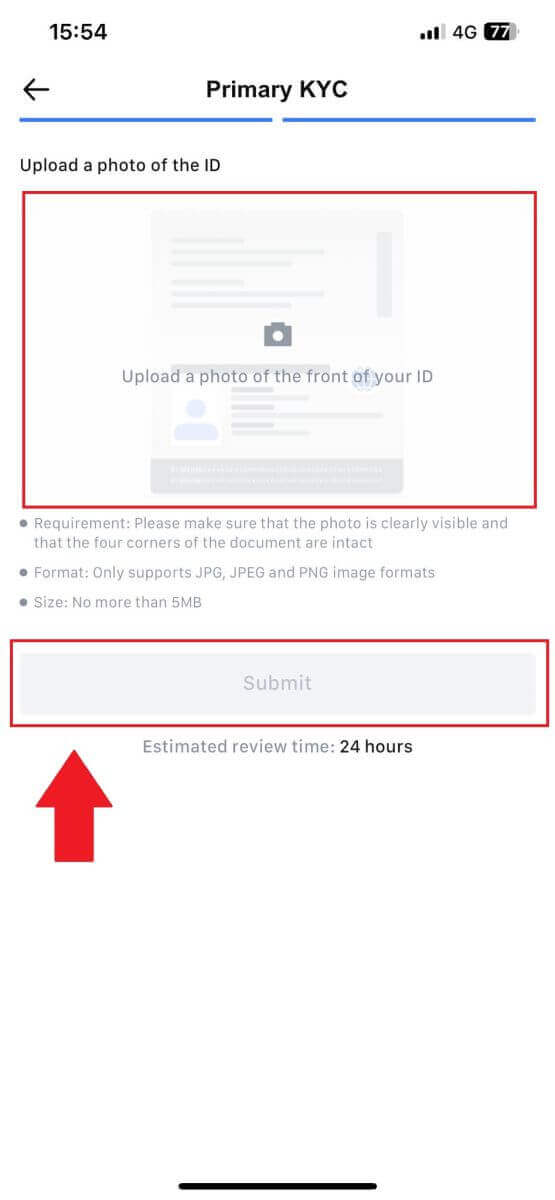

The image file format must be JPG, JPEG or PNG, file size cannot exceed 5 MB. Face should be clearly visible! Note should be clearly readable! Passport should be clearly readable.

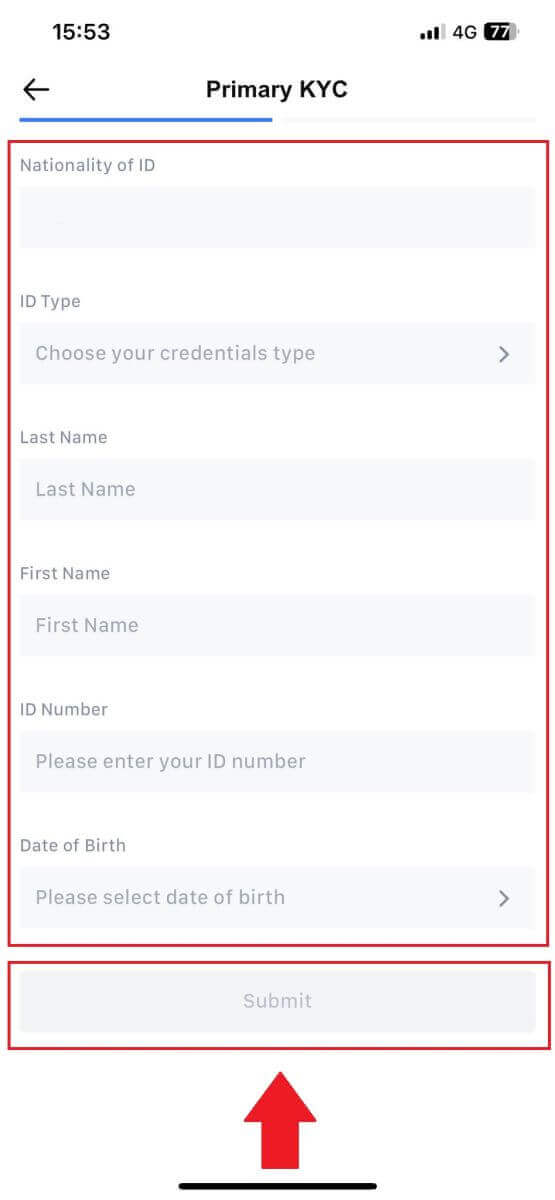

Primary KYC on MEXC (App)

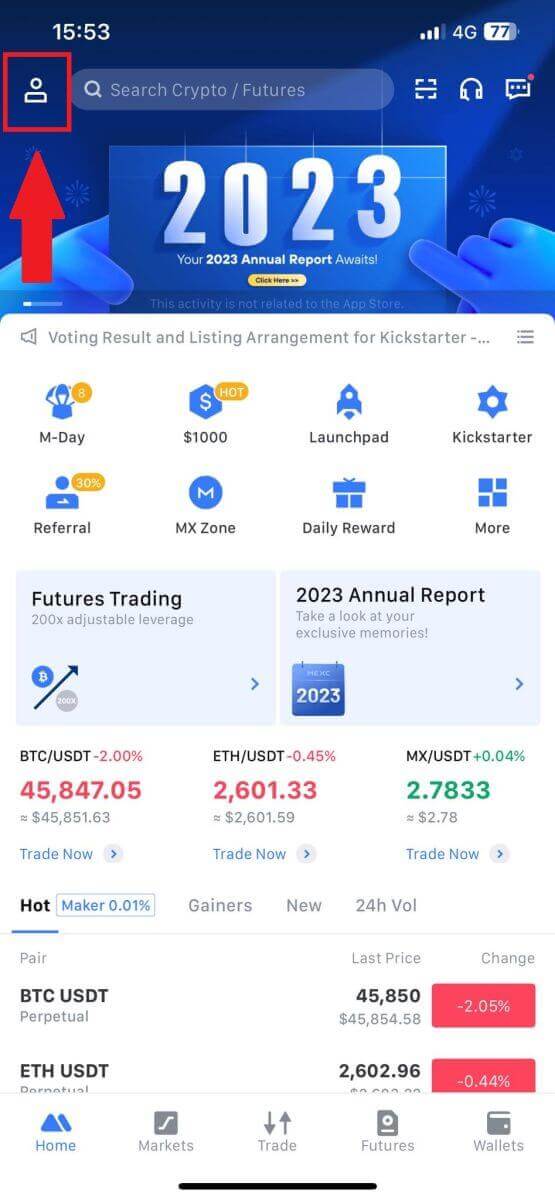

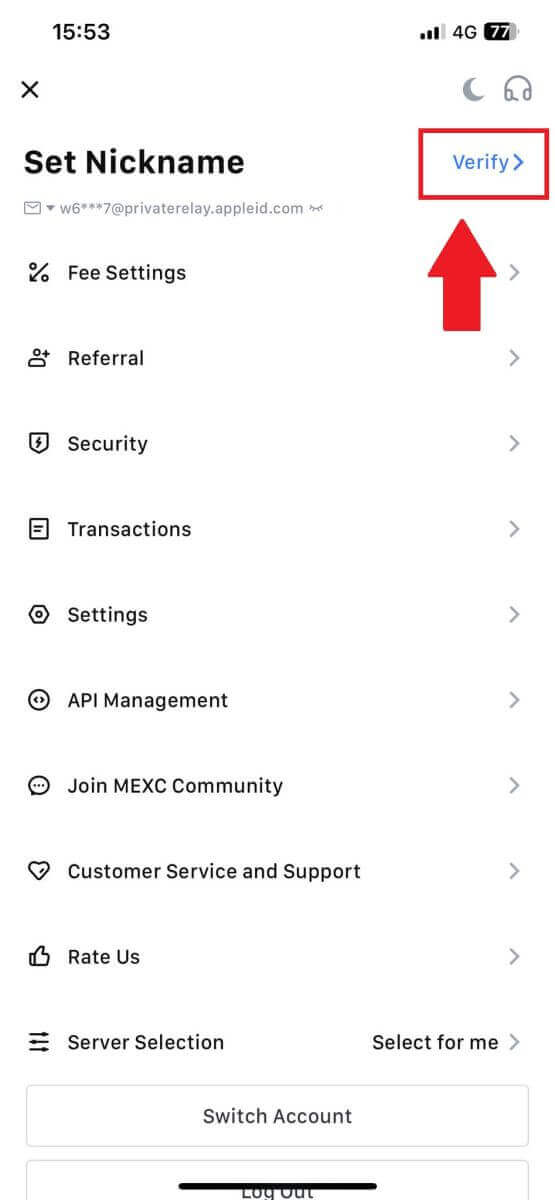

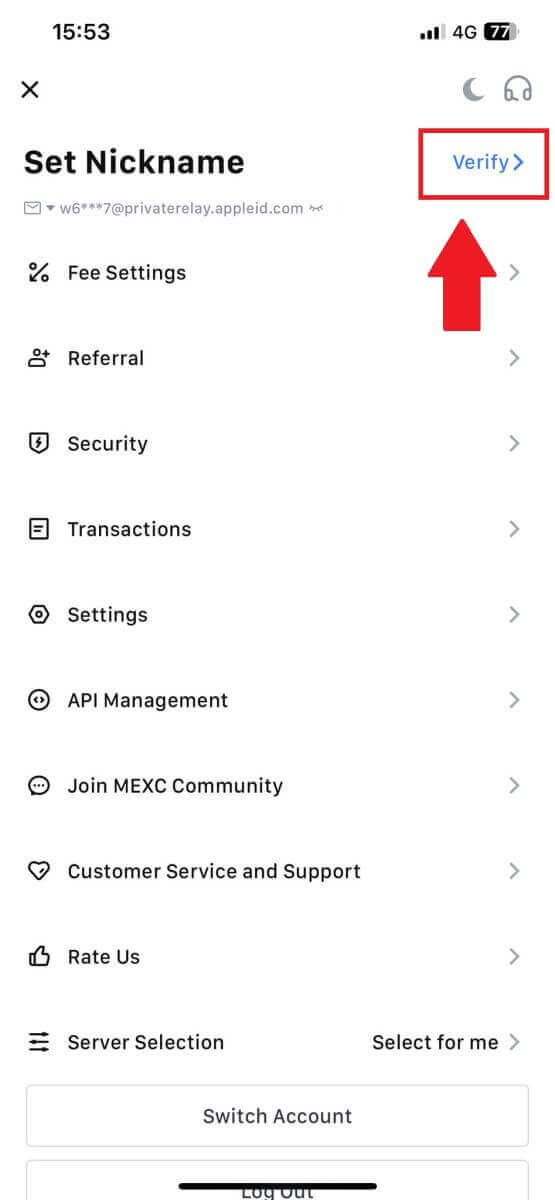

1. Open your MEXC app, tap on the [Profile] icon, and select [Verify].

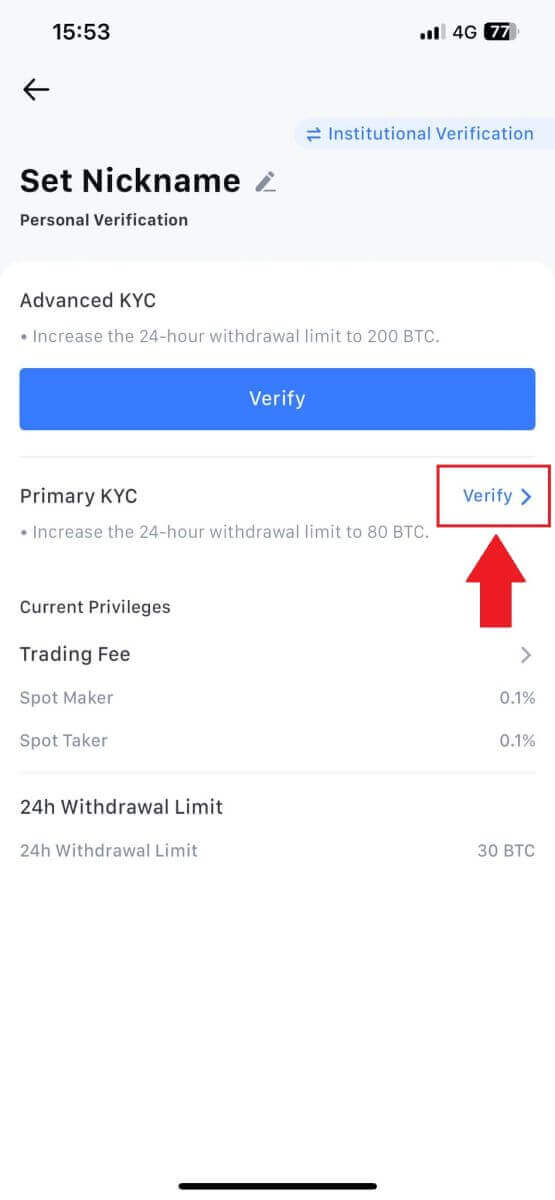

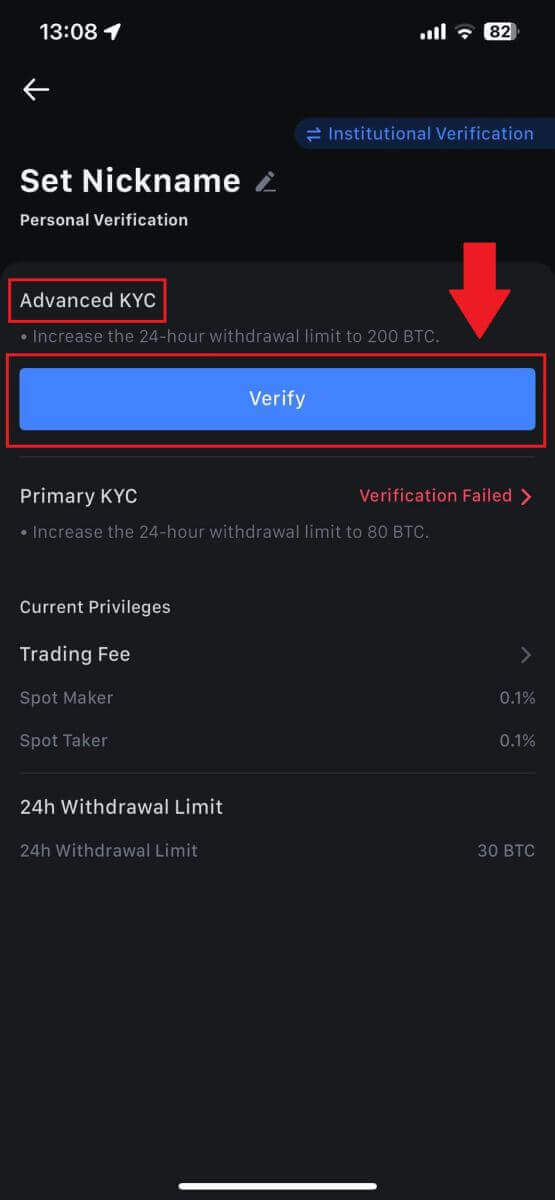

2. Select [Primary KYC] and tap [Verify].

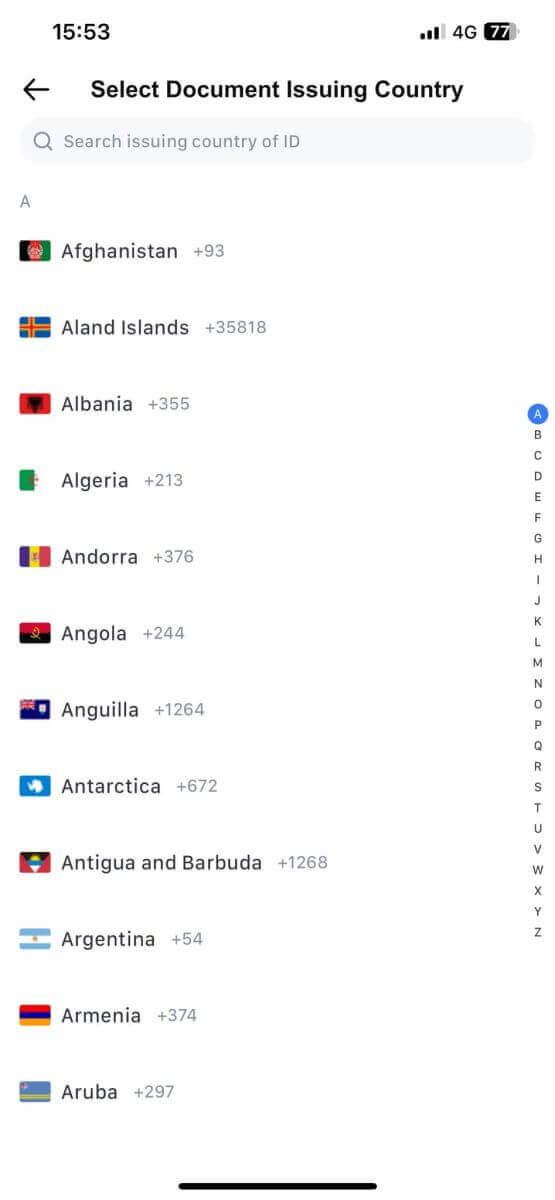

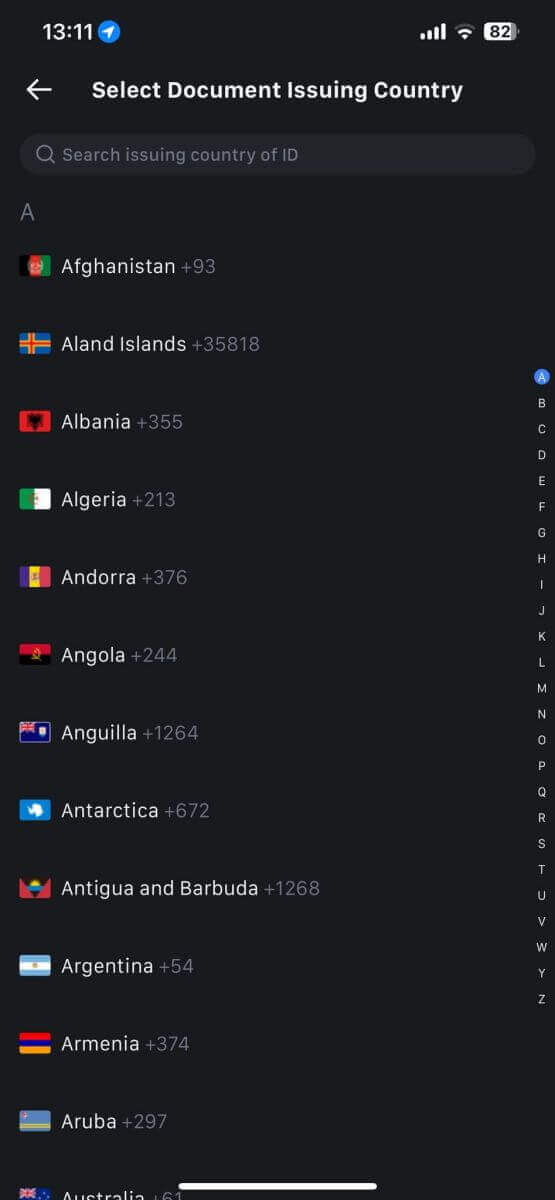

3. Choose your document-issuing country

4. Fill out all the information below and tap [Submit].

5. Upload a photo of your chosen document and tap [Submit].

6.After verification, you will see your verification is under review, wait for the confirmation email or access your profile to check the KYC status

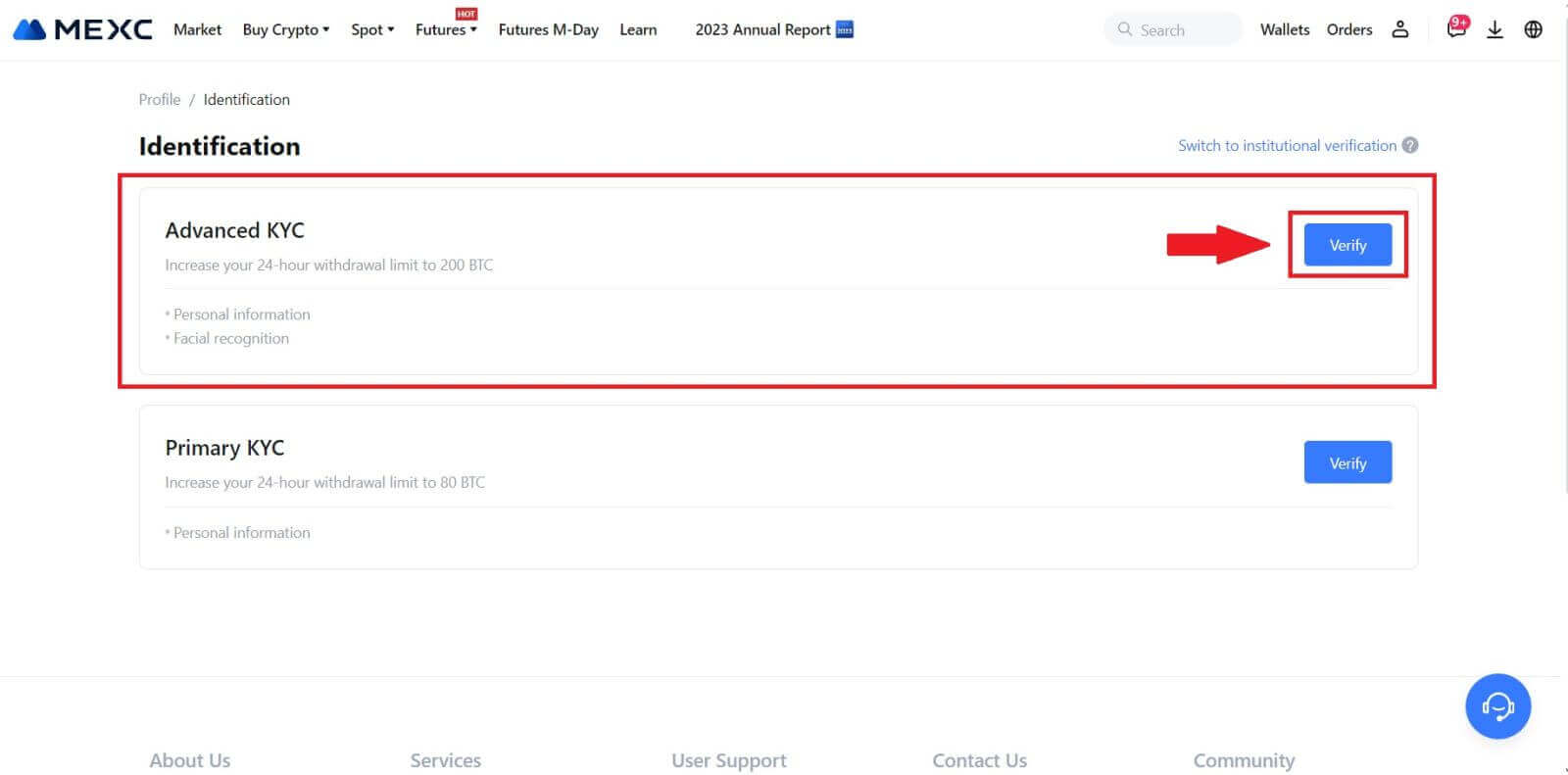

Advanced KYC on MEXC (Website)

1. Log in to your MEXC account. Place your cursor on the top-right profile icon and click on [Identification]. 2. Select [Advanced KYC], click on [Verify].

2. Select [Advanced KYC], click on [Verify].

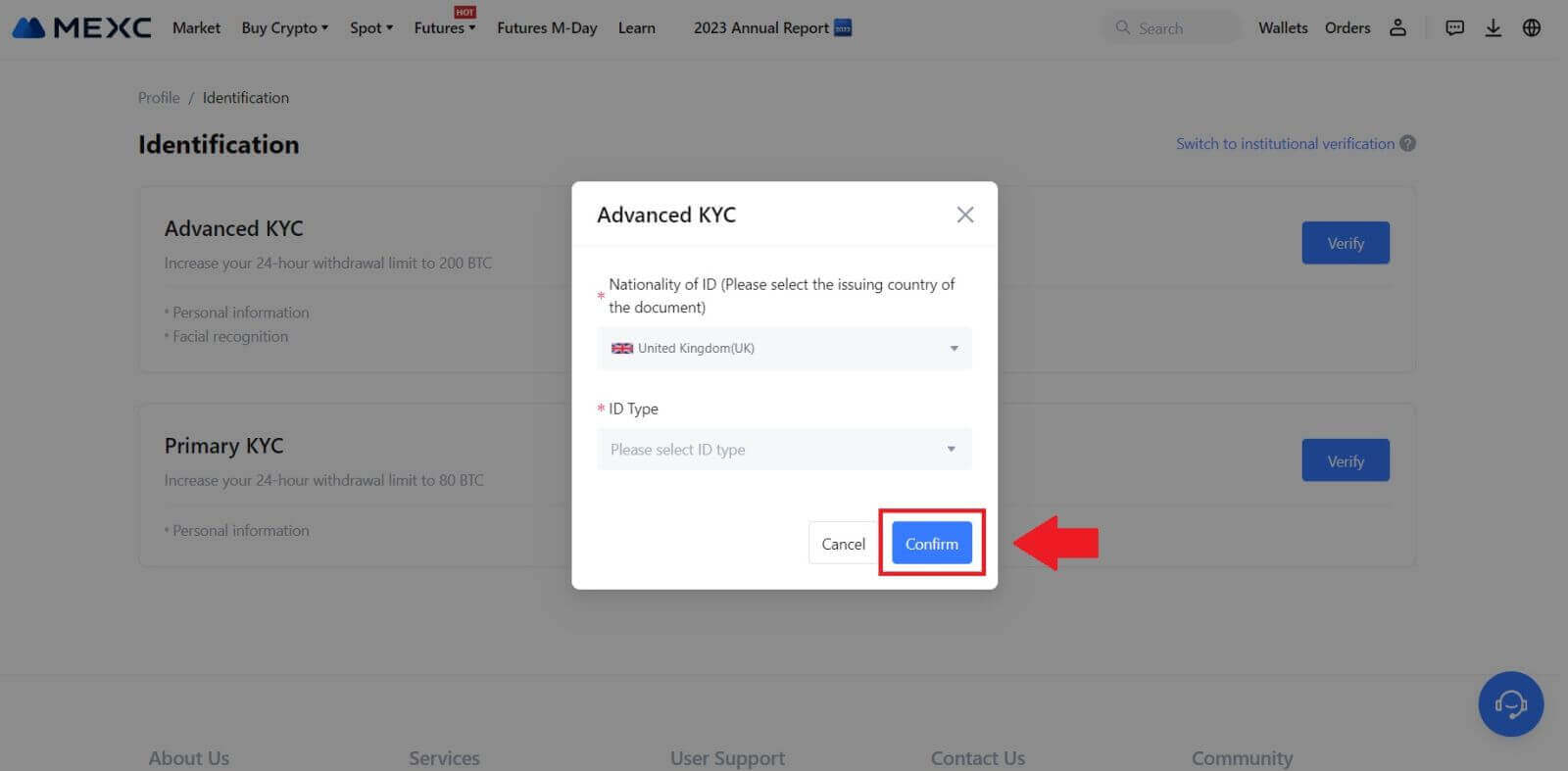

3. Choose the issuing country of your document and ID type, then click [Confirm].

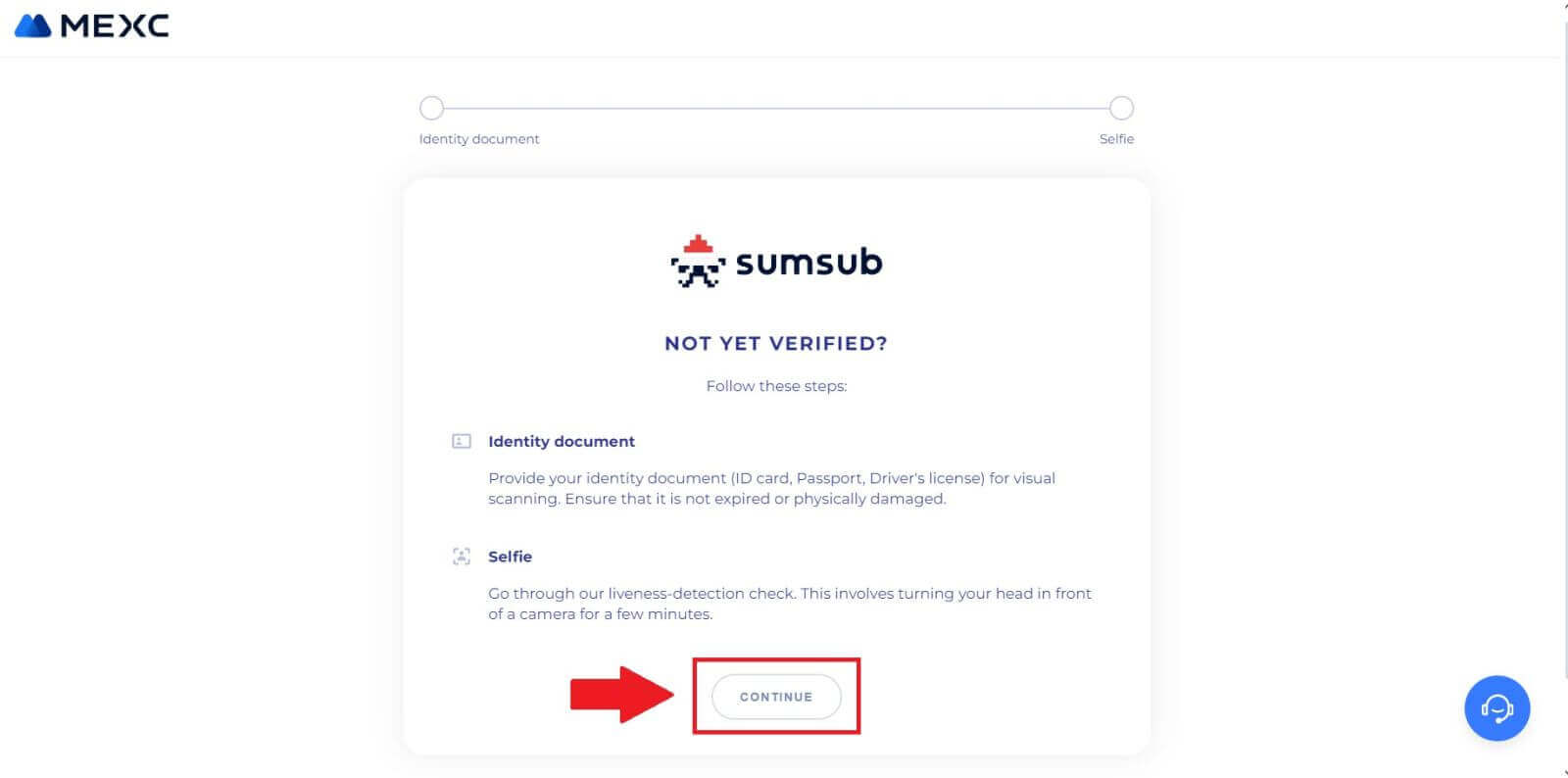

4. Follow the verification steps and click [CONTINUE].

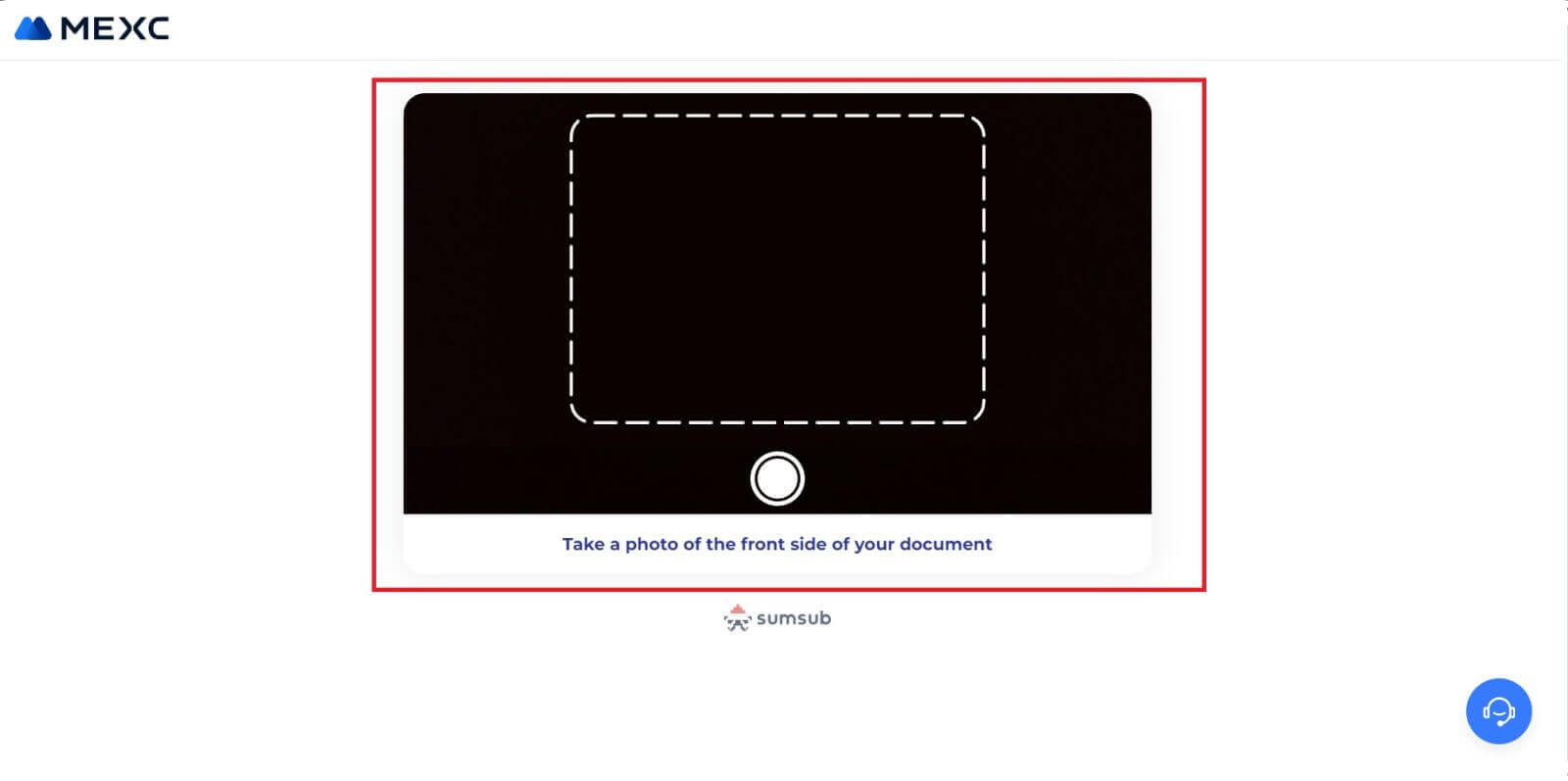

5. Next, place and take your ID-type photo on the frame to continue.

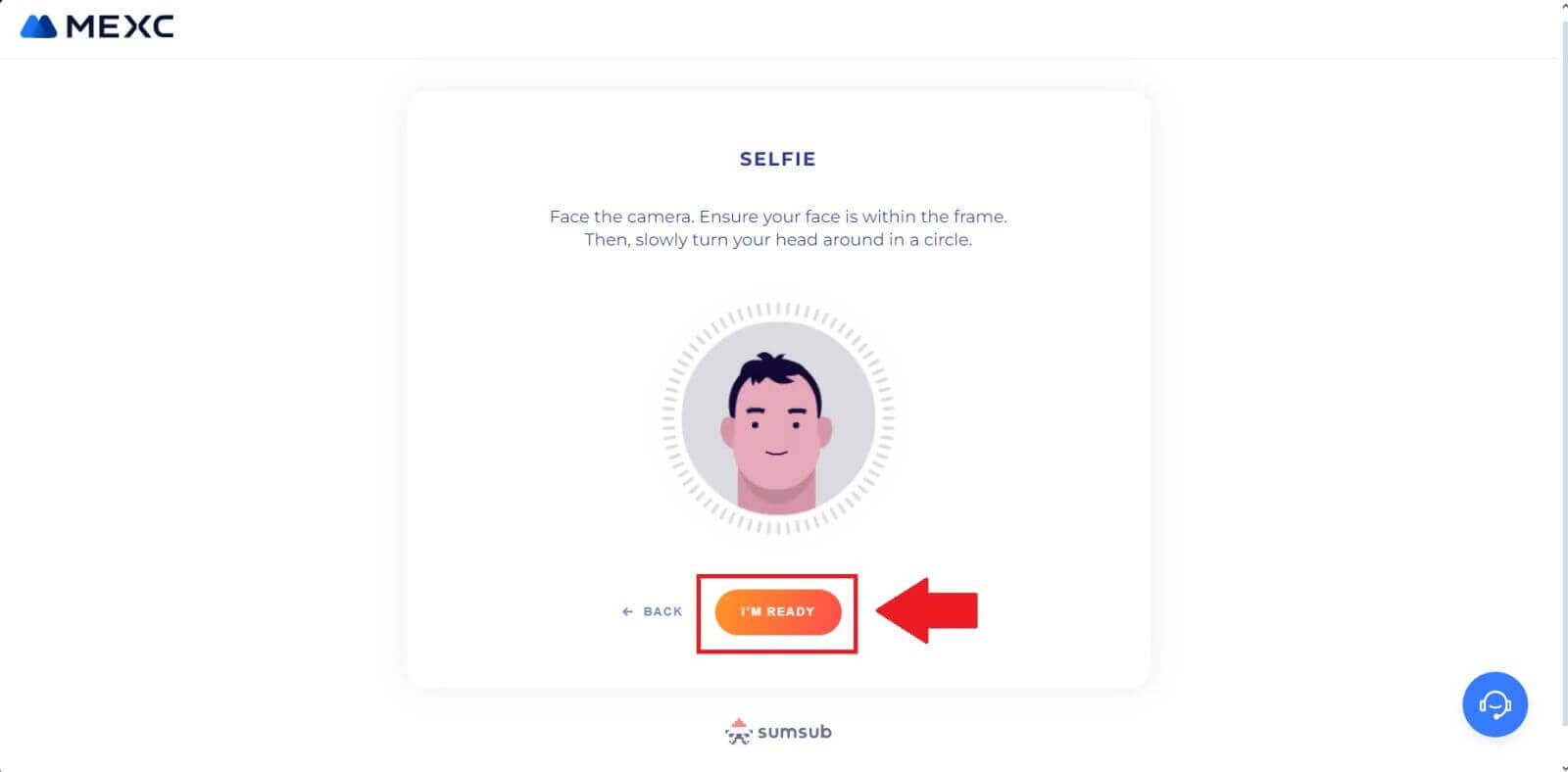

6. Next, start taking your selfie by clicking on [I’M READY].

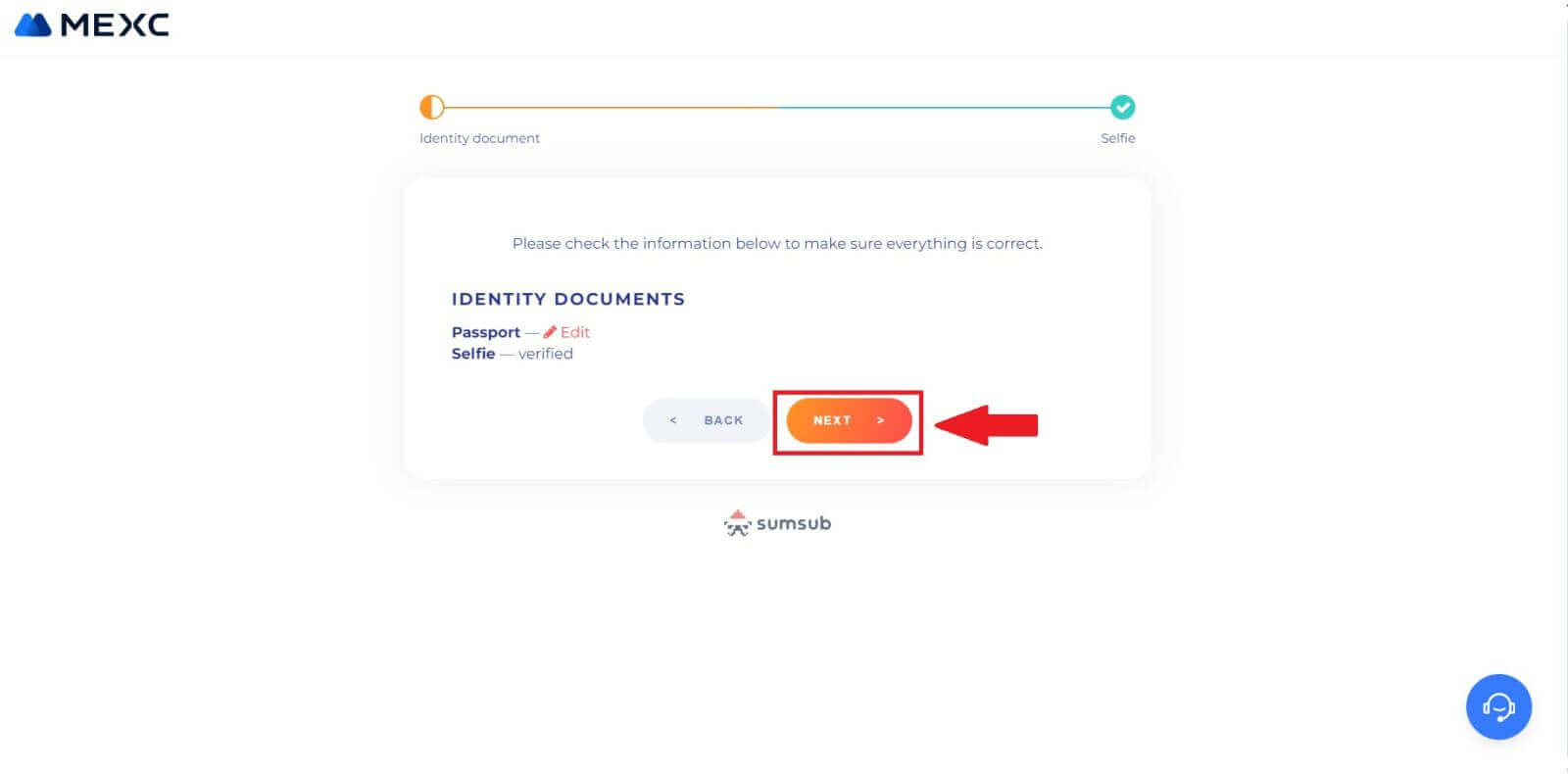

7. Lastly, check out your document information, then click [NEXT].

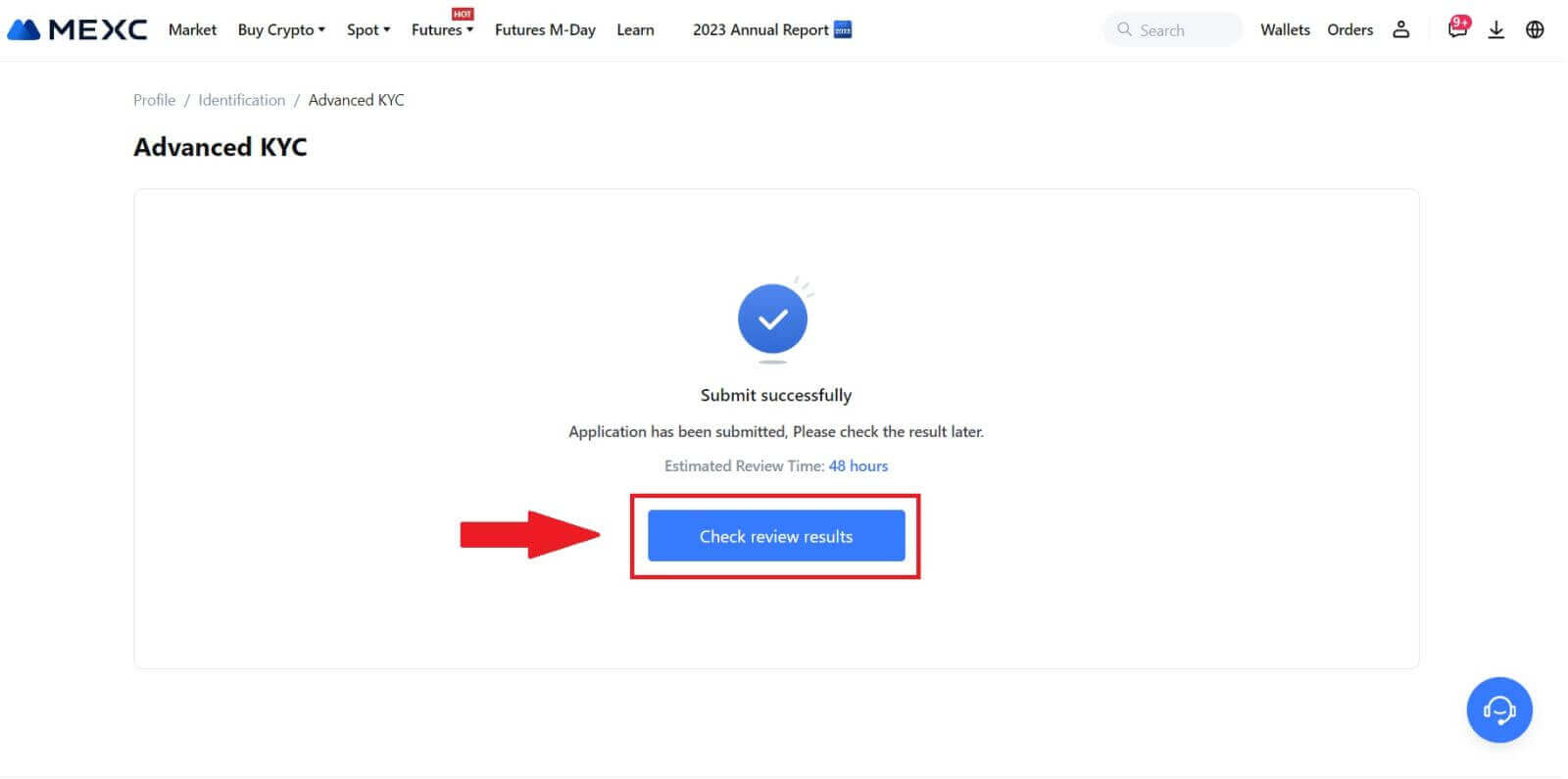

8. After that, your application has been submitted.

You can check your status by clicking on [Check review results].

Advanced KYC on MEXC (App)

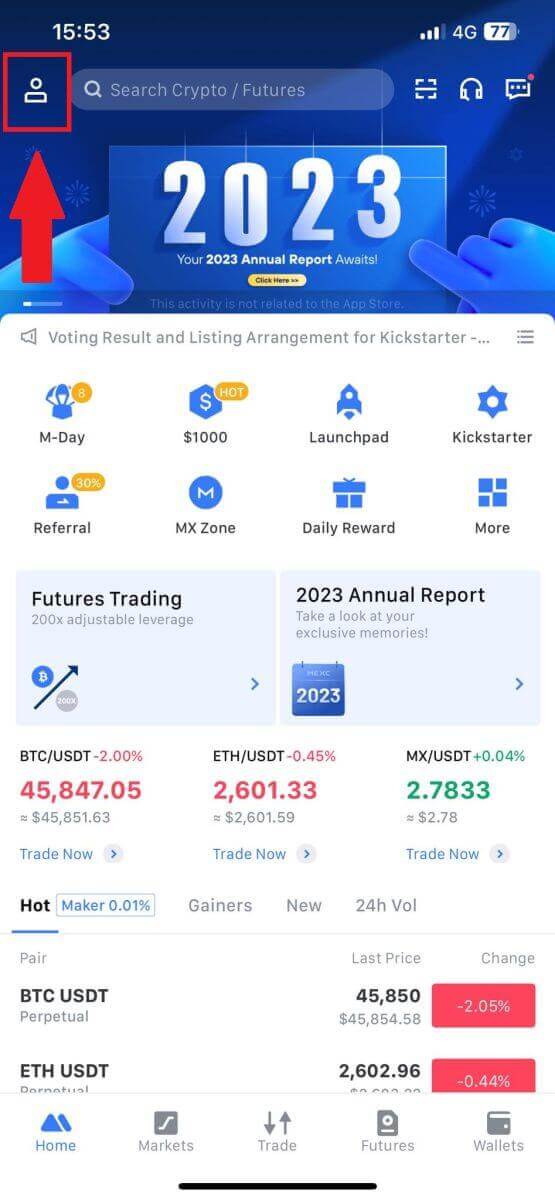

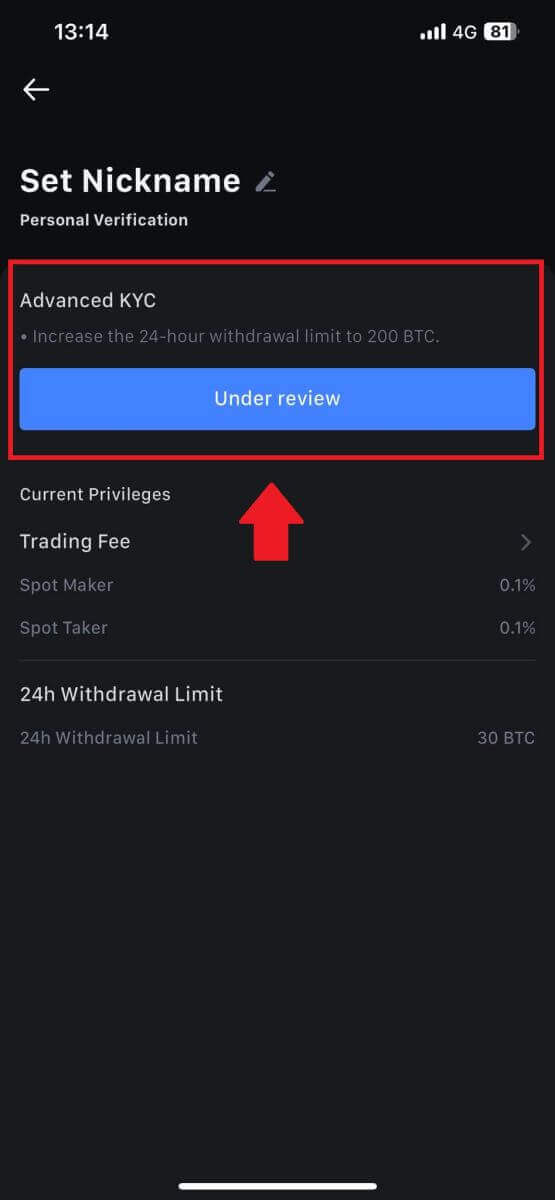

1. Open your MEXC app, tap on the [Profile] icon, and select [Verify].

2. Select [Advanced KYC] and tap [Verify].

3. Choose your document-issuing country

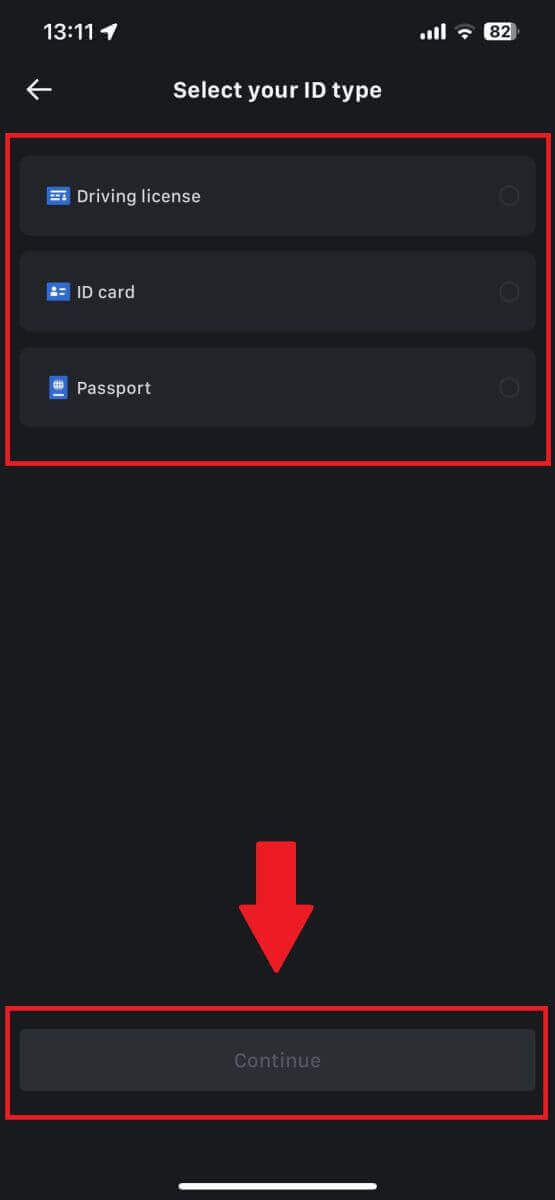

4. Select your ID type and tap [Continue].

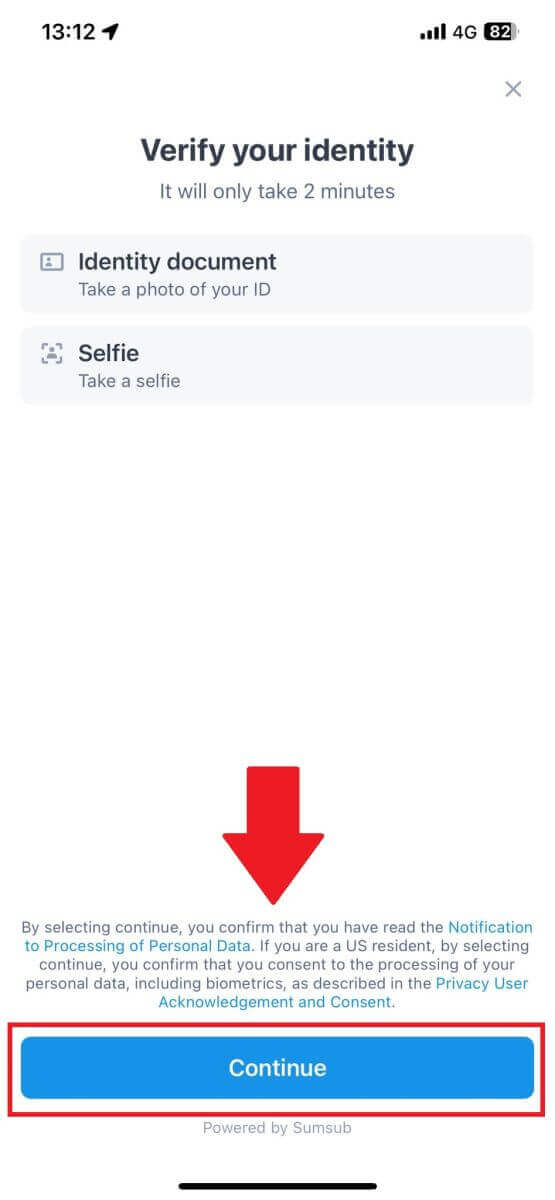

5. Continue your process by tapping [Continue].

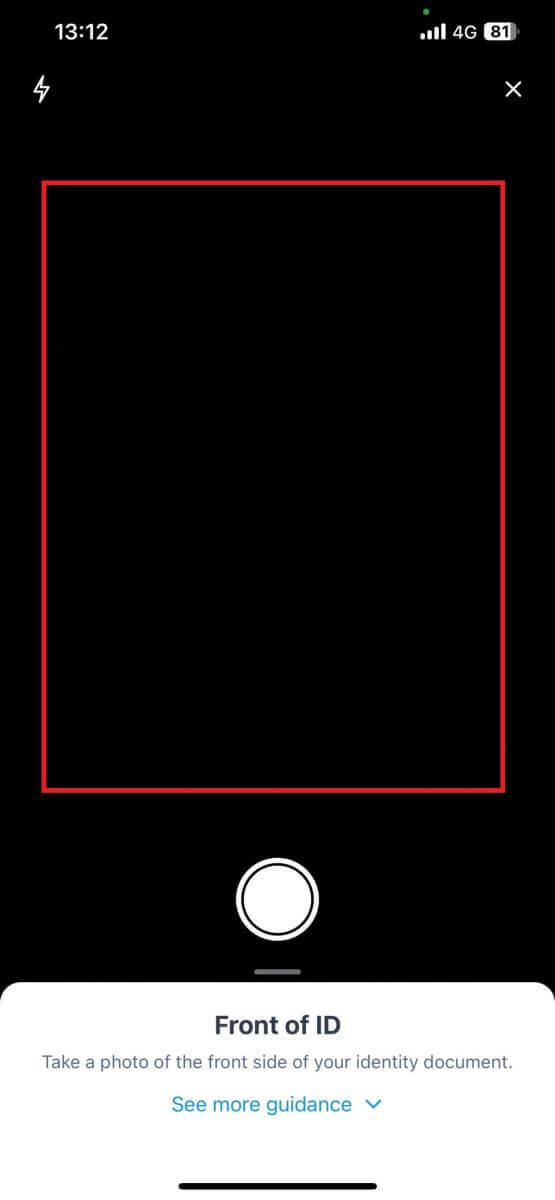

6. Take your photo of your ID to continue.

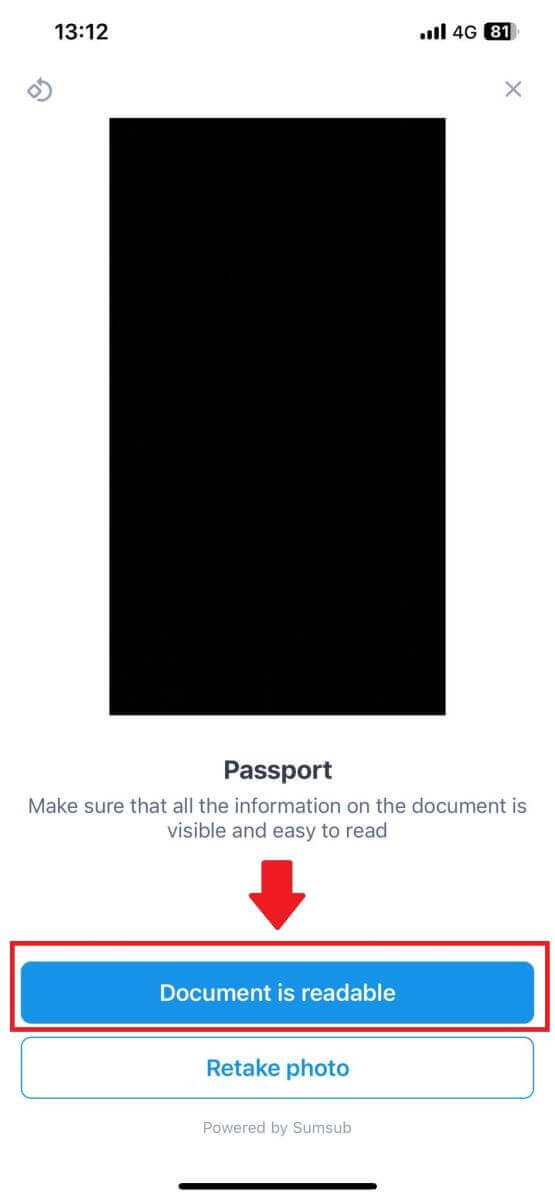

7. Make sure all the information in your photo is visible and tap [Document is readable].

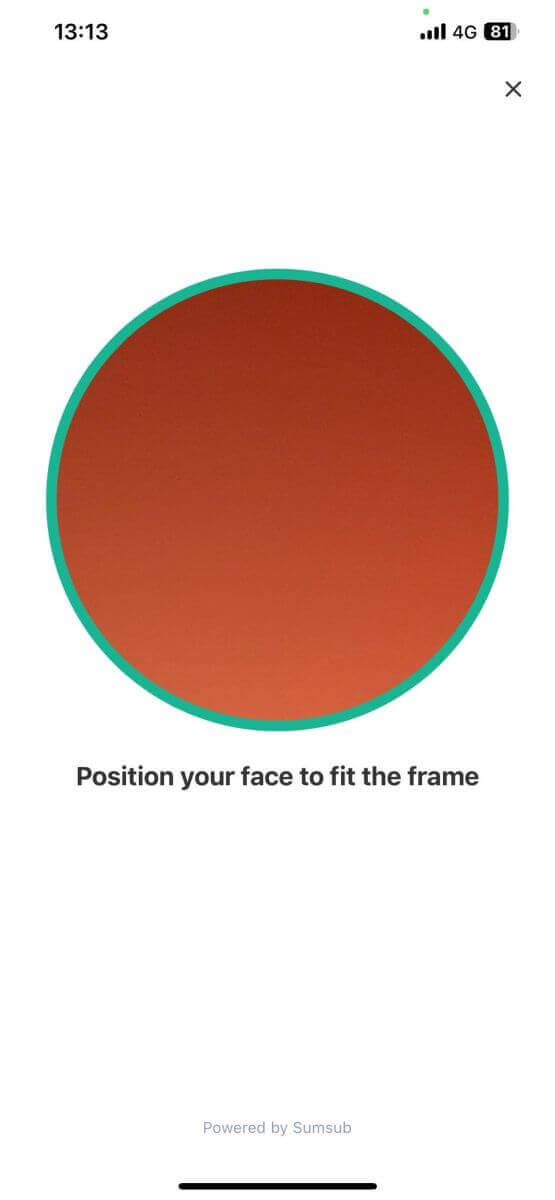

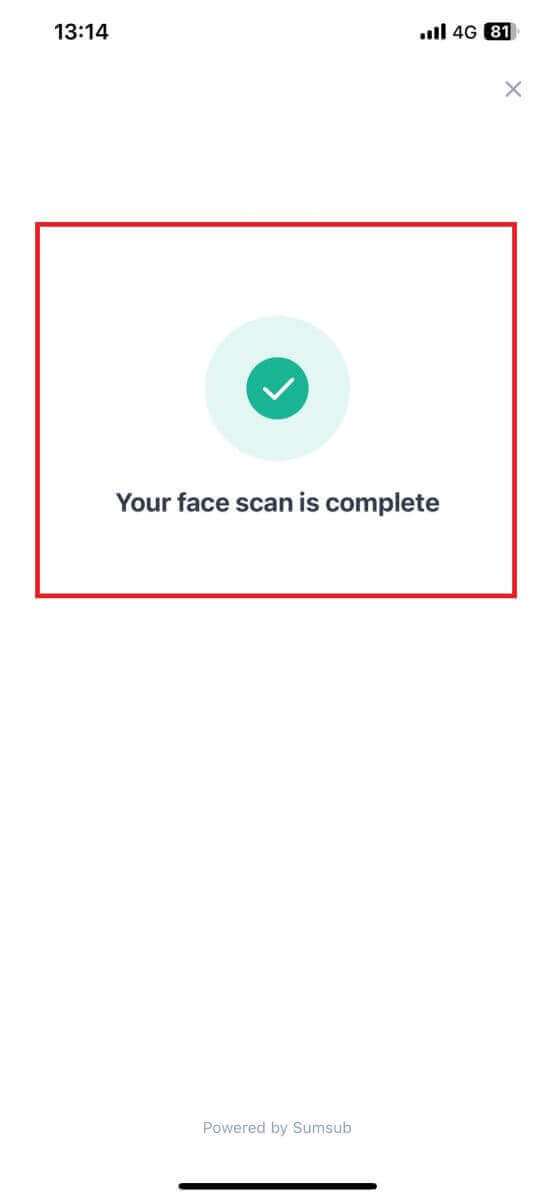

8. Next, take a selfie by putting your face into the frame to complete the process.

9. After that, your verification is under review. Wait for the confirmation email or access your profile to check the KYC status.

How to Apply and Verify for Institution Account

To apply for an Institution account, please follow the step-by-step guide below:

1. Log in to your MEXC account and go to [Profile] - [Identification].

Click on [Switch to institutional verification].

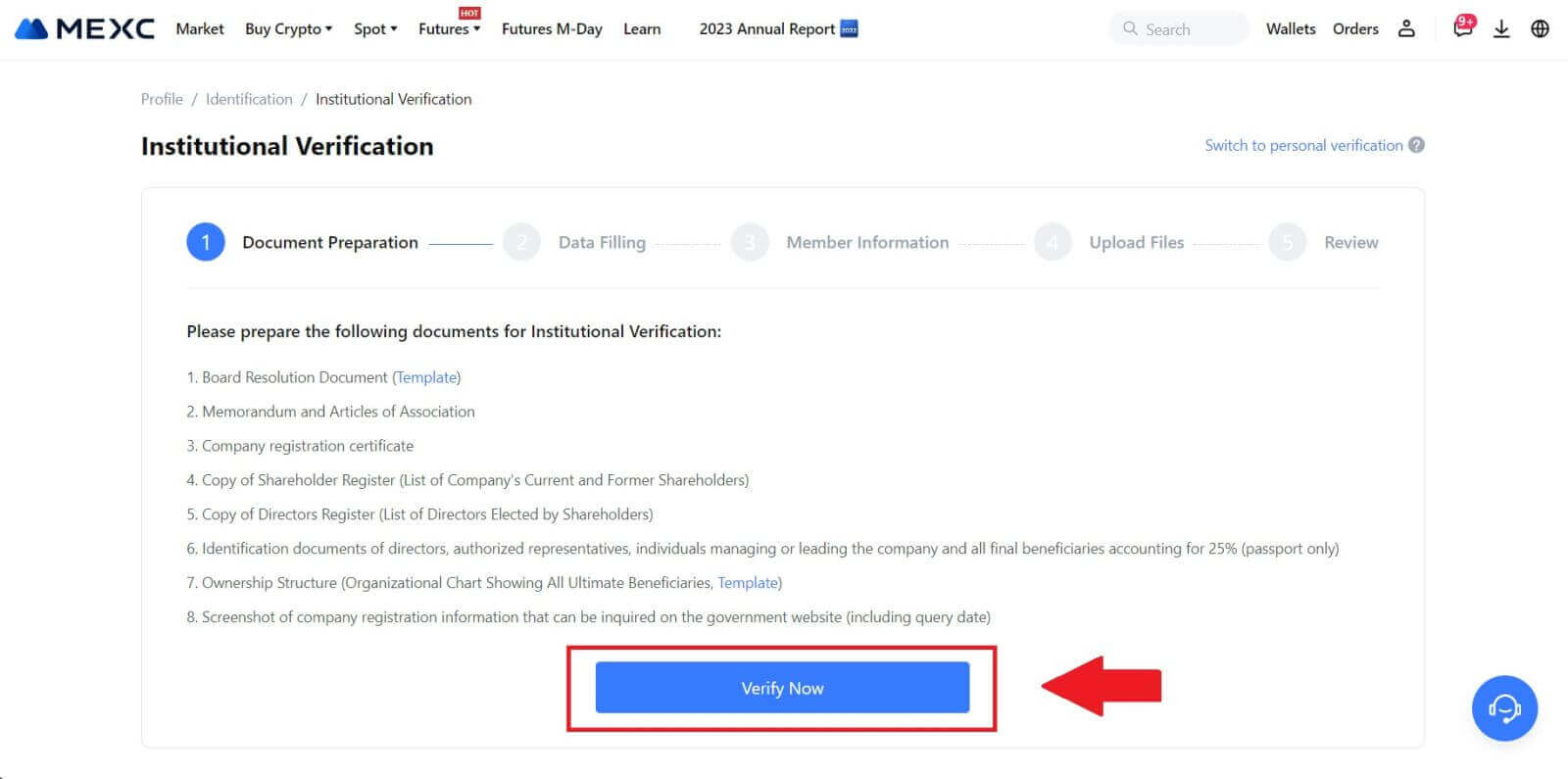

2. Prepare the following documents that have been listed below and click on [Verify Now].

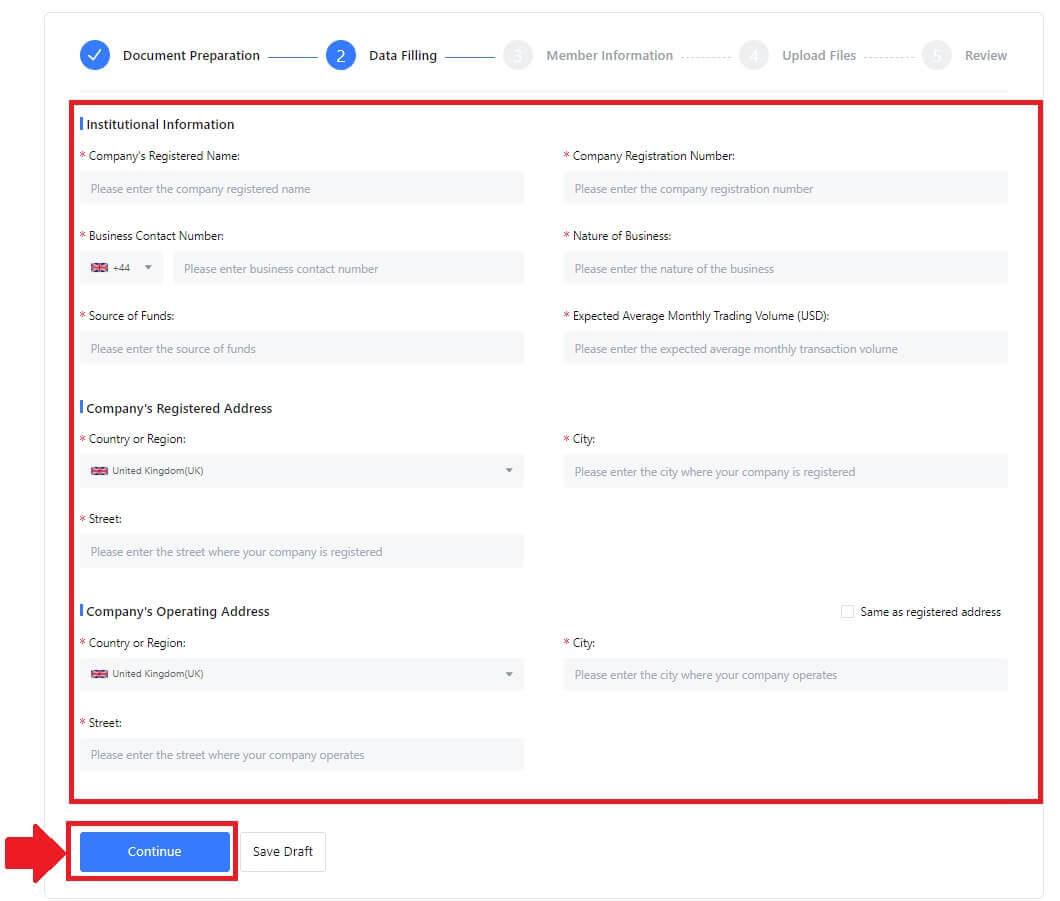

3. Complete the "Data Filling" page by providing comprehensive details, including institutional information, the registered address of your company, and its operating address. Once the information is filled in, proceed by clicking on [Continue] to move to the member information section.

3. Complete the "Data Filling" page by providing comprehensive details, including institutional information, the registered address of your company, and its operating address. Once the information is filled in, proceed by clicking on [Continue] to move to the member information section.

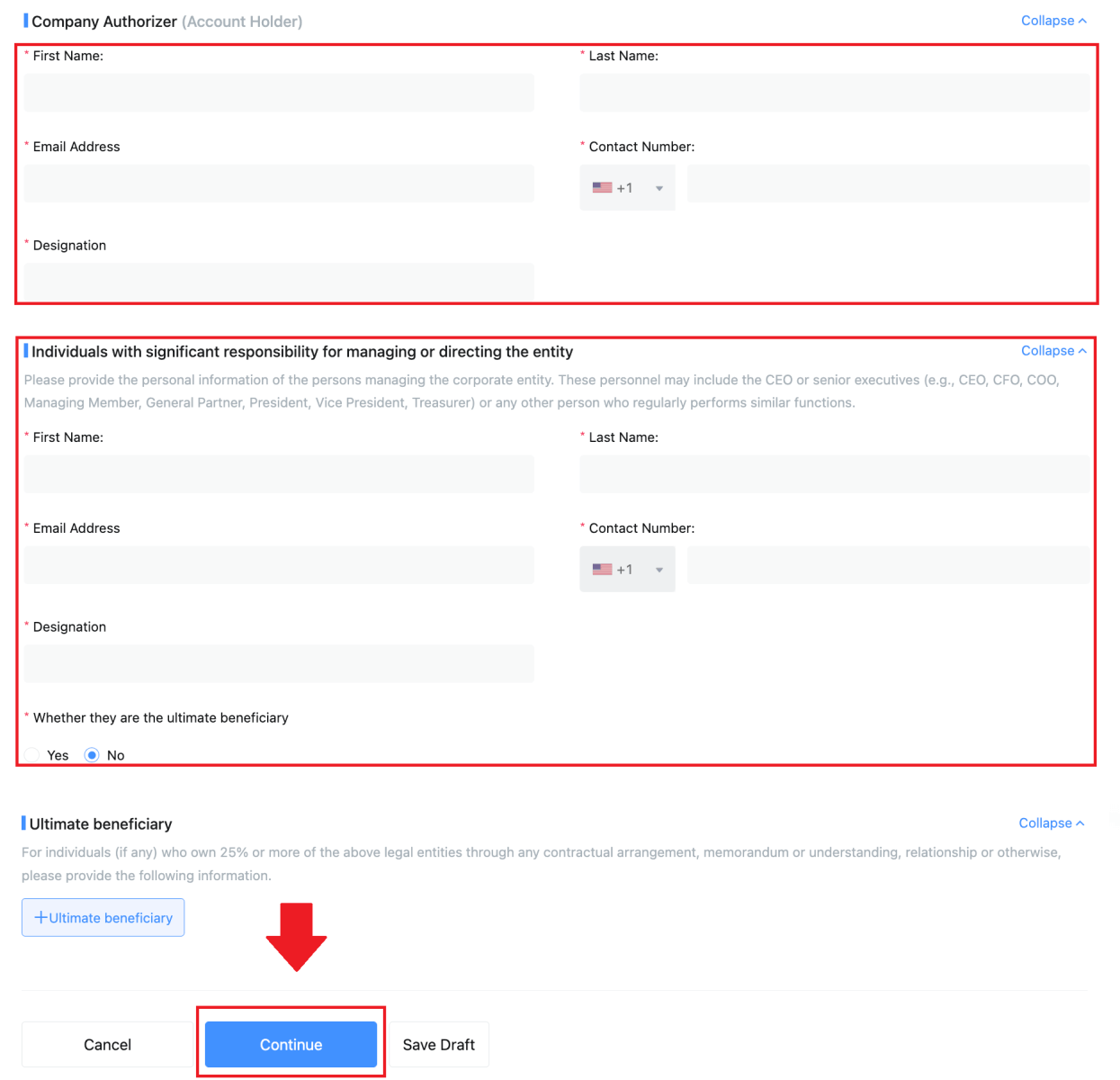

4. Navigate to the "Member Information" page, where you are required to input essential details concerning the company authorizer, individuals holding significant roles in managing or directing the entity, and information about the ultimate beneficiary. Once you’ve filled in the required information, proceed by clicking the [Continue] button.

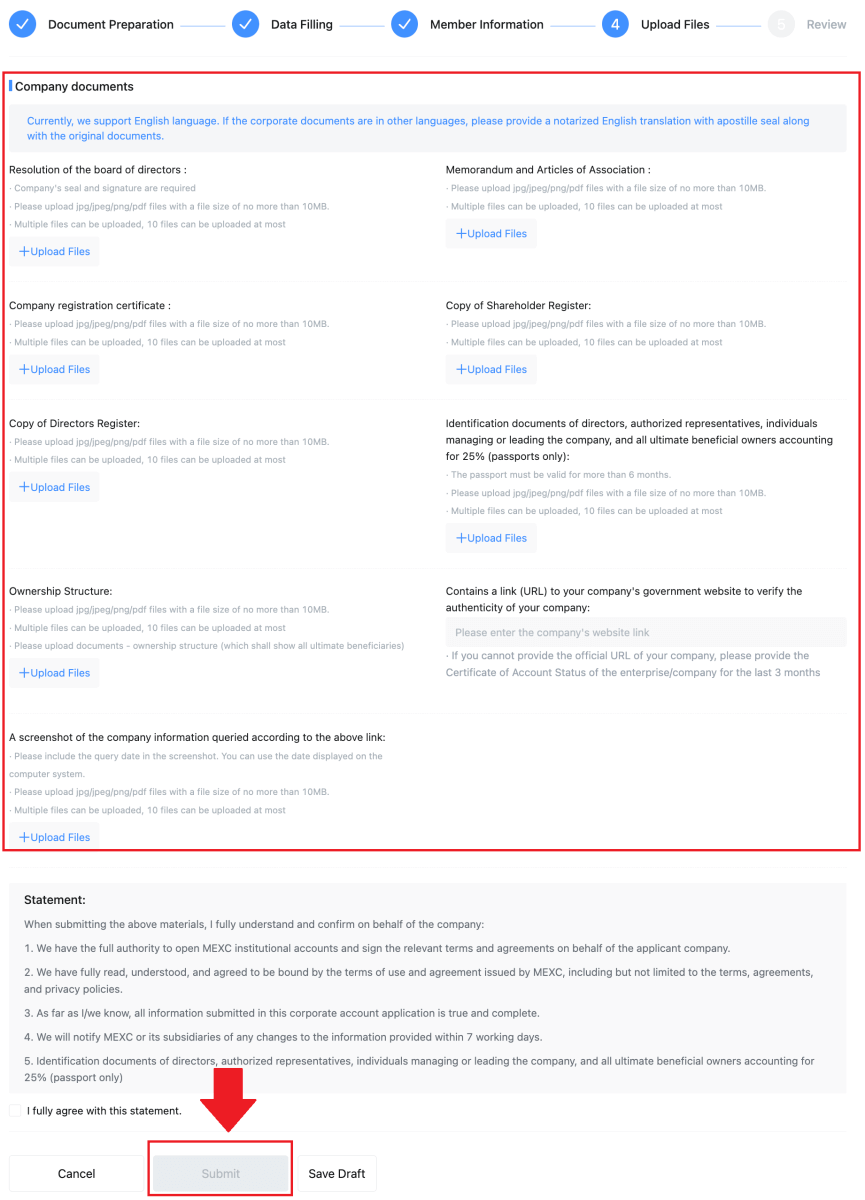

5. Proceed to the "Upload Files" page, where you can submit the documents prepared earlier for the institutional verification process. Upload the necessary files and carefully review the statement. After confirming your agreement by checking the "I fully agree with this statement" box, click on [Submit] to complete the process.

5. Proceed to the "Upload Files" page, where you can submit the documents prepared earlier for the institutional verification process. Upload the necessary files and carefully review the statement. After confirming your agreement by checking the "I fully agree with this statement" box, click on [Submit] to complete the process.

6. After that, your application is successfully submitted. Please wait patiently for us to review.

Frequently Asked Questions (FAQ)

Unable to upload photo during KYC Verification

If you encounter difficulties uploading photos or receive an error message during your KYC process, please consider the following verification points:- Ensure the image format is either JPG, JPEG, or PNG.

- Confirm that the image size is below 5 MB.

- Use a valid and original ID, such as a personal ID, driver’s license, or passport.

- Your valid ID must belong to a citizen of a country that allows unrestricted trading, as outlined in "II. Know-Your-Customer and Anti-Money-Laundering Policy" - "Trade Supervision" in the MEXC User Agreement.

- If your submission meets all the above criteria but KYC verification remains incomplete, it might be due to a temporary network issue. Please follow these steps for resolution:

- Wait for some time before resubmitting the application.

- Clear the cache in your browser and terminal.

- Submit the application through the website or app.

- Try using different browsers for the submission.

- Ensure your app is updated to the latest version.

Common Errors During the Advanced KYC Process

- Taking unclear, blurry, or incomplete photos may result in unsuccessful Advanced KYC verification. When performing face recognition, please remove your hat (if applicable) and face the camera directly.

- Advanced KYC is connected to a third-party public security database, and the system conducts automatic verification, which cannot be manually overridden. If you have special circumstances, such as changes in residency or identity documents, that prevent authentication, please contact online customer service for advice.

- Each account can only perform Advanced KYC up to three times per day. Please ensure the completeness and accuracy of the uploaded information.

- If camera permissions are not granted for the app, you will be unable to take photos of your identity document or perform facial recognition.